Simpson (NYSE:SSD) Delivers Unexpected Q4 CY2025 Revenue Results

Simpson (SSD) Surpasses Q4 2025 Expectations

Simpson Manufacturing (NYSE:SSD), a leading producer of building materials, delivered fourth-quarter 2025 results that exceeded analyst forecasts. The company reported $539.3 million in revenue, marking a 4.2% increase from the previous year and outperforming Wall Street projections. Earnings per share under GAAP reached $1.35, coming in 11.1% above consensus estimates.

Curious if Simpson is a smart buy right now?

Highlights from Simpson’s Q4 2025 Performance

- Revenue: $539.3 million, topping analyst expectations of $530.7 million (4.2% year-over-year growth, 1.6% above estimates)

- GAAP EPS: $1.35, compared to the projected $1.22 (11.1% beat)

- Adjusted EBITDA: $104.7 million, surpassing the $94.39 million forecast (19.4% margin, 10.9% above estimates)

- Operating Margin: 13.9%, a decrease from 15% in the same period last year

- Market Cap: $8.05 billion

“Throughout 2025, our disciplined execution drove strong results, and I’m proud of our team’s achievements,” commented Mike Olosky, President and CEO of Simpson Manufacturing Co., Inc.

About Simpson Manufacturing

Simpson (NYSE:SSD) specializes in designing and producing structural connectors, anchors, and related construction solutions, all aimed at enhancing the safety and durability of buildings.

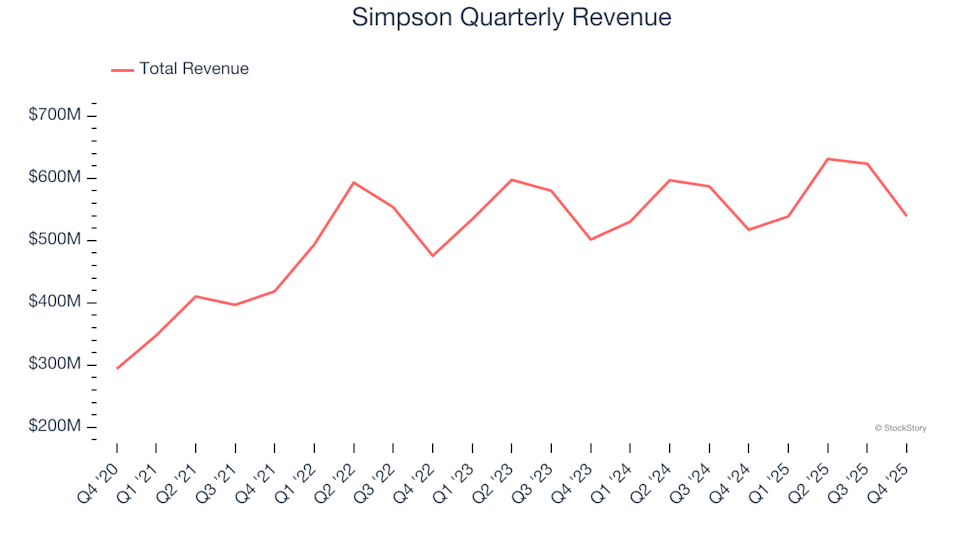

Examining Revenue Trends

Consistent sales growth is a hallmark of a high-quality business. While any company can have a strong quarter, sustained expansion over years is more telling. Simpson has achieved a robust 13% compound annual growth rate in revenue over the past five years, outpacing the typical industrial sector company and reflecting strong demand for its products.

However, it’s important to consider recent trends. Over the last two years, Simpson’s annualized revenue growth slowed to 2.7%, falling short of its five-year average and indicating a deceleration in demand.

In the most recent quarter, revenue grew by 4.2% year-over-year, beating analyst expectations by 1.6%.

Looking forward, analysts predict Simpson’s revenue will rise by 2.5% over the next year, mirroring its recent pace. This suggests that new offerings may not yet be driving significant top-line growth.

While major attention is on Nvidia’s record highs, a lesser-known semiconductor company is excelling in a vital AI segment.

Profitability and Margins

Over the past five years, Simpson has consistently delivered strong profitability, with an average operating margin of 21.2%—an impressive figure for an industrial company, thanks in part to its high gross margins.

Operating Margin Trends

Despite its historical strength, Simpson’s operating margin has declined by 4.3 percentage points over the last five years. This trend raises concerns about rising costs, as revenue growth typically helps companies achieve greater efficiency and improved margins.

This quarter, the operating margin stood at 13.9%, down 1.2 percentage points from the prior year. The sharper decline in operating margin compared to gross margin suggests increased spending on areas like marketing, research and development, and administrative functions.

Earnings Per Share (EPS) Analysis

Tracking long-term EPS growth helps assess whether a company’s expansion translates into higher profitability for shareholders. Simpson’s EPS has grown at a notable 14.1% annual rate over the past five years, in line with its revenue trajectory, indicating sustained per-share earnings as the business scaled.

However, over the last two years, EPS has remained flat, diverging from its strong five-year trend. Investors will be watching to see if earnings growth resumes in the near future.

For Q4, Simpson posted EPS of $1.35, up from $1.31 a year ago and comfortably ahead of analyst expectations. Wall Street anticipates full-year EPS of $8.25 for the next 12 months, representing a 4.6% increase.

Summary and Investment Considerations

Simpson’s latest quarter featured standout EBITDA and revenue results, both exceeding analyst forecasts. While the share price remained steady at $196.25 immediately after the announcement, the quarter showcased several positive developments.

Is Simpson a compelling investment at its current valuation? While quarterly results are important, long-term business fundamentals and valuation are even more critical when making investment decisions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Chipotle's CEO aims to attract more diners earning above $100,000 — signaling that menu prices are set to rise

Alphabet's debt raise fuels forecasts for record year in corporate bond sales

Butterfield Bank (NYSE:NTB) Delivers Unexpected Q4 CY2025 Revenue Results