Chegg (NYSE:CHGG) Surpasses Q4 CY2025 Projections

Chegg Q4 2025 Earnings Overview

Chegg (NYSE:CHGG), a platform offering online academic support, released its financial results for the fourth quarter of 2025, surpassing revenue expectations with $72.66 million in sales. However, this figure represents a steep 49.4% drop compared to the same period last year. Looking ahead, the company's revenue outlook for the next quarter stands at $61 million, which is 5.5% below what analysts had anticipated. On a positive note, Chegg reported a non-GAAP loss per share of $0.01, significantly outperforming consensus estimates.

Should You Consider Investing in Chegg?

Highlights from Chegg’s Q4 2025 Performance

- Total Revenue: $72.66 million, exceeding analyst projections of $71 million, but down 49.4% year-over-year

- Adjusted Earnings Per Share: -$0.01, beating expectations of -$0.10

- Adjusted EBITDA: $12.89 million, higher than the $10.76 million forecast (margin of 17.7%)

- Q1 2026 Revenue Outlook: $61 million at the midpoint, below the $64.58 million analysts expected

- Q1 2026 EBITDA Guidance: $11.5 million at the midpoint, surpassing the $7.23 million estimate

- Operating Margin: -47.2%, a significant decline from -2.3% in the prior year

- Free Cash Flow: -$15.48 million, compared to -$943,000 in the previous quarter

- Market Value: $86.37 million

About Chegg

Chegg began as a company renting out physical textbooks and has since evolved into a digital platform focused on helping students with their academic needs.

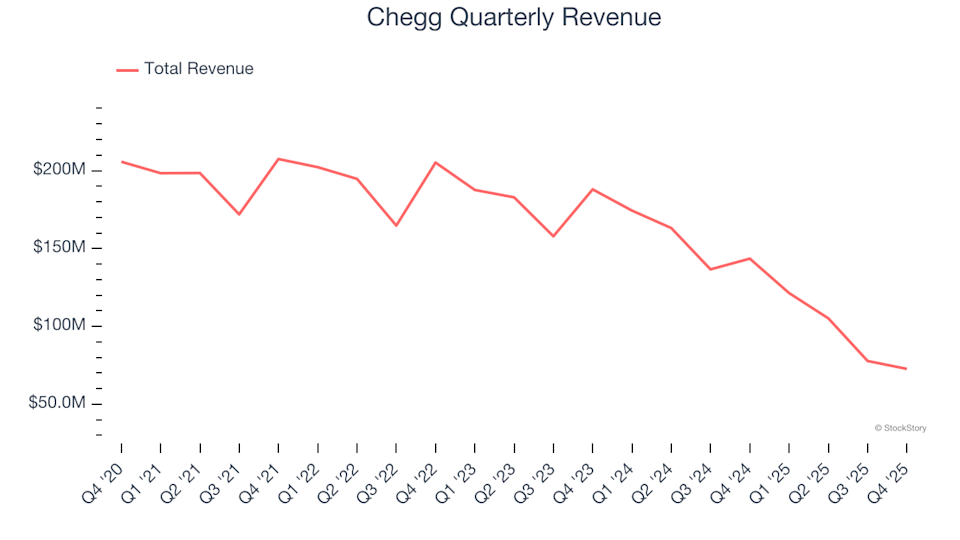

Trends in Revenue

Examining long-term sales trends can reveal much about a company’s underlying strength. While any business can have a strong quarter, sustained growth is a sign of quality. Over the past three years, Chegg’s revenue has declined at an average annual rate of 21.1%, indicating ongoing challenges for the company.

In the most recent quarter, Chegg’s revenue dropped by 49.4% year-over-year to $72.66 million, though this was still 2.3% above Wall Street’s expectations. Management forecasts another sharp decline of 49.7% for the upcoming quarter.

Looking further out, analysts predict a 42.3% decrease in revenue over the next year, which, while slightly better than recent trends, still points to ongoing demand issues for Chegg’s offerings.

As technology continues to transform industries, the need for software tools that support developers grows—whether for managing cloud infrastructure, integrating multimedia, or ensuring seamless streaming.

Cash Flow Analysis

At StockStory, we place a strong emphasis on free cash flow, as it ultimately determines a company’s ability to meet its obligations and return value to shareholders.

Chegg’s cash generation has been lackluster over the past two years, with an average free cash flow margin of just 3.8%—below average for a consumer internet company. This is partly due to Chegg’s capital-heavy operations, which require significant investment in inventory and facilities, resulting in a gap between EBITDA and free cash flow margins.

Over recent years, Chegg’s margin has dropped by 23.5 percentage points. This decline, combined with already modest margins, puts the company in a challenging position. If this trend continues, Chegg may become even more capital intensive, which could concern investors.

In Q4, Chegg reported a negative free cash flow of $15.48 million, translating to a -21.3% margin. This reversal from positive cash flow in the same period last year highlights ongoing financial difficulties.

Summary of Chegg’s Q4 Results

Chegg’s upbeat EBITDA forecast for the next quarter was a bright spot, significantly outpacing analyst expectations. The company also delivered a strong EBITDA result this quarter. However, its revenue outlook for the upcoming quarter fell short of market hopes. Overall, while there were positive aspects, the market reacted negatively, with Chegg’s stock price dropping 3.1% to $0.73 following the announcement.

Is Chegg a good investment at this point? When evaluating, it’s crucial to consider the company’s valuation, operational strengths, and the latest financial results.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Chipotle's CEO aims to attract more diners earning above $100,000 — signaling that menu prices are set to rise

Alphabet's debt raise fuels forecasts for record year in corporate bond sales

Butterfield Bank (NYSE:NTB) Delivers Unexpected Q4 CY2025 Revenue Results