The first week of February has been brutal carnage, exposing investors to massive losses as Bitcoin [BTC] dropped to sub-$60Ks for the first time since 2024.

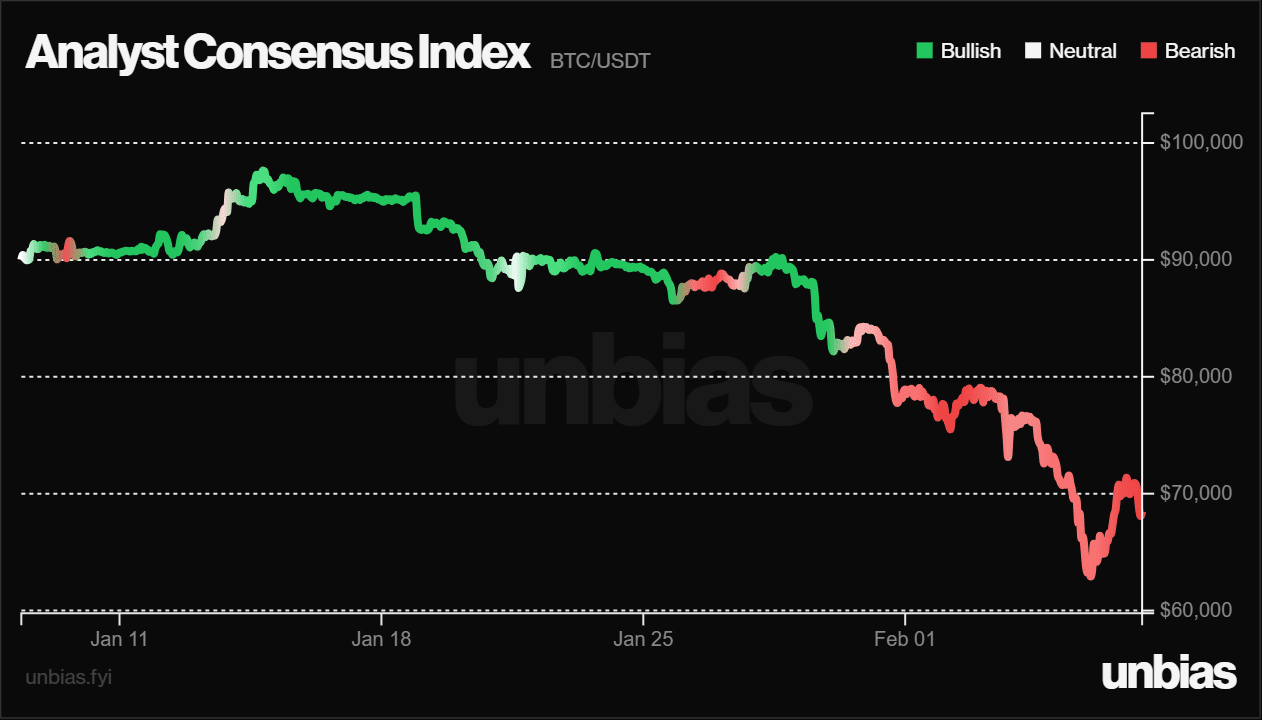

Unsurprisingly, the market sentiment soured to ‘extreme fear’ with the consensus index showing all analysts flipped bearish this week. Contrarian sentiment is starting to surface following the shaky yet relief bounce around the $60K level.

Will $60K hold steady?

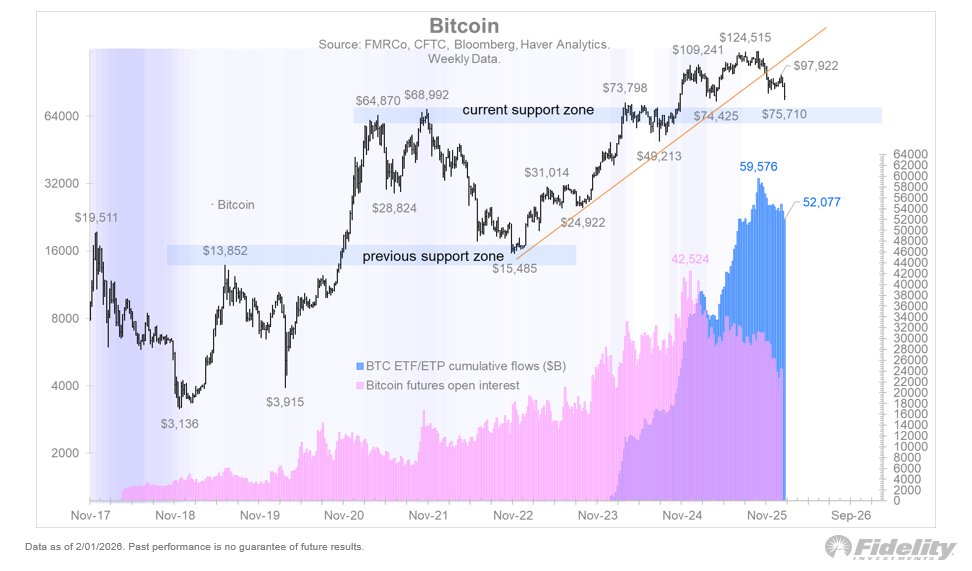

From a technical chart’s perspective, the price zone above $60K, which aligns with the past cycle peak, could ease the correction.

A similar stance was echoed by Jurrien Timmer, director of global macro at asset manager Fidelity. Timmer billed the extended sharp drawdown as BTC pricing in Kevin Warsh’s confirmation as the next Fed chair.

“The markets spoke loudly last week to the next Fed Chair being announced. For Bitcoin, though, I continue to view $65k as an attractive entry point.”

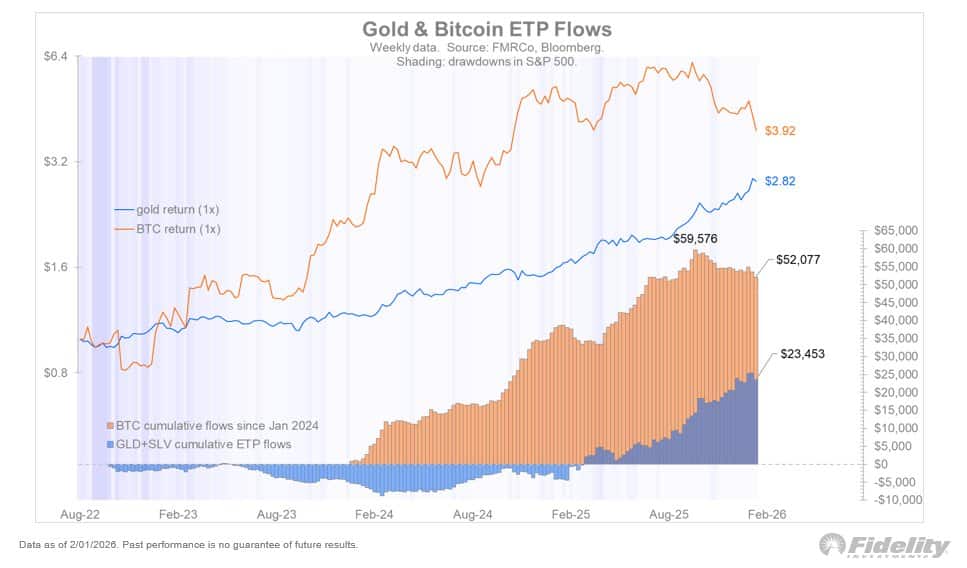

However, gold outperformance may keep it muted. Timmer predicted that gold could maintain its market lead until BTC ETF inflows resume.

The ETF flows factor

According to the chart shared by Timmer, BTC ETF inflows peaked in October and then contracted.

In contrast, gold and silver ETF flows climbed as investors piled into metals and safe havens amid heightened macro uncertainty ahead of a new Fed chair in May.

Even so, analysts at asset manager Bitwise were still firmly bearish, warning that off-chain signals, particularly BTC ETFs, suggested the drawdown was far from over.

The analysts, led by Andre Dragosch, said that the market crash has not attracted massive ETF outflows, but the resilience could still be a problem.

“Historically, sustained ETF outflows have tended to coincide with capitulation events, implying that a decisive shift in ETF flows could still serve as a crescendo moment for broader market capitulation.”

A recent AMBCrypto report established that BTC held by ETFs dropped by only 6.6% despite the +50% price crash since late 2025, underscoring the resilience mentioned by Bitwise analysts.

But will the market test this resilience?

Market fear eased, but not cleared

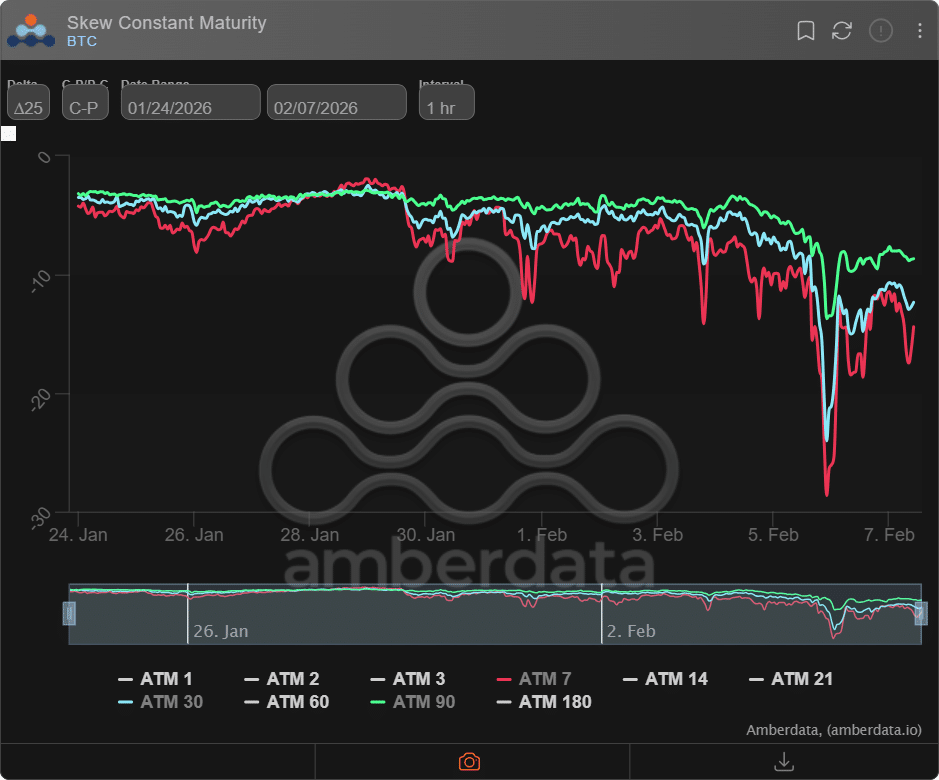

At press time, Options insights also painted a similar cautious outlook. Notably, the 25-Delta Skew climbed slightly after hitting a low of -28 in the volatility index, but remained negative.

This meant negative market sentiment eased after the relief bounce at $60K but caution persisted. Put differently, Options players were still buying more puts (bearish bets for downside protection) than calls (bullish bets).

Final Thoughts

- A Fidelity analyst viewed BTC’s sub-$60K levels as a great buying opportunity, citing past market correction patterns.

- However, the market remained cautious despite retesting $60K, and continued ETF outflows could push BTC lower.