International Flavors & Fragrances (IFF) Q4 Earnings Report Preview: Key Points to Watch

IFF Set to Announce Earnings: Key Insights for Investors

International Flavors & Fragrances (NYSE:IFF), a leader in the flavor and fragrance industry, is scheduled to release its latest financial results this Wednesday after the market closes. Here’s a summary of what investors should keep in mind.

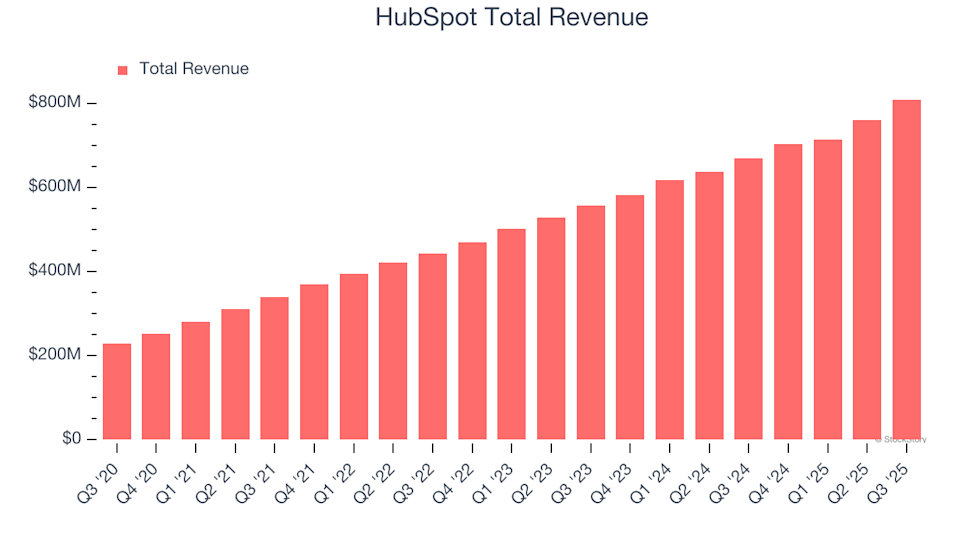

In the previous quarter, IFF surpassed Wall Street’s revenue forecasts by 2.1%, posting $2.69 billion in sales—a 7.9% decrease compared to the same period last year. The company not only exceeded expectations for organic revenue growth but also outperformed analyst projections for EBITDA, marking a robust quarter overall.

Curious whether IFF is a buy or sell ahead of its earnings report?

Expectations for the Upcoming Quarter

Analysts are projecting that IFF’s revenue will fall by 9.2% year over year to $2.52 billion this quarter, reversing the 2.5% growth seen in the same period last year. Adjusted earnings per share are anticipated to reach $0.83.

Over the past month, analyst forecasts for IFF have remained steady, indicating confidence that the company will maintain its current trajectory. Notably, IFF has consistently outperformed revenue expectations for the last eight quarters, with an average beat of 2.2%.

Industry Peers: Recent Performance

Several companies in the ingredients, flavors, and fragrances sector have already shared their Q4 results, offering some context for IFF’s upcoming report:

- Bunge Global achieved a 75.5% increase in revenue year over year, surpassing analyst estimates by 6.1%. However, its stock declined by 2.5% after the announcement.

- Archer-Daniels-Midland experienced a 13.7% drop in revenue, missing expectations by 12.6%, and its shares fell 1.1% post-results.

For a deeper dive, check out our full reviews of Bunge Global’s performance and Archer-Daniels-Midland’s results.

Market Sentiment and Price Targets

The ingredients, flavors, and fragrances sector has seen positive momentum, with average stock prices rising 5.8% over the past month. IFF’s shares have climbed 9% during this period. Heading into earnings, analysts have set an average price target of $82.32 for IFF, compared to its current price of $75.06.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is the Bitcoin Sell-Off Finally Losing Momentum?

Crypto Futures Liquidations Trigger $213M Market Shakeout as Bitcoin Leads with $121M

Coinbase Q4 Earnings Preview: Subscription Resilience Amid Trading Volume Challenges

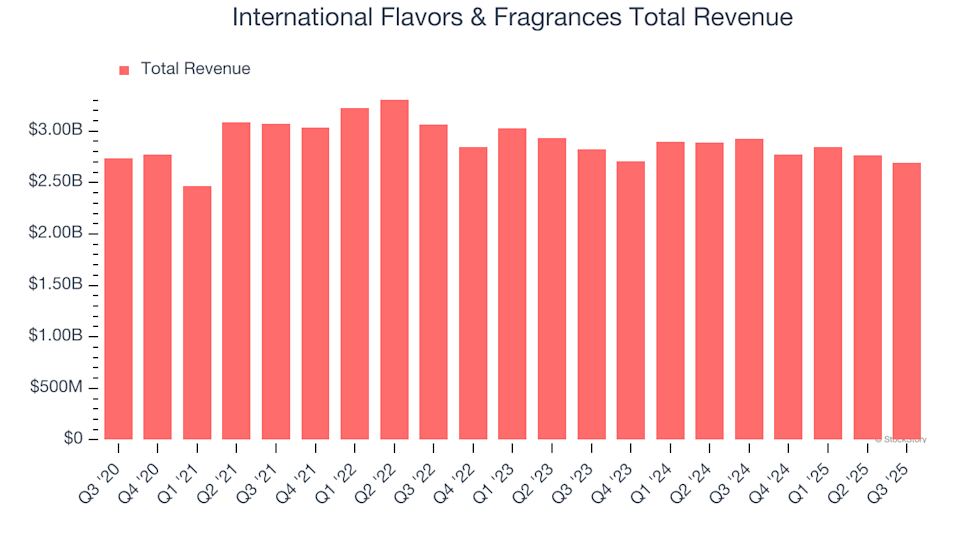

HubSpot (HUBS) Q4 Results: What You Should Know