Bank of Japan Issues Strong Statement on Rate Hike: Summary of Opinions from January Policy Meeting

On February 2, 2026, the Bank of Japan website released the "Summary of Opinions at the Monetary Policy Meeting on January 22 and 23, 2026".A strong determination regarding rate hikes was expressed, as seen in the blue sections below.

The content is as follows:

I. Opinions on Economic and Financial Developments

1. Economic Development

Although some sectors of the Japanese economy show signs of weakness, it has been recovering moderately. Looking ahead, with overseas economies returning to growth, and with support from government economic measures and accommodative financial conditions, the Japanese economy is expected to continue moderate growth, although it will also be affected by trade and other policies in various jurisdictions.

Regarding the US economy, there remain uncertainties about the risks surrounding employment and the direction of monetary policy considering these risks. However, robust IT-related demand, especially that related to AI, appears to have eased these uncertainties.

Globally, both monetary and fiscal policies have been accommodative, and AI-related investments continue to increase. Against this backdrop, the global economy is expected to enter a transitional phase this year, with recovery momentum starting to build.

The growth in energy and food prices is expected to gradually slow down, and the increase in the CPI may also decrease accordingly. As a result, real wage growth is expected to eventually turn positive and remain so.

The depreciation of the yen has increased profits and wages for large companies but has depressed profits and wages for small and medium-sized enterprises. In addition, the rising prices caused by the yen's depreciation may exacerbate inequality.

2. Prices

Core CPI is highly likely to continue rising moderately, as the mutually reinforcing mechanism between wages and prices is expected to be maintained. In the latter half of the forecast period, core CPI is expected to reach a level roughly consistent with the price stability target. In terms of risk balance, upside and downside risks to prices are roughly balanced.

So far, the pass-through of labor costs to prices in areas other than food, eating out, and accommodation has been relatively moderate, partly due to limited household financial room. It is necessary to closely monitor how the balance between prices, household income, and private consumption evolves, including the effects of government economic measures that transfer income to households.

The rise in rice prices was triggered by supply shortages, but given the demand factors during the 2025 autumn rice procurement season, the price increase may be the result of multiple factors. Close attention should still be paid to whether price increases in other goods can be explained solely by cost-push factors.

In addition to previous increases in food prices, housing rents, mainly in urban areas, have also risen recently. This is partly because housing prices reflect the rising cost of materials due to overseas inflation and yen depreciation, as well as higher labor costs, which has increased demand for rental housing. Although national and local governments have taken measures, given that housing rents significantly affect households' sense of economic well-being and consumption behavior, it is necessary to closely monitor their development.

When examining how deeply entrenched underlying inflation has become, it is necessary to closely monitor the pace at which the year-on-year growth in food prices slows and the impact of government measures to address price hikes on the underlying trend of prices. That said, some long-term inflation expectation indicators have already begun to show stability.

The main driver of price increases has shifted to labor costs, and inflation is becoming sticky. If (1) the annual spring labor-management wage negotiations, (2) price developments, and (3) the development of inflation expectations are in line with the Bank of Japan's outlook, it may be possible to determine as early as this spring that the underlying trend of prices has reached 2%.

In recent years, the pricing behavior of Japanese companies has changed significantly, making the pass-through of import price increases caused by yen depreciation to prices more evident. In light of this, greater attention should be paid to the impact of exchange rates on prices. If the yen depreciates further, the pace of CPI decline may slow or even start to rise again.

With the depreciation of the yen, even low-priced imported goods seem less likely to depress prices. Furthermore, the domestic reliance on imports is also increasing. In this context, the likelihood of exchange rate factors pushing up prices becomes greater.

Considering changes in wage norms and strengthened expectations of overseas economic recovery, it is necessary, when considering risk balance, to pay greater attention to the upside risks to prices.

Facing supply constraints in the labor market, price risks in the Japanese economy are now more tilted to the upside, as seen in the pass-through of yen depreciation to prices, demand expansion driven by fiscal policy, and China's restrictions on Japanese exports, among others.

II. Opinions on Monetary Policy

Although not much time has passed since the policy rate hike last December, taking into account factors such as funding demand by corporations and others, financial institutions' lending attitudes, and commercial paper and corporate bond issuance conditions, financial conditions have remained accommodative since the rate hike.

Some large corporations with ultra-long-term investment projects and some small and medium-sized enterprises may face a heavier interest burden. However, for corporations overall, the increased interest burden has been largely absorbed by their current sound business conditions.If the pace of policy rate hikes is not too fast, the Bank of Japan does not need to be overly concerned about the impact on corporate performance.

Given that real interest rates are significantly low, if the Bank of Japan's outlook for economic activity and prices materializes, it would be appropriate for the Bank of Japan to continue raising policy rates and adjusting the degree of monetary easing in line with improvements in the economy and prices.

The Bank of Japan has been examining the reaction of economic activity, prices, and financial conditions to each rate hike, and has raised policy rates accordingly. It is appropriate for the Bank of Japan to continue doing so.

Given the recent depreciation of the yen, current financial conditions are still quite accommodative relative to economic fundamentals. As the underlying trend of prices steadily approaches 2%, it is necessary for the Bank of Japan to continue adjusting the degree of monetary easing at appropriate times.

It cannot be said that the risk of the Bank of Japan falling behind the curve has necessarily become more apparent, but it is becoming increasingly important for the Bank of Japan to implement monetary policy prudently and in a timely manner.

If the overseas interest rate environment changes this year, there is a risk that the Bank of Japan could inadvertently fall behind the curve. Japan's real policy rate is at the lowest level in the world, and since foreign exchange market participants focus on differences in real interest rates,the Bank of Japan needs to adjust the significantly negative real policy rate.

Yen depreciation and the rise in long-term rates largely reflect fundamentals such as inflation expectations. Under such circumstances,the only monetary policy response is to raise policy rates in a timely and appropriate manner.

Given that addressing rising prices is Japan's top priority,the Bank of Japan should not spend too much time studying the impact of rate hikes but should move ahead with the next step—raising rates—in a timely manner.

It is appropriate for the Bank of Japanto raise policy rates at intervals of several months, while assessing the impact of rate hikes on corporate and household behavior based on market information and evaluating the current policy rate relative to the neutral rate.

The rise in long-term rates in recent years can be seen as part of the normalization of the Japanese government bond market and reflects expectations of achieving the price stability target, but the one-sided steepening of the yield curve over the past two weeks or so is noteworthy.

The upward pressure on long-term rate risk premiums stemming from fiscal conditions and inflation appears to be partly offset by the stock effects of Japanese government bonds held by the Bank of Japan. The Bank of Japan should continue to examine whether lenders and borrowers can adapt to the recent pace of long-term rate increases.

Regarding Japanese government bond purchases, the Bank of Japan should reduce the amount of purchases in line with the current approach, while responding to special circumstances by increasing purchases as needed.

Volatility has increased in the Japanese government bond market, especially in the ultra-long-term segment, and concerns about supply and demand persist. Therefore, it is necessary to consider flexible responses, including government bond purchases, in special situations.

Although the specific timing and scale cannot be determined, it is foreseeable that volatility in the Japanese bond market could increase as it has recently. When volatility rises, it is important for the central bank to examine whether market functions are being maintained. It is essential for the Bank of Japan to continue efforts to promote understanding of the measures it takes based on its role and policy objectives.

III. Opinions of Government Representatives

1. Ministry of Finance

The government is closely monitoring recent volatility in global and Japanese markets with a high degree of vigilance.

In the fiscal 2026 budget, the government has kept the overall reliance on government bonds at its lowest level since the global financial crisis subsided. The government will seek to obtain parliamentary approval for this budget as soon as possible.

The government expects the Bank of Japan to sustainably and stably implement appropriate monetary policy to achieve the 2% "price stability target," in close cooperation with the government, while paying due attention to domestic and international economic developments and communicating effectively with the market.

2. Cabinet Office

Upholding the policy of "responsible and proactive public finance," the Takamichi Cabinet will make every effort to build a "strong Japanese economy" through the implementation of measures related to comprehensive economic policies and other initiatives.

It is extremely important to implement appropriate monetary policy to achieve both strong economic growth and stable inflation.

The government expects the Bank of Japan, in accordance with the Bank of Japan Act and the spirit of the joint statement between the government and the Bank of Japan, to sustainably and stably implement appropriate monetary policy to achieve the 2% price stability target, while carefully examining economic and price developments and working closely with the government.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Curve DAO Token (CRV) Price Prediction 2026, 2027-2030: Can CRV Break Its Long-Term Range?

20% Bounce and an ETF Filing: Why ONDO Price is Separating from the Crypto Pack.

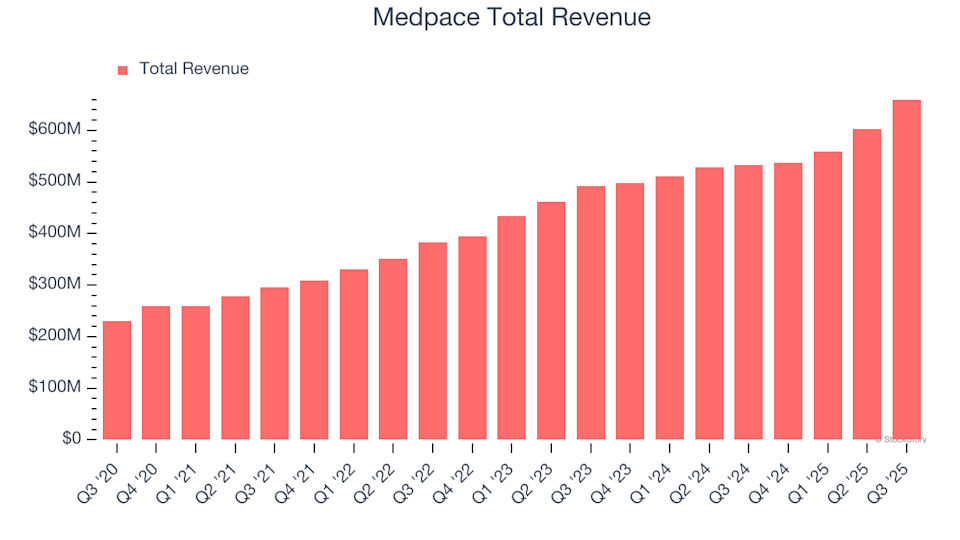

Earnings To Watch: Medpace (MEDP) Will Announce Q4 Results Tomorrow

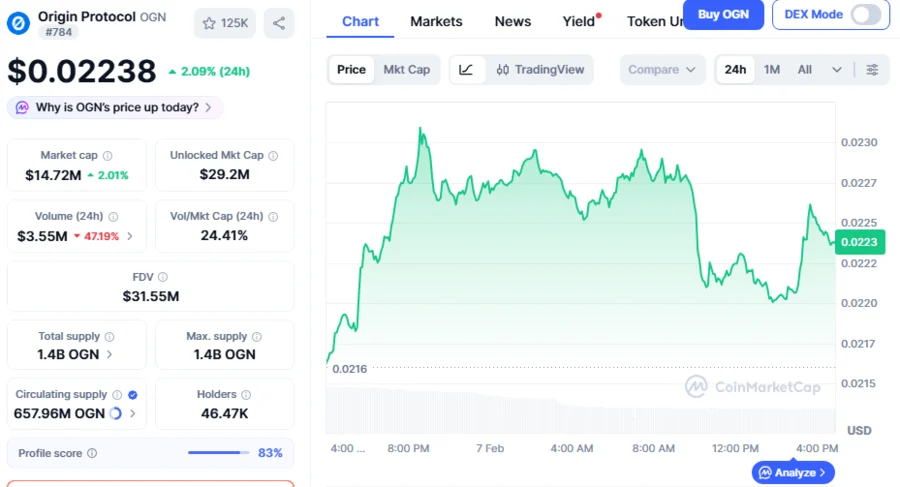

OGN Trades At $0.02229 Crucial Support, Sets Up for Further Bear Market: Analyst