Columbus McKinnon (NASDAQ:CMCO) Delivers Impressive Results in Q4 CY2025

Columbus McKinnon (CMCO) Surpasses Q4 CY2025 Expectations

Columbus McKinnon, a leading producer of material handling equipment, posted its Q4 CY2025 financial results, outperforming analyst projections. The company reported revenue of $258.7 million, marking a 10.5% increase compared to the same period last year. Adjusted earnings per share came in at $0.62, exceeding consensus forecasts by 6.6%.

Considering these results, is now an opportune moment to invest in Columbus McKinnon?

Q4 CY2025 Performance Highlights

- Revenue: $258.7 million, surpassing analyst expectations of $245.7 million (10.5% year-over-year growth, 5.3% above estimates)

- Adjusted EPS: $0.62, beating the projected $0.58 (6.6% above consensus)

- Adjusted EBITDA: $39.8 million, compared to the anticipated $36.1 million (15.4% margin, 10.3% above estimates)

- Operating Margin: 6.3%, a decrease from 10.9% in the prior year’s quarter

- Free Cash Flow Margin: 6.4%, up from 2.6% a year ago

- Backlog: $341.6 million at quarter-end, reflecting a 15.2% year-over-year increase

- Market Capitalization: $646.5 million

“Our team achieved double-digit growth in sales, orders, and earnings per share this quarter, outperforming our own expectations as we advanced our commercial strategies and benefited from steady U.S. demand,” stated David J. Wilson, President and CEO.

About Columbus McKinnon

Operating through 19 brands worldwide, Columbus McKinnon (NASDAQ:CMCO) supplies material handling solutions to sectors such as construction, manufacturing, and transportation.

Revenue Trends and Growth

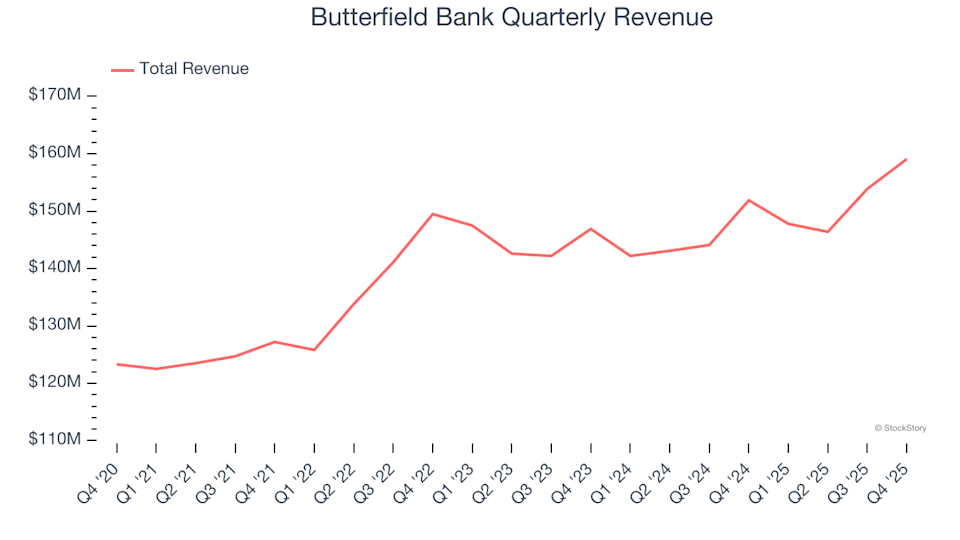

Evaluating a company’s long-term growth provides valuable perspective. While any business can have a strong quarter, sustained expansion is a sign of quality. Over the past five years, Columbus McKinnon’s sales have grown at a compounded annual rate of 9%, slightly outpacing the average for industrial companies and indicating strong market acceptance.

Although long-term growth is crucial, recent trends can reveal shifts in demand. Over the last two years, Columbus McKinnon’s revenue has remained steady, suggesting a slowdown in momentum.

The company’s backlog, representing unfulfilled orders, reached $341.6 million in the latest quarter, averaging 15.2% annual growth over the past two years. This backlog growth outpaces revenue, indicating robust demand but also hinting at potential capacity constraints.

Recent Financial Performance

In the most recent quarter, Columbus McKinnon’s revenue rose 10.5% year over year, with the $258.7 million figure exceeding Wall Street’s expectations by 5.3%.

Looking forward, analysts predict a 3% revenue increase over the next year. While this suggests new products and services may drive future growth, the forecast remains below the industry average.

For investors seeking high-growth opportunities, the evolving landscape of enterprise software—especially companies leveraging generative AI—may offer compelling alternatives.

Profitability and Operating Margins

Operating margin is a key indicator of profitability, reflecting how much profit remains after accounting for production, marketing, and R&D costs. Over the past five years, Columbus McKinnon has maintained an average operating margin of 9.1%, outperforming the broader industrial sector.

However, the company’s operating margin has declined by 1.9 percentage points over this period, raising questions about rising expenses. Ideally, revenue growth should have led to improved cost efficiency and higher margins.

This quarter, the operating margin stood at 6.3%, down 4.7 percentage points from the previous year. The sharper decline compared to gross margin suggests increased spending in areas like marketing, research, and administration.

Earnings Per Share (EPS) Analysis

While revenue growth shows a company’s expansion, changes in earnings per share (EPS) reveal how profitable that growth is. Over the last five years, Columbus McKinnon’s EPS has grown at a compounded annual rate of 13.4%, outpacing its revenue growth. However, since operating margins did not improve and no share buybacks occurred, this improvement likely resulted from lower interest or tax expenses.

Short-term analysis shows a less favorable trend: EPS has declined at an annual rate of 10.5% over the past two years, underperforming flat revenue growth. The primary driver behind this drop appears to be shrinking operating margins.

For Q4, adjusted EPS reached $0.62, up from $0.56 a year earlier and 6.6% above analyst expectations. Looking ahead, Wall Street anticipates full-year EPS of $2.34, representing an 18.1% increase over the next 12 months.

Summary and Investment Considerations

Columbus McKinnon delivered a strong quarterly performance, notably surpassing EBITDA and revenue forecasts. Despite these positives, the company’s stock price remained unchanged at $23.11 following the results.

While the recent earnings report was impressive, potential investors should also weigh factors such as valuation, business fundamentals, and broader market trends before making a decision.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Chipotle's CEO aims to attract more diners earning above $100,000 — signaling that menu prices are set to rise

Alphabet's debt raise fuels forecasts for record year in corporate bond sales

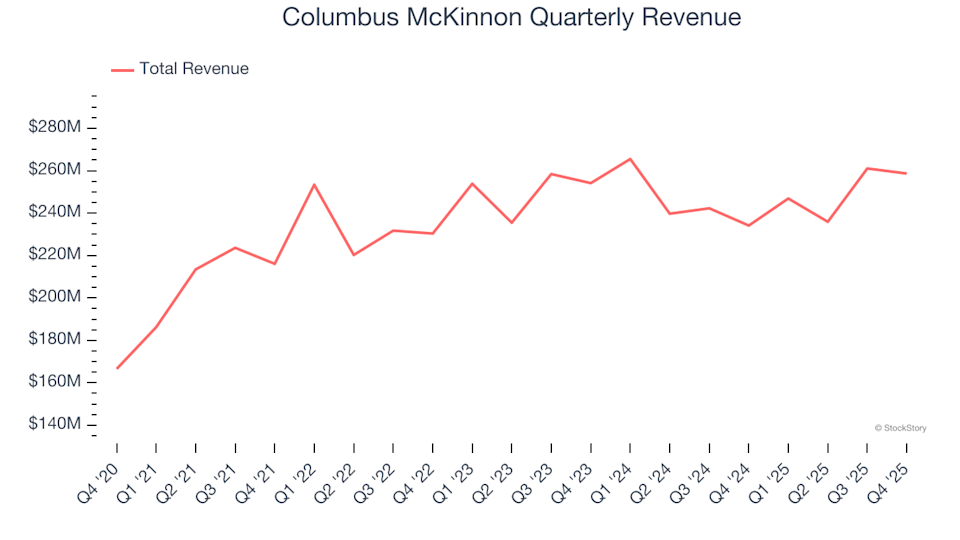

Butterfield Bank (NYSE:NTB) Delivers Unexpected Q4 CY2025 Revenue Results