Mattel (NASDAQ:MAT) Falls Short of Q4 CY2025 Revenue Expectations, Shares Decline

Mattel Q4 2025 Earnings Overview

Mattel (NASDAQ:MAT), a leading name in toy manufacturing and entertainment, reported fourth-quarter revenue for calendar year 2025 that did not meet market expectations. Despite this, sales increased by 7.3% year over year, reaching $1.77 billion. Adjusted earnings per share came in at $0.39, which was 28.8% below what analysts had anticipated.

Highlights from Mattel’s Q4 2025 Results

- Revenue: $1.77 billion, falling short of the $1.83 billion analyst forecast (7.3% annual growth, 3.7% below expectations)

- Adjusted EPS: $0.39, compared to the $0.55 predicted by analysts (28.8% miss)

- Adjusted EBITDA: $234.2 million, under the $316.7 million estimate (13.3% margin, 26.1% miss)

- 2026 Adjusted EPS Guidance: Midpoint at $1.24, which is 29.6% below analyst projections

- Operating Margin: 8%, down from 9.4% in the prior year’s quarter

- Market Cap: $6.70 billion

Ynon Kreiz, Mattel’s Chairman and CEO, commented: “We delivered solid top-line growth in the fourth quarter, with positive consumer demand across all regions for both the quarter and the full year. However, U.S. gross billings in December increased less than anticipated. Our international segment performed well, and we expanded our market share in key categories worldwide.”

About Mattel

Mattel is a global leader in children’s entertainment, best known for creating iconic brands like Barbie and Hot Wheels. The company specializes in designing and producing a wide range of consumer products for kids.

Revenue Trends

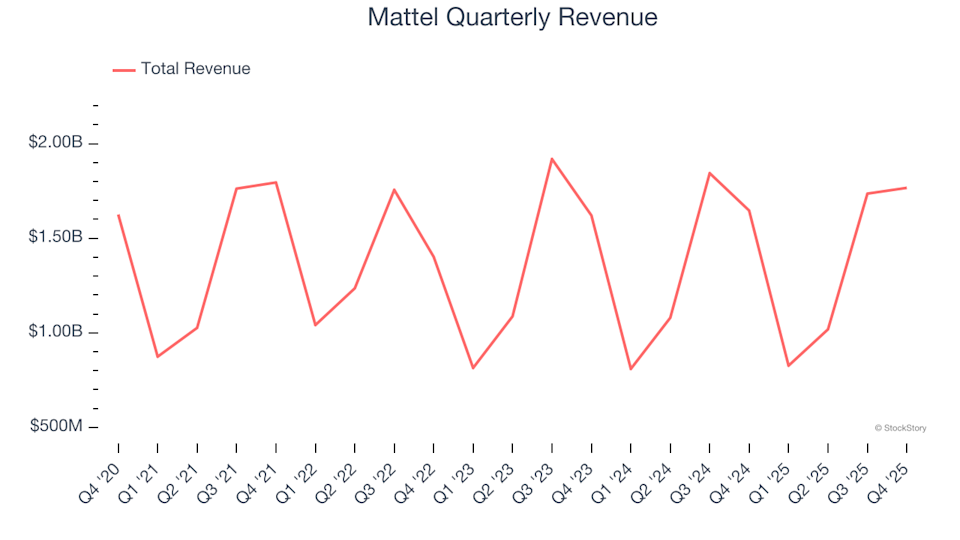

Evaluating a company’s long-term sales trajectory offers valuable perspective on its overall strength. While short-term gains can happen, sustained growth over several years is a hallmark of a robust business. Over the past five years, Mattel’s annualized revenue growth was just 3.1%, which is considered weak for the consumer discretionary sector and sets a low starting point for further analysis.

At StockStory, we prioritize long-term growth. However, in consumer discretionary industries, focusing solely on the past can overlook companies benefiting from new products or trends. Mattel’s recent results indicate a slowdown, with revenue remaining flat over the last two years.

This quarter, revenue increased by 7.3% year over year to $1.77 billion, but still missed Wall Street’s expectations.

Looking forward, analysts anticipate Mattel’s revenue will rise by 4.7% over the next year. While this suggests some optimism for new offerings, it remains below the industry average.

Profitability and Margins

Operating Margin

Operating margin is a crucial indicator of a company’s profitability, reflecting earnings before taxes and interest. Over the past year, Mattel’s operating margin has declined, averaging 12.3% over the last two years. This level of profitability is modest for a consumer discretionary company and suggests that Mattel has struggled to offset rising operating costs.

In the fourth quarter, the company posted an operating margin of 8%, a decrease of 1.5 percentage points from the previous year. This relatively small drop indicates that Mattel’s cost structure has remained fairly steady.

Earnings Per Share (EPS)

Tracking long-term EPS growth helps assess whether a company’s expansion is translating into profitability. Over the past five years, Mattel’s EPS grew at a compounded annual rate of 22.1%. While this outpaced its stagnant revenue, the lack of improvement in operating margin limits the significance of this growth.

For Q4, Mattel reported adjusted EPS of $0.39, up from $0.35 a year earlier. Despite this year-over-year improvement, the figure still fell short of analyst expectations. Wall Street projects that Mattel’s full-year EPS will reach $1.44 in the next 12 months, representing a 23% increase.

Summary and Outlook

There were few bright spots in Mattel’s latest results. The company’s full-year EPS guidance and EBITDA both missed analyst targets, making this a disappointing quarter. Following the announcement, Mattel’s stock price dropped 8.8% to $19.21.

Although this quarter’s performance was underwhelming, a single earnings report doesn’t determine a company’s long-term prospects. To decide if Mattel is a worthwhile investment at current prices, it’s important to consider broader fundamentals and valuation, not just recent results.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Chainlink and Hedera Lead the Top 10 RWA Assets by Social Rankings

Saks is shutting down additional locations as its bankruptcy moves forward

Crypto Downturn Reveals Crucial Structural Shift, Not a Single Collapse, Says Galaxy CEO

Cathie Wood’s Strategic Leap: Joins LayerZero Advisory Board to Revolutionize Cross-Chain Connectivity