Report: Venture Capital Firms (VCs) Divided Over Non-Financial Use Cases in Web3 and Crypto Sectors

Recently, partners at well-known crypto venture capital firms have been fiercely debating online: Are non-financial applications in the crypto, Web3, and blockchain sectors failing due to a lack of investor demand and product-market fit, or is the best non-financial innovation still to come?

The controversy began on Friday when Chris Dixon, managing partner at a16z crypto, published an article stating that over the years, “fraud, extractive behavior, and regulatory crackdowns” have prevented non-financial crypto applications from taking off.

These use cases include decentralized social media, digital identity management, decentralized media streaming platforms, digital copyright platforms, Web3 gaming, and more.

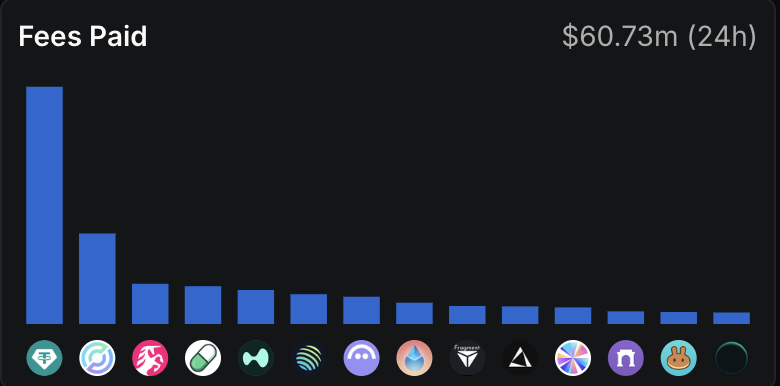

In the past 24 hours, crypto exchanges and decentralized finance applications have collected over $60.7 million in fees. Source: DeFiLlama

In the past 24 hours, crypto exchanges and decentralized finance applications have collected over $60.7 million in fees. Source: DeFiLlama “The reason non-financial applications in crypto have failed is because nobody needs them,” Haseeb Quereshi, managing partner at crypto venture capital firm Dragonfly, said in response on Sunday. He added:

“Let’s just admit it, they were bad products to begin with, and they failed the market test. It wasn’t Gensler, Sam Bankman-Fried (SBF), or Terra that made them fail—nobody wanted these things. Pretending otherwise is just self-comfort.”

Dixon countered that a16z crypto’s funds are managed with at least a 10-year cycle, saying, “Building new industries takes time.”

The top ten crypto applications ranked by fees and revenue are all financial scenarios. Source: DeFiLlama

The top ten crypto applications ranked by fees and revenue are all financial scenarios. Source: DeFiLlama “In venture capital, you don’t have the luxury of ‘waiting to be proven right,’” said Nic Carter, founding partner at venture firm Castle Island Ventures, replying to Quereshi. “You need to anticipate the market and make judgments within the 2-3 year investment cycle of a fund.”

This debate comes as crypto projects are set to experience a venture capital boom in 2025, with most funding flowing into tokenized real-world assets (RWA) and physical or traditional financial assets represented on-chain through digital tokens.

Different Portfolio Construction Approaches

Dragonfly’s portfolio focuses mainly on financial use cases and blockchain infrastructure that enables the flow of value and risk in the on-chain financial system.

Some of the firm’s investments include stablecoin and payment platform Agora, payment infrastructure provider Rain, synthetic dollar issuer Ethena, and Monad public chain network.

As for a16z, although its crypto portfolio covers many financial applications such as Coinbase and decentralized exchange Uniswap, it also spans a broader range of Web3 sectors, including community building, gaming, and media streaming.

These projects include community-building club Friends With Benefits, digital identity provider World, and Web3 gaming platform Yield Guild Games.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

'Weakest bitcoin bear case in history': Bernstein reiterates $150,000 price target for 2026

Tether Goes Global As Profits Power Hiring And Tech Push

Wallet Poisoning and Phishing Scams Drain Millions in Crypto

Crypto Market Shakes Up: Altcoins Surpass Bitcoin