UBS Interprets Lumentum: Performance Fully Delivered, but Valuation Enters a Consolidation Period

On February 3, UBS released its First Read on the FY26 Q2 (end of calendar year 2025) earnings report of Lumentum Holdings.

This is atypical “exceptional performance, but tougher for the stock price” analyst report.

Looking at the earnings report itself, this is analmost flawless AI optical communications delivery;

but from an investment perspective, the question becomes:How much good news is left, and how much has already been priced in by the market?

1. First, the conclusion: this is an “across-the-board beat” earnings report

UBS’s judgment is very clear—

Revenue, profit margin, operating leverage, and guidance all exceeded expectations.

Here are the core figures:

This quarter’s revenue was $666 million, above UBS expectations

Gross margin 42.5%, significantly higher than the previous market expectation of around 39%

Operating margin 25.2%, far above the company’s previous guidance of 20%–22%

Non-GAAP EPS $1.67, well above consensus expectations

Looking at these numbers alone, this is a standard “AI hardware boom acceleration phase” earnings report.

2. The real driver: not “selling more”, but “selling higher and more stably”

UBS repeatedly emphasized one point in the report:

This performance was not achieved by a short-term shipment surge, but by a qualitative change in the order structure.

1️⃣ Data center-related business is scaling up across the board

Optical communication component revenue +68% YoY

Cloud customer optical module shipments hit a record high

Share of high-end products like 200G EML continues to increase

What does this mean?

It’s not that “AI demand has arrived”, but rather that

AI’s demand for optical communications is already starting to drive product mix and profit margins higher.

2️⃣ More importantly: the “certainty” of orders is being extended

UBS specifically highlighted two points:

OCS (optical switching) business has a quarterly run-rate exceeding $10 million

OCS order backlog exceeds $400 million

The company added a new CPO (co-packaged optics) order worth several hundred million dollars, to be delivered in the first half of 2027

In other words:

A large portion of the next 1–2 years’ revenue is not “guessed”, but already secured by orders.

3. The real “highlight” of this report is the guidance

If this quarter’s results are “good”, then the guidance is “very aggressive”.

Lumentum’s FY26 Q3 guidance:

Revenue $780–830 million

Operating margin 30%–31%

Implied gross margin close to 45%

UBS states bluntly:

This is a guidance levelwhere operating leverage is fully unleashed.

What does such a profit margin mean in the optical communications industry?

It means:

Capacity utilization is already very high

Pricing power is starting to shift upstream

Cost-side pressures are fully offset by demand

4. So why does UBS remain Neutral?

This is exactly the most worthwhile part of this report.

UBS does not deny the fundamentals, on the contrary, it explicitly acknowledges:

“The market already sees FY27 EPS approaching $12.”

The problem is:

The stock price in after-hours trading already corresponds to about 40x FY27 potential earnings

Three months ago, this valuation was around 30x

In other words:

A large portion of the good news for the next two years has already been priced in by the market in advance

UBS’s judgment is very calm:

The earnings report “is already as good as it can get”,

but for further upside, what’s needed isnew variables beyond current expectations.

That’s also why:

No matter how strong the earnings report

No matter how high the guidance

UBS still believes the stock pricewill have a hard time finding further upside from the current base

5. This is a company with “no fundamental issues, but rising investment difficulty”

To sum up the report in one sentence:

Lumentum has already moved from “validating the AI thesis” to “valuation digestion of the AI thesis”.

What you’re facing now is no longer:

Whether AI will bring demand

Whether optical modules are a key link

But rather:

Whether this degree of certainty can still bring you excess returns

From an industry perspective, Lumentum is one of the most direct and pure beneficiaries in the AI optical communications chain

From a trading perspective, it has already entered a zone where:

“Being a bit wrong doesn’t matter, being a bit right doesn’t necessarily make money”

This is exactly the stage in the AI industry chain that is the hardest to play and most likely to distort emotions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Curve DAO Token (CRV) Price Prediction 2026, 2027-2030: Can CRV Break Its Long-Term Range?

20% Bounce and an ETF Filing: Why ONDO Price is Separating from the Crypto Pack.

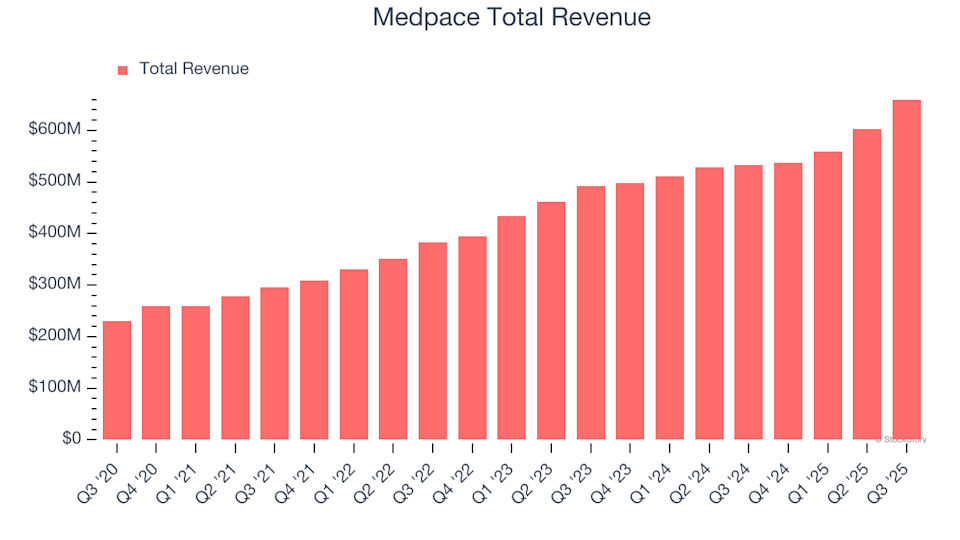

Earnings To Watch: Medpace (MEDP) Will Announce Q4 Results Tomorrow

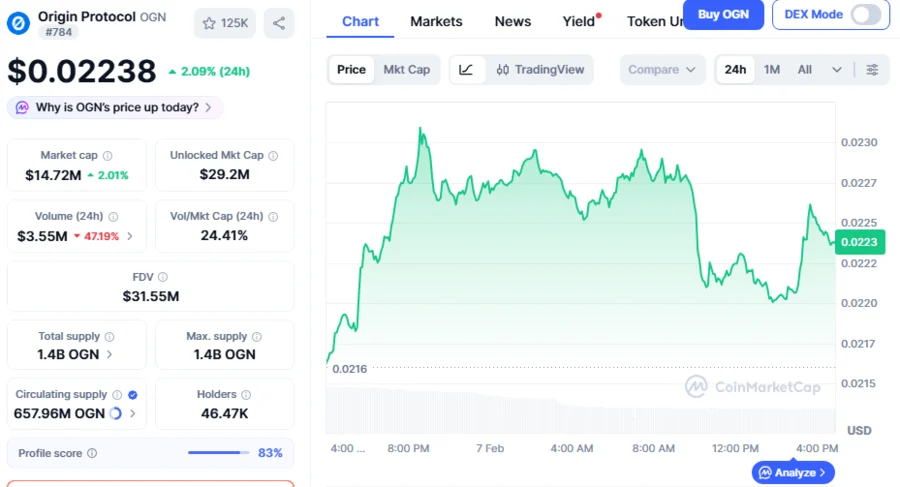

OGN Trades At $0.02229 Crucial Support, Sets Up for Further Bear Market: Analyst