Nvidia Stock Soars as Major Tech Companies Announce $650 Billion Investment in AI

Nvidia Leads Market Rally as AI Infrastructure Spending Surges

Nvidia Corp. experienced a significant boost on Friday, with its stock price climbing up to 7.7%—the largest single-day increase since early April. This surge added over $300 billion to the company’s market capitalization, breaking a five-day streak of losses that had previously wiped out about $500 billion due to a broader downturn in technology and software stocks.

Top Stories from Bloomberg

The rally was ignited by Amazon.com Inc., which announced during its earnings call that it intends to invest $200 billion this year in data centers, semiconductors, and related infrastructure. Combined with Alphabet Inc., Meta Platforms Inc., and Microsoft Corp., these tech giants are projected to allocate approximately $650 billion toward artificial intelligence infrastructure in 2026—a 60% increase over the previous year. While the companies making these massive investments are still facing market pressure, investors are now favoring the firms that will supply and build the backbone of the AI revolution.

“Demand is sky high,” remarked Nvidia CEO Jensen Huang in a CNBC interview on Friday, describing the current period as a “once in a generation infrastructure buildout.”

This wave of spending has lifted a broad range of companies involved in AI infrastructure, often referred to as the “picks and shovels” of the industry. Semiconductor manufacturers such as Broadcom Inc. and Marvell Technology Inc. saw their shares rise, with the sector’s revenue expected to hit a record $1 trillion this year. Digital storage providers like Sandisk Corp., Western Digital Corp., and Seagate Technology Holdings Plc each enjoyed gains exceeding 5%.

Cloud computing firm CoreWeave Inc. surged by about 20%, marking its best performance since December. Companies supplying power equipment and supporting data centers—including Amphenol Corp., GE Vernova Inc., and Vertiv Holdings Co.—also advanced, along with businesses in the nuclear, uranium, and hydrogen sectors. Growth-oriented firms such as Palantir Technologies Inc. and those specializing in quantum computing joined the upward trend.

This turnaround follows a sharp decline in software stocks earlier in the week, which weighed on the broader U.S. market. The selloff was triggered by Anthropic PBC’s release of new AI tools, which raised concerns that these innovations could disrupt existing business models and potentially render some companies obsolete. These fears quickly spread across the technology sector and impacted the wider market.

Additional Reporting

With contributions from Subrat Patnaik and Neil Campling.

©2026 Bloomberg L.P.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

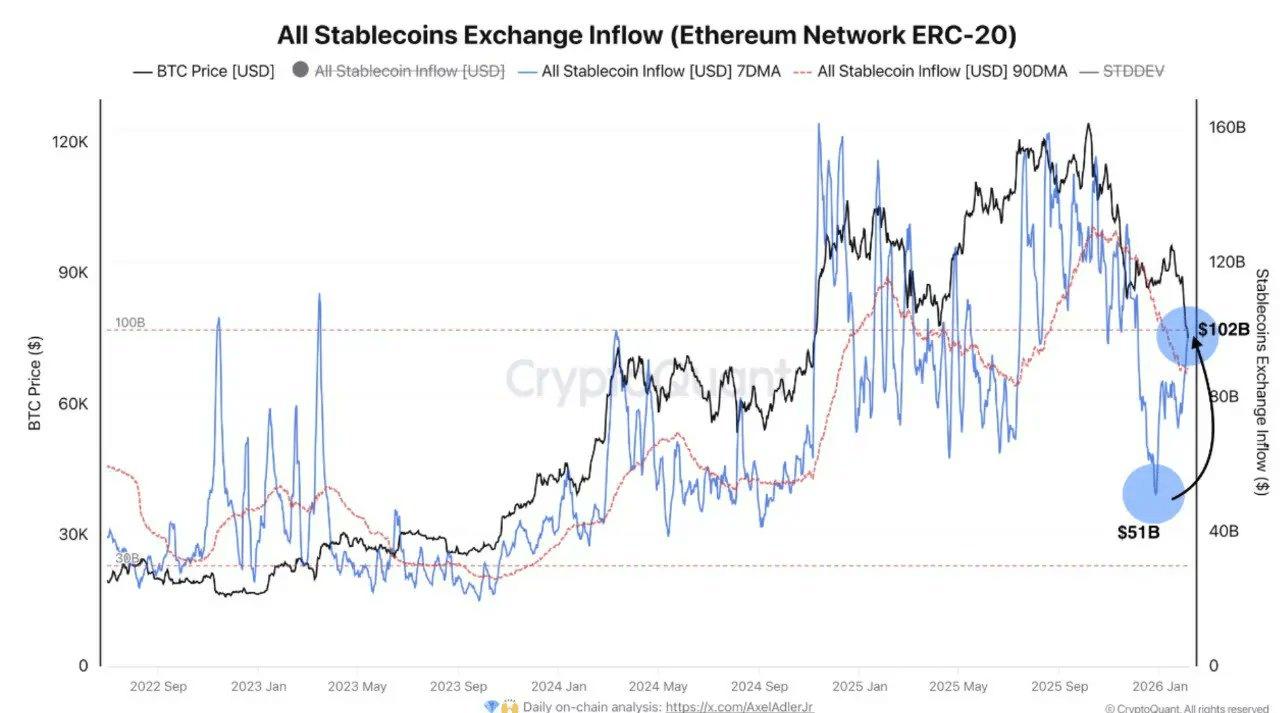

Stablecoin inflows surge to $102B – Could this be the first bullish signal of 2026?

You have outperformed your competitor in the contest for CEO. Now, what is the best way to guide them forward?

Big Tech firms are beginning to resemble IBM during the 1960s