ENS abandons Namechain: Ethereum the master of the game?

In February 2026, ENS marked a turning point by abandoning its Layer 2 project, Namechain, to stay on Ethereum L1. A decision that illustrates the rapid evolution of the Ethereum blockchain, now able to compete with external scaling solutions. Analysis of the stakes and impacts for crypto users.

In brief

- ENS abandons Namechain L2 to focus on Ethereum L1, thanks to a 99% reduction in gas costs.

- Ethereum updates, such as Fusaka, have improved L1 scalability, making L2s less essential.

- Crypto users benefit from a simplified experience, with reduced fees and enhanced security on Ethereum L1.

ENS abandons Namechain L2: a strategic revolution for Ethereum

ENS’s announcement to abandon Namechain L2 in favor of Ethereum L1 surprised the crypto ecosystem. Initially designed to reduce costs and improve accessibility, Namechain became obsolete facing Ethereum’s increased scalability. Thanks to activation of updates like Fusaka, gas costs for ENS registrations fell by 99%! Making transactions on L1 more economical than ever.

ENS abandons Namechain.

ENS abandons Namechain.

This decision fits a logic of simplification and security. Indeed, Ethereum L1 offers unmatched infrastructure guarantees, eliminating the need for a dedicated L2 solution. For users, this means a smoother experience, with improvements like one-step registration and purchases in stablecoins, all without leaving Ethereum. ENSv2, now deployed on L1, remains interoperable with other L2s, thus preserving flexibility for developers.

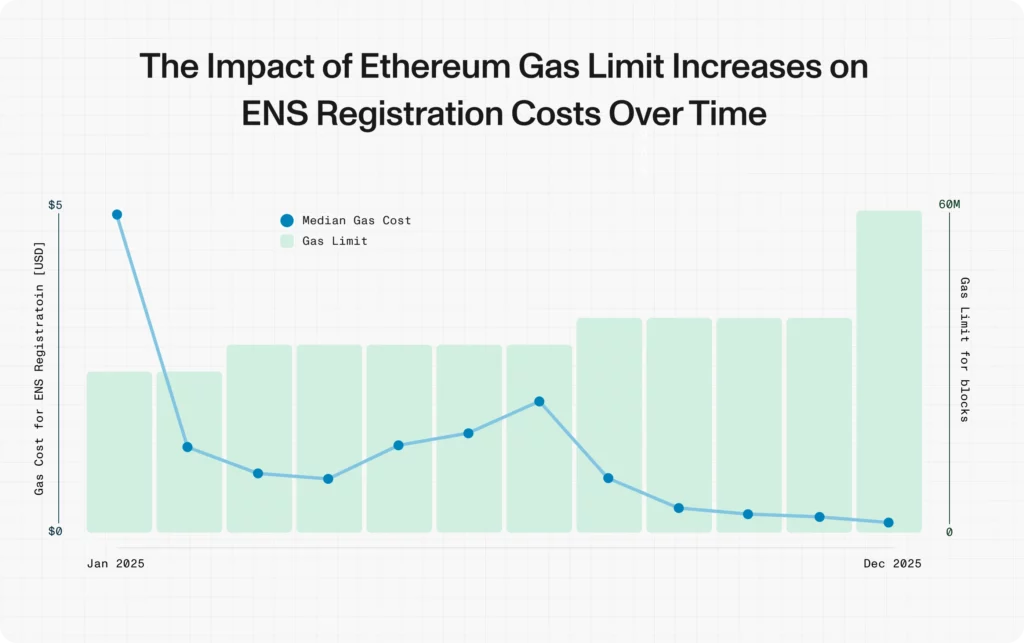

The impact of Ethereum gas limit increases on transaction costs

Recent increases in the Ethereum gas limit have had a direct impact on transaction costs, as shown by the changes in fees for ENS registrations. Between January and December 2025, the gas limit rose from 30M to 60M, drastically reducing fees for crypto users.

Impact of the gas limit on Ethereum.

Impact of the gas limit on Ethereum.

This capacity increase has allowed costs to be divided by 10, making Ethereum more accessible. Visual data confirms this trend. Median fees for ENS registrations have followed a downward curve correlated with the gas limit increase. For users, this translates into increased accessibility and reduced financial barriers.

Ethereum transaction fees, a key variable for crypto adoption?

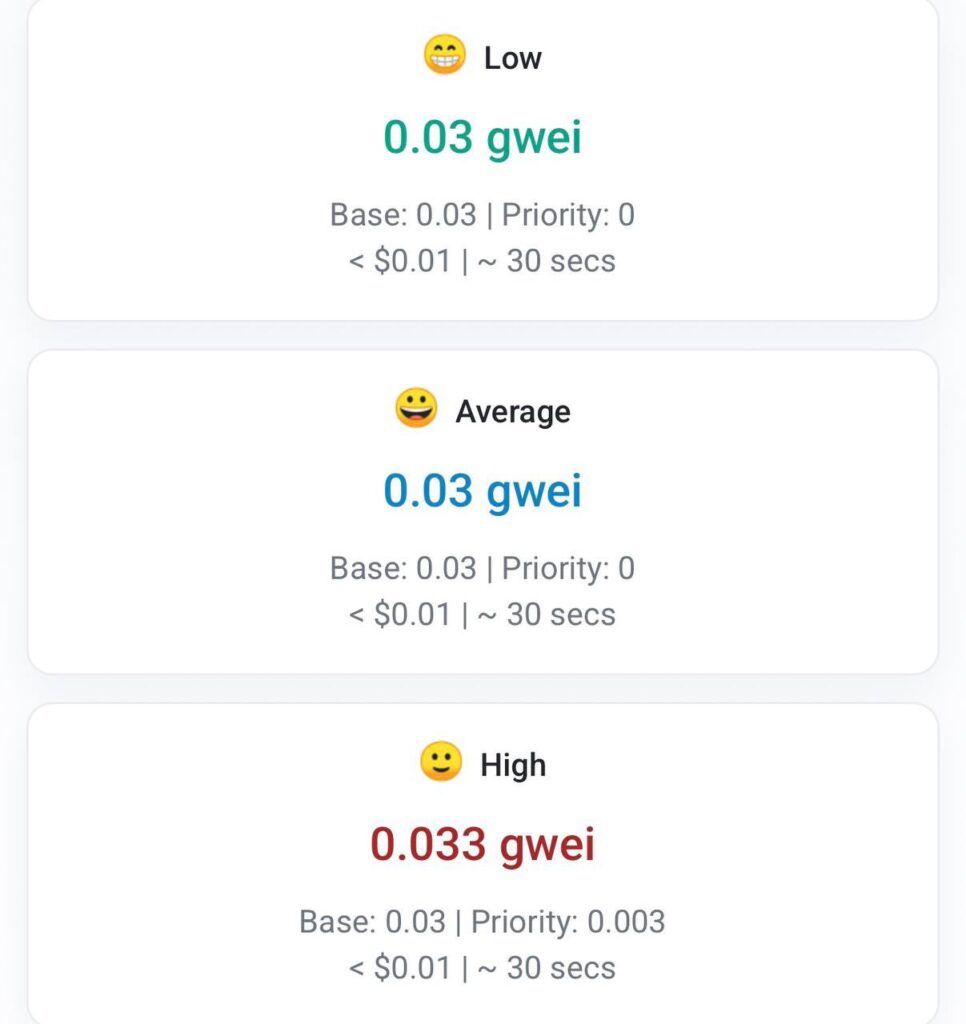

Transaction fees in gwei play a crucial role in Ethereum adoption. Low (0.03 gwei), medium (0.03 gwei), and high (0.033 gwei) levels directly influence the final cost for crypto users. A high priority can slightly increase fees, but remains negligible compared to past costs.

This fee stability is a major asset for Ethereum. Indeed, it allows projects like ENS to offer competitive services while attracting new users. The outlook is promising: with future updates, these costs could decrease further. This would strengthen the blockchain’s attractiveness and could make the ETH price skyrocket.

ENS’s decision to remain on Ethereum L1 marks a turning point in the crypto ecosystem. With falling transaction costs and improved scalability, Vitalik Buterin’s blockchain proves it can compete with L2 solutions. In your opinion, will L2s become obsolete due to Ethereum’s evolution?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Chipotle's CEO aims to attract more diners earning above $100,000 — signaling that menu prices are set to rise

Alphabet's debt raise fuels forecasts for record year in corporate bond sales

Butterfield Bank (NYSE:NTB) Delivers Unexpected Q4 CY2025 Revenue Results