Ethereum Price Resumes Bloodbath as ETF Exodus Hits $3.2 Billion. But, Not Everyone Is Giving Up.

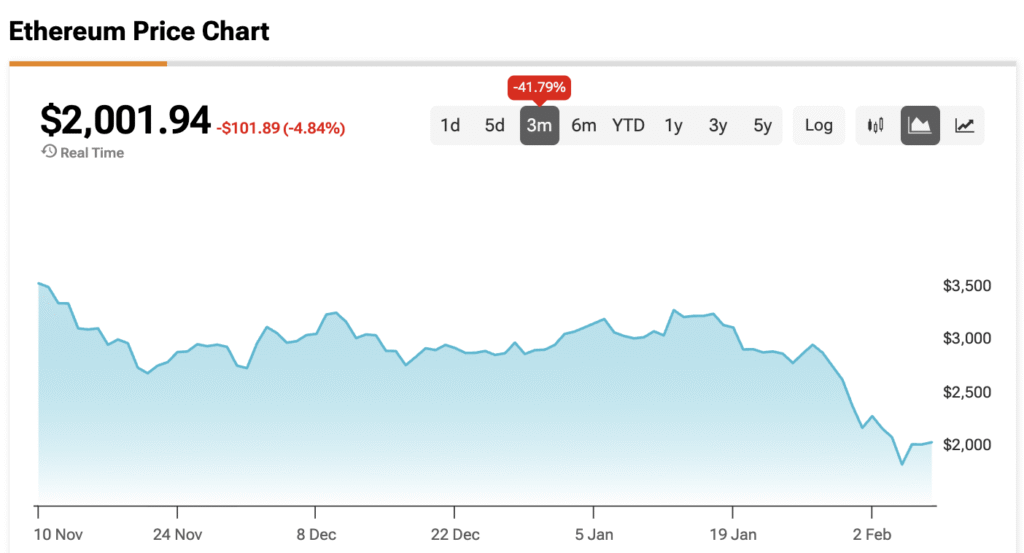

Ethereum (ETH-USD) is staring into the abyss today. After a weekend of deceptive calm, the second-largest cryptocurrency resumed its downward slide, dropping as much as 6% to hit a low of $1,994. While Bitcoin is also feeling the heat, falling below the $69,000 mark, Ethereum’s losses have been far more aggressive. Analysts point out that bears still control the trend, leaving the market in a fragile consolidation phase rather than a true recovery.

Valentine's Day Sale - 70% Off

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The Exit of $3.2 Billion in Institutional Capital Remains Most Damaging

The most damaging news for Ethereum remains the relentless exit of institutional capital. Since the sharp market crash in October, investors have pulled a staggering $3.2 billion from Ether ETFs. This year alone has seen $462 million in redemptions, suggesting that the big players are losing confidence in ETH’s short-term future. Investors heading for the exits have created a self-reinforcing cycle of selling pressure, as fund managers are forced to liquidate holdings to meet these massive redemptions.

Fiercely Bearish Sentiment Grips the Market

Market sentiment has reached what experts call a capitulation phase. The MVRV Z-Score, a key indicator of whether an asset is over or undervalued, has plunged to -0.42, levels not seen since the major market bottoms of 2018 and 2022. Analyst Rachael Lucas notes that ETH remains in a bearish structure after losing the $2,800 to $3,000 range. With global interest in crypto hitting annual lows, the current risk-off mood means there is very little appetite for anyone to buy-the-dip in a meaningful way.

Not Everyone Is Ready to Throw In the Towel Just Yet

Not everyone is ready to give up. Bitmine Immersion Technologies (BMNR) just added another 40,613 ETH to its treasury, and Chairman Tom Lee is predicting a V-shaped recovery similar to the rebounds seen in 2025. However, for this to happen, Ethereum must first hold the $2,000 support level. If this floor breaks, the next major demand zone doesn’t appear until $1,740, which could lead to a final, dramatic capitulation of long-term holders.

At the time of writing, Ethereum is sitting at $2,001.94

Copyright © 2026, TipRanks. All rights reserved.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Wallet upgrades "MEV Protection" feature to further enhance the Swap trading experience

Bitget Wallet launches the industry's first MPC wallet solution supporting the TON mainnet

Bitget Wallet to Launch BWB Token Subscription on its Launchpad Platform