DBS Group's Q4 Profit Misses Expectations Due to Declining Net Interest Margin and Increased Tax Expenses

DBS Group's fourth-quarter profit fell short of expectations due to a decline in net interest margin and increased tax expenses, offsetting growth brought by its wealth management business.

The largest bank in Southeast Asia reported on Monday that net profit for the quarter ended December 31, excluding one-off items, declined by 10% to 2.36 billion Singapore dollars (1.85 billion USD). In comparison, the average analyst estimate in a Bloomberg survey was 2.57 billion Singapore dollars.

DBS Group stated that the dividend for this quarter will be 0.81 Singapore dollars per share. Unless unforeseen circumstances arise, its capital return plan will be maintained through the end of 2027.

DBS Group's share price fell as much as 1.9% in early trading, marking the largest drop in nearly three months. The company's share price has risen more than 4% so far this year.

“Although net interest margin pressure and geopolitical tensions are expected to persist, our strong business foundation and robust balance sheet provide a solid base for the coming year,” said DBS CEO Piyush Gupta in a statement. She expects net profit in 2026 to be slightly below the 2025 level, while the wealth management business will achieve “around 15% growth,” consistent with the previously announced annual outlook.

DBS's net interest margin narrowed by 22 basis points from a year earlier, resulting in a decline in net interest income. Its net fee and commission income increased by 14%, while wealth management fee income surged 24% to 645 million Singapore dollars.

Editor: Yu Jian SF069

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Midnight Price Prediction: NIGHT Outperforms Market With 25% Rally

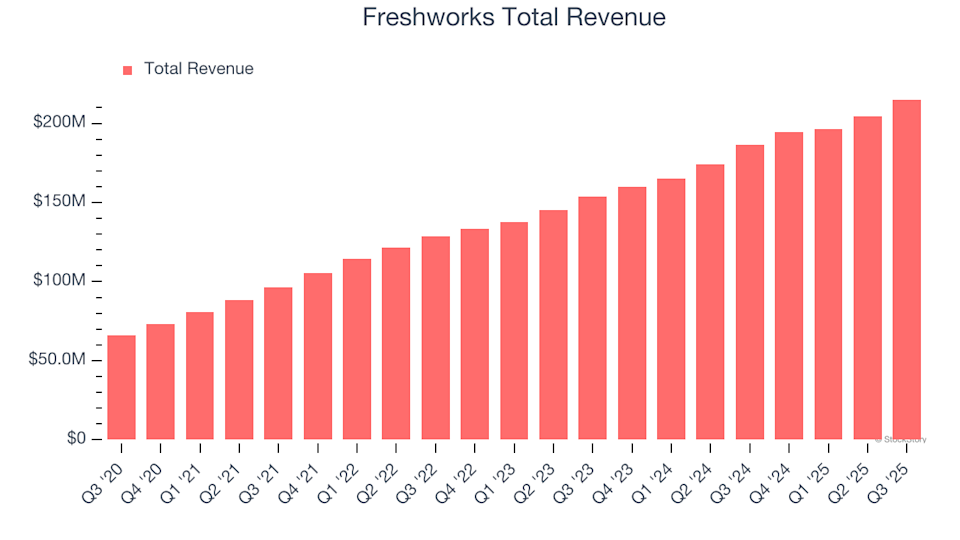

Freshworks (FRSH) Q4 Results: Anticipated Highlights

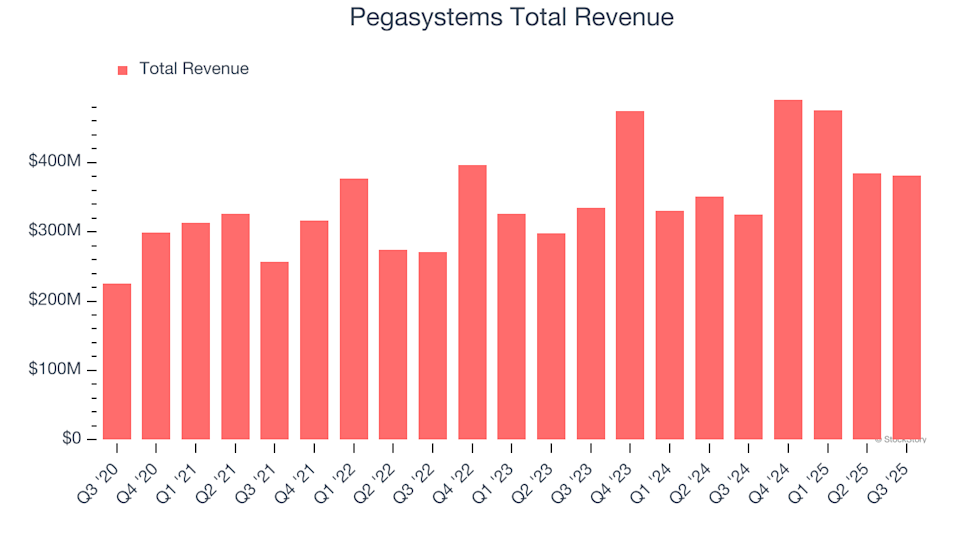

Pegasystems (PEGA) Q4 Preview: Key Insights Before Earnings Release

ECB's Cipollone: No Specific Exchange Rate Goal, Yet It Influences Inflation Forecasts