Retail Investors Hit Hard by Crypto Crash Following Major Wall Street Investments

Retail Crypto Investors Face Harsh Reality Amid Market Downturn

Many individual investors who eagerly embraced the Trump administration’s vision of a crypto-friendly America—often through Wall Street-backed investment vehicles—are now grappling with the harsh realities of a declining market.

Bitcoin, along with a wave of newly launched altcoin ETFs, has experienced a dramatic drop, erasing all the gains made since Donald Trump’s return to the White House. The speculative surge that once defined this digital asset boom has now vanished.

Top Stories from Bloomberg

Despite promises to make the United States a global leader in cryptocurrency, Bitcoin has plummeted by half from its previous high, now trading near $63,000. Other digital currencies have suffered even steeper declines, with an index tracking 50 smaller coins dropping 67% since October. In total, the crypto market has lost at least $700 billion in value over the past week.

This rapid downturn represents a sharp reversal for an asset class that Trump once pledged to elevate to a national priority. Regulatory agencies, encouraged by the administration’s pro-crypto stance, opened the door for a flood of exchange-traded products. Asset managers quickly launched funds tied to both established and riskier tokens, offering investors a range of ETFs covering speculative, thematic, and income-focused strategies.

Yet, for everyday investors, the influx of institutional support has brought more losses than security.

Nate Geraci, president of NovaDius Wealth Management, remarked, “A pro-crypto administration doesn’t erase the inherent volatility of this sector. Anyone who thought otherwise is learning a tough lesson. Like other asset classes, crypto is prone to sharp declines—something neither regulators nor the White House can prevent.”

Mounting Losses and Shaken Confidence

Data from Glassnode reveals that the average purchase price for US spot-Bitcoin ETF investors is around $84,100, leaving many underwater as Bitcoin trades far below that mark. While financial losses mount, the psychological impact is proving even more severe.

Unlike seasoned crypto holders accustomed to wild price swings, many newcomers entered the market after institutional and regulatory endorsements. Now, the very ETFs once hailed as transformative are delivering disappointing results, causing confidence to waver.

From Post-Election Optimism to Market Stagnation

The exuberance that fueled the post-election crypto rally—driven by Trump’s support and regulatory approval—has faded. Trading activity has slowed, liquidity is drying up, and investors are left waiting for a new catalyst or bracing for further declines.

On a single Wednesday, over $740 million was withdrawn from more than 140 crypto-focused ETFs, according to Bloomberg data. Over the past three months, outflows have reached nearly $4 billion. While much of this is attributed to spot-Bitcoin funds, products tied to Ether, XRP, Solana, and multi-coin portfolios have also suffered significant losses.

Veteran and New Investors Alike Feel the Pain

Even long-term crypto enthusiasts have been caught off guard by the speed of the downturn. Bruno Ver, a veteran investor and holder of the WLFI token linked to Trump-affiliated World Liberty Financial, admitted, “I didn’t expect a bear market to arrive so soon. This cycle feels different—I hope it’s a sign of maturation.”

He noted that frustration is even greater among those who bought near Bitcoin’s peak. “Those who invested at $120,000 are hurting. They’re upset with themselves, not with Trump or any politicians.”

ETF Supporters Remain Optimistic

Proponents of crypto ETFs argue that volatility is part of the landscape. Bitcoin has weathered severe downturns before—often losing 70% or more—only to recover. For them, this is just another buying opportunity on the path to future highs.

They emphasize that ETFs are functioning as intended, providing regulated and transparent access to a volatile market. Just as stock funds don’t shield investors from tech sector crashes, crypto funds shouldn’t be expected to offer protection from price swings. Furthermore, not all tokens are created equal; Bitcoin’s liquidity and institutional backing set it apart from coins like Dogecoin.

Still, positive narratives can only do so much in the face of harsh numbers.

Corporate and Political Ties Suffer Losses

Strategy Inc., the world’s largest corporate holder of crypto, reported a $12.4 billion net loss in the fourth quarter, largely due to the declining value of its holdings.

Businesses linked to the Trump family have also been hit. American Bitcoin Corp., co-founded by Eric Trump, saw its shares tumble again, while the World Liberty Financial token lost over 25% of its value in just one week.

Lessons for Newcomers

For those new to trading who mistook political endorsement for price stability, the message is clear: government support can legitimize an asset class but cannot shield it from market volatility. As momentum fades and leverage unwinds, the Trump-era crypto surge is being replaced by a painful market correction and a lesson in the realities of speculation.

Historical Perspective on Policy and Market Cycles

Peter Atwater, founder of Financial Insyghts, points out that policymakers often adopt hands-off approaches during periods of peak optimism. He cites the repeal of Glass–Steagall and the merging of commercial and investment banks just before the dot-com crash, as well as similar patterns before the global financial crisis.

“Washington follows the prevailing mood. It always wants to keep the party going at its height,” Atwater said. “Given historical patterns, the current sharp selloff in crypto should come as no surprise.”

With contributions from Lu Wang and Denitsa Tsekova.

Most Popular from Bloomberg Businessweek

©2026 Bloomberg L.P.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Japan's biggest banks ready to increase JGB holdings despite growing losses

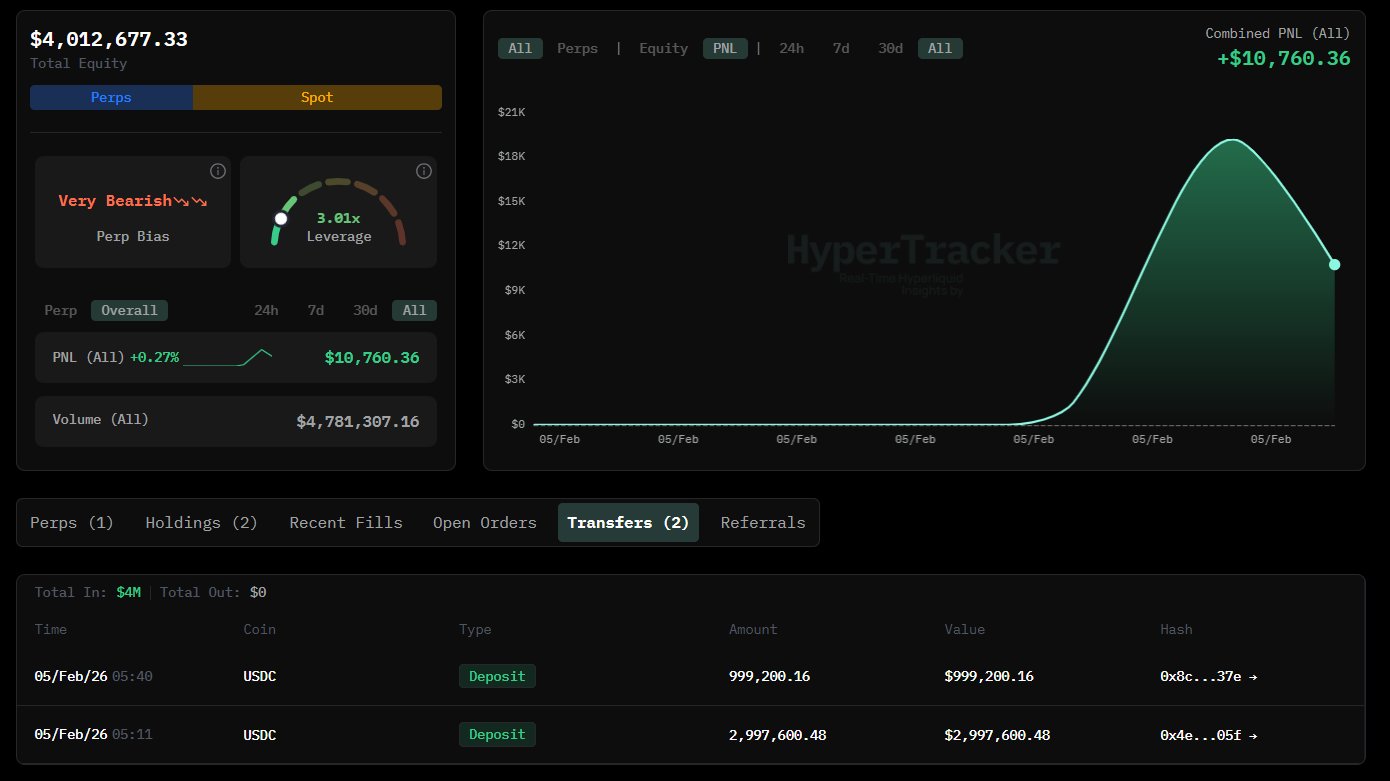

$4mln Hyperliquid whale opens 3x SOL short – Trouble ahead for Solana?

Affirm unveils a new artificial intelligence solution designed for retailers