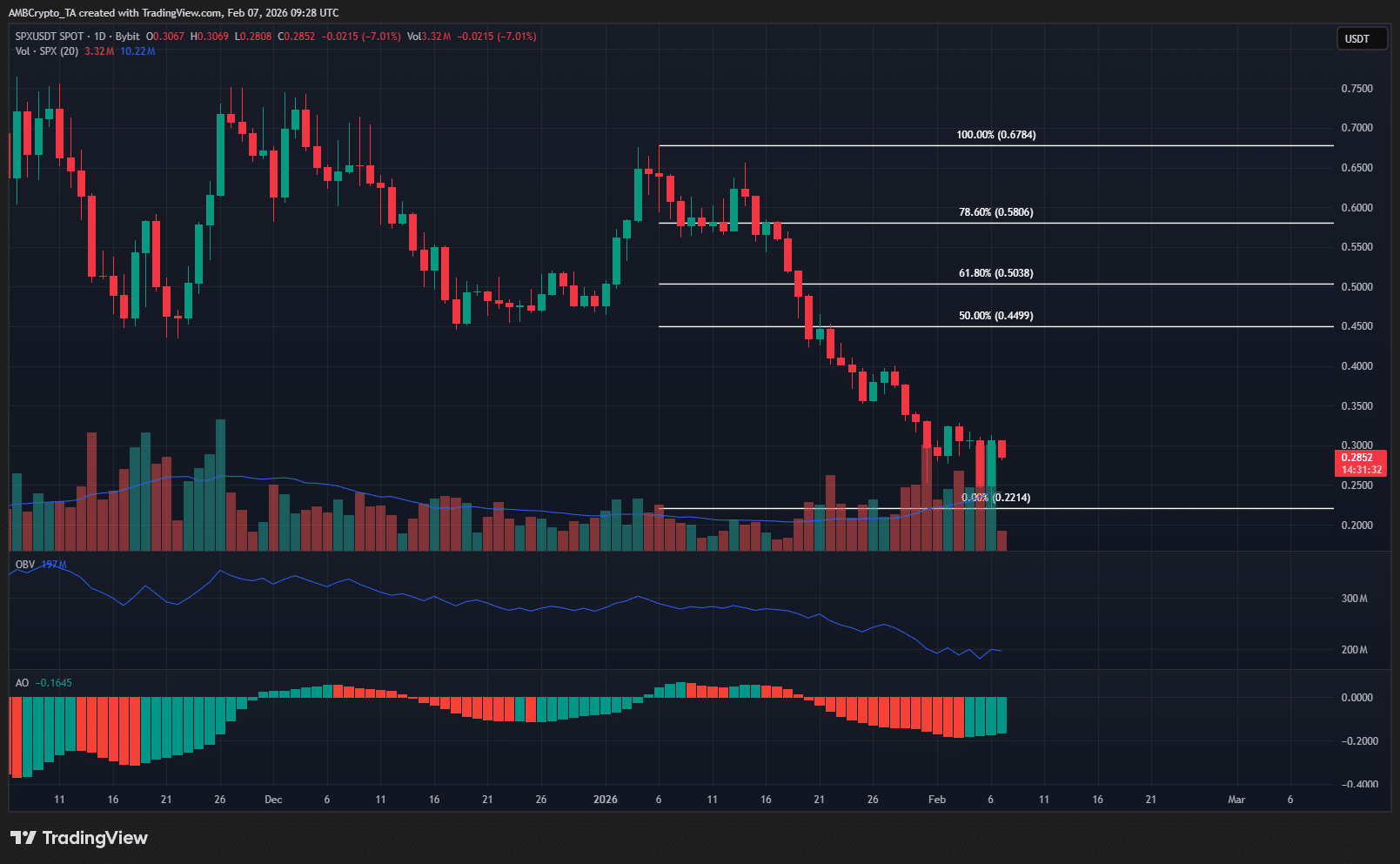

Recently, Ethereum experienced significant depreciation, prompting key crypto firms to make critical asset management decisions. One such company, Trend Research, engaged in crypto treasury management, substantially reduced its position by transferring a large amount of Ether to exchanges following market volatility.

Trend Research Executes Major Ether Sale

An examination of Trend Research’s blockchain data reveals a significant reduction in its Ether holdings within a week. At the start of the week, the company held approximately 651,000 Ether on Aave, which dropped to 247,000 by the end of the week. This massive transaction of over 400,000 Ether coincided with a dramatic weekly price drop of nearly 30% in Ether, placing the firm’s leveraged positions at risk.

Leveraged Investments Under Pressure

Trend Research, under Jack Yi’s strategic guidance, used Ether as collateral across various protocols to borrow stable cryptocurrencies and reinvest in Ether. The company’s significant moves were shaped by the price plunges nearing different liquidation levels.

According to data from analytic platforms, Trend Research was forced to significantly cut its positions in a short span due to the rapid market downturn. The price bracket of $1,562 to $1,698 in the company’s leveraged positions highlighted the increased risk of automatic collateral liquidation.

Jack Yi predicted an earlier market bottom yet emphasized following the process to manage risks. He stated their preparedness for a potential recovery.

Trend Research’s Ether accumulation commenced following the October 2025 clearance of $19 billion in crypto assets. By December, the company had become one of the largest Ether investors globally. However, its absence from public company lists excludes these assets from official reports.

BitMine Faces a $7 Billion Setback

Another institutional player impacted by Ether’s sharp decline is BitMine Immersion Technologies. Managed by Tom Lee, BitMine holds approximately 4.28 million Ether, with unrealized losses exceeding $7 billion following recent price moves.

BitMine transitioned from Bitcoin mining to an Ethereum-focused strategy in 2025, purchasing Ether at around $3,800 to $3,900 per unit, becoming one of the largest institutional investors globally. The price drop weakened both its portfolio and share value.

Tom Lee highlighted a strengthening in Ethereum fundamentals, with transaction volumes and active addresses increasing.

The company holds about 3.5% of Ethereum’s supply, with an ambition to increase this to 5%. Additionally, BitMine prepares to launch its validator network by 2026, underscoring the importance of diversity and risk management in institutional investor strategies within the Ethereum ecosystem.