Should You Invest in Uber Shares Now to Seize the ‘Multitrillion-Dollar’ Robotaxi Opportunity?

The Rise of Autonomous Vehicles and Uber's Strategic Shift

Artificial intelligence has evolved far beyond powering chatbots and cloud-based applications—it is now steering vehicles on our roads. Self-driving cars, once considered a distant dream, are gradually integrating into daily transportation. Uber Technologies is at the forefront of this transformation, aggressively advancing its robotaxi initiatives. Despite recent quarterly earnings falling short of some investors’ expectations, Uber’s intensified commitment to autonomous technology could prove pivotal for its future growth.

During the latest earnings call, Uber’s leadership announced plans to deploy robotaxis in 15 cities by the end of the year, signaling a strong push toward autonomous mobility. CEO Dara Khosrowshahi voiced optimism about the positive impact self-driving vehicles could have on the broader transportation industry. He pointed to cities like San Francisco, Atlanta, and Austin as early examples where robotaxis are already gaining momentum and contributing to Uber’s expansion.

Latest Updates from Barchart

Currently, autonomous vehicles account for a mere 0.1% of global rideshare journeys, both on Uber and competing platforms. However, Uber’s CEO envisions a much larger role for AVs in the future, suggesting that this technology could unlock a market worth trillions of dollars. With leadership making bold, long-term investments in autonomy despite short-term earnings challenges, the question arises: Is now the right time for investors to consider Uber stock?

Uber’s Evolution and Market Presence

Since its inception in 2010, Uber has revolutionized urban transportation, making ride-hailing accessible with just a smartphone. What started in San Francisco has grown into a worldwide network, facilitating over 72 billion trips to date. The company has diversified its offerings, moving beyond rides to include food delivery and freight logistics.

By branching into various sectors of mobility and logistics, Uber has become an integral part of urban life, connecting passengers, drivers, couriers, and businesses. This digital platform is reshaping how people travel and receive goods in cities. Now, Uber is intensifying its efforts to bring autonomous vehicles directly to consumers’ doorsteps.

Uber’s Partnerships and Robotaxi Expansion

To accelerate its robotaxi rollout, Uber is relying on strategic partnerships. The company recently joined forces with electric vehicle maker Lucid Group and autonomous driving specialist Nuro, aiming to deploy at least 20,000 robotaxis worldwide—a significant leap from initial pilot programs.

Uber also collaborates with Waymo (a subsidiary of Alphabet) and May Mobility, both leaders in self-driving technology. Additionally, Nvidia supplies the advanced computing hardware essential for powering these autonomous systems. These alliances highlight Uber’s commitment to building a robust ecosystem to support its robotaxi ambitions.

Uber currently boasts a market capitalization of about $155.3 billion. Over the past year, its stock has delivered a 6.83% return, slightly outperforming the S&P 500 Index’s nearly 14% gain. However, in 2026, Uber’s shares have faced headwinds, declining by almost 8.5%.

Recent volatility has largely stemmed from underwhelming quarterly results and concerns over rising expenses tied to Uber’s autonomous vehicle investments. While these costs may pressure short-term profits, they are intended to fuel future growth.

Inside Uber’s Q4 2025 Financial Results

Uber’s fourth-quarter 2025 financial report, released on February 4, showcased robust demand but softer profitability, prompting a 5.2% drop in the stock price that day. Revenue climbed 20% year-over-year to $14.37 billion, narrowly surpassing analysts’ expectations and reflecting strong activity across Uber’s platform.

The company’s core mobility division generated $8.2 billion, up 19% from the previous year, while delivery revenue surged 30% to $4.9 billion. Despite these gains, adjusted earnings per share reached $0.71—a 27% annual increase, but below the anticipated $0.79.

On a GAAP basis, net income was $296 million, a steep decline from $6.88 billion the prior year. This drop was influenced by a $1.6 billion pre-tax loss related to equity investment revaluations, higher tax expenses, and initiatives to offer more affordable rides to attract new users and boost bookings.

Operationally, Uber maintained strong momentum. Total trips jumped 22% year-over-year to 3.8 billion, driven by an 18% increase in monthly active users. Gross bookings also rose 22% to $54.1 billion, underscoring sustained engagement on the platform.

Looking ahead to the first quarter of fiscal 2026, Uber projects gross bookings between $52 billion and $53.5 billion, representing 17% to 21% year-over-year growth on a constant-currency basis. The company also expects non-GAAP EPS of $0.65 to $0.72, indicating 37% growth at the midpoint, and adjusted EBITDA between $2.37 billion and $2.47 billion.

Analyst Sentiment on Uber Shares

Despite recent earnings disappointments, Wall Street remains largely bullish on Uber’s prospects. The stock currently enjoys a consensus “Strong Buy” rating, with analysts viewing recent setbacks as temporary rather than indicative of a long-term slowdown.

Of the 51 analysts covering Uber, 37 recommend a “Strong Buy,” three suggest a “Moderate Buy,” 10 rate it as “Hold,” and only one assigns a “Strong Sell.” The average price target stands at $107.07, implying about 43% upside from current levels. The most optimistic projections see shares potentially doubling if Uber’s growth strategy succeeds.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

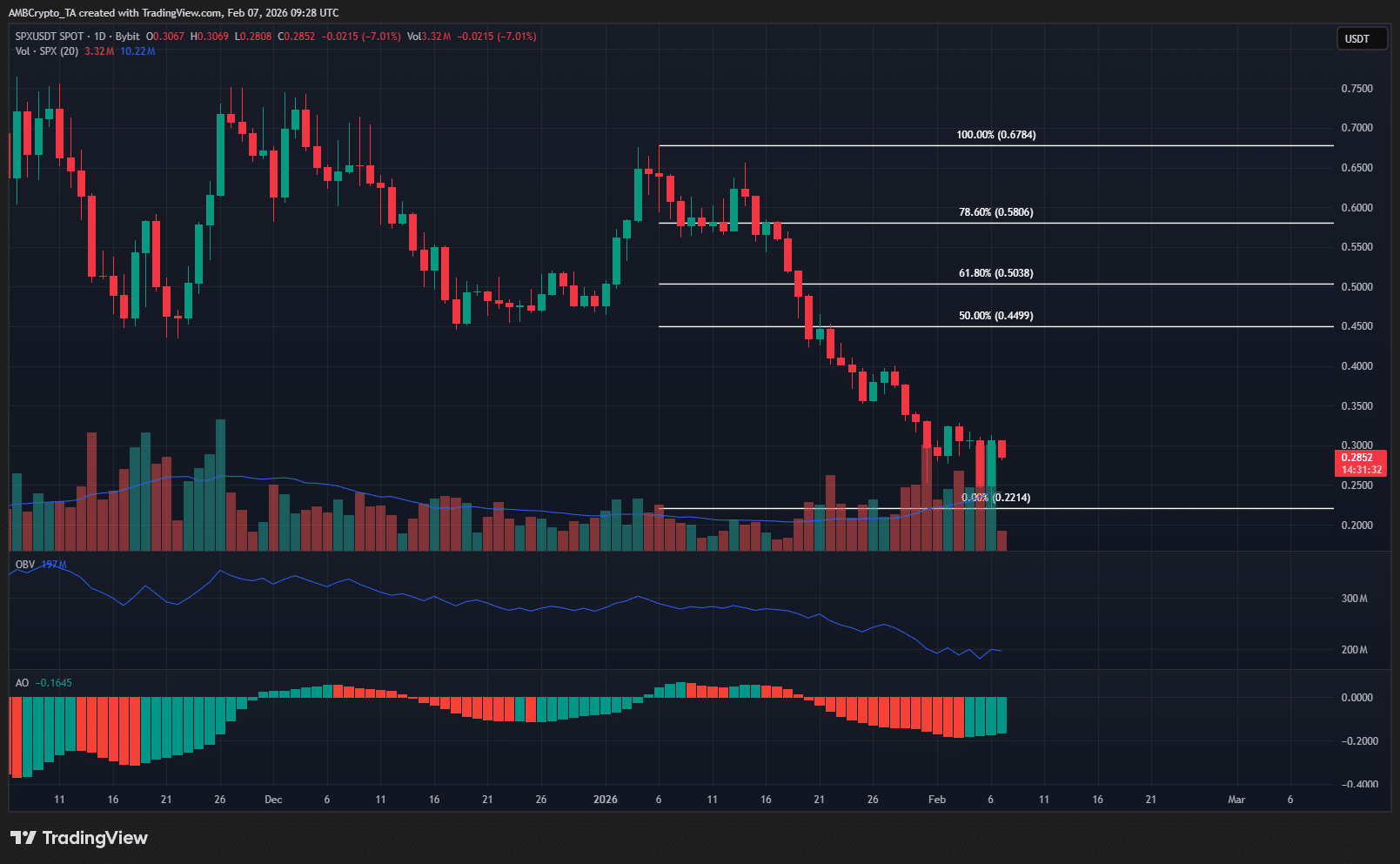

SPX6900 tests 2025 lows: Why SPX’s quick recovery looks unlikely

Will Bitcoin Price Recover, or Will It Fall Further? Chinese Analysis Company Issues Warning for This Summer

Best Presale Crypto of 2026: Zero Knowledge Proof (ZKP), Digitap, BlockchainFX, & BMIC