Freshworks (NASDAQ:FRSH) Exceeds Sales Expectations in Q4 CY2025

Freshworks Surpasses Q4 2025 Expectations

Freshworks (NASDAQ:FRSH), a leading provider of business software, delivered fourth-quarter 2025 results that exceeded analyst forecasts. The company reported a 14.5% year-over-year increase in revenue, reaching $222.7 million. Looking ahead, Freshworks projects next quarter’s revenue to hit $223.5 million at the midpoint, which is 1.3% higher than what Wall Street anticipated. Non-GAAP earnings per share came in at $0.14, surpassing consensus estimates by 23.8%.

Should You Consider Investing in Freshworks?

Curious if now is the right time to invest in Freshworks?

Highlights from Freshworks Q4 2025

- Revenue: $222.7 million, beating analyst expectations of $218.7 million (14.5% year-over-year growth, 1.8% above estimates)

- Adjusted EPS: $0.14, outpacing the $0.11 consensus (23.8% higher than expected)

- Adjusted Operating Income: $41.62 million, exceeding the $32.15 million forecast (18.7% margin, 29.4% above estimates)

- Q1 2026 Revenue Outlook: $223.5 million at the midpoint, above the $220.7 million analyst estimate

- 2026 Adjusted EPS Guidance: $0.56 at the midpoint, which is 19% below analyst expectations

- Operating Margin: 17.8%, a significant improvement from -12.2% in the same period last year

- Free Cash Flow Margin: 25.2%, slightly lower than the previous quarter’s 26.6%

- Customer Base: 24,762 clients spending over $5,000 annually

- Net Revenue Retention Rate: 104%, a slight decrease from 105% in the prior quarter

- Billings: $259.6 million at quarter’s end, up 16.7% year over year

- Market Cap: $2.43 billion

“Freshworks delivered a stellar fourth quarter and fiscal year 2025, surpassing our targets for growth and profitability for the fifth quarter in a row,” commented Dennis Woodside, CEO and President of Freshworks.

About Freshworks

Initially focused on customer service solutions, Freshworks (NASDAQ:FRSH) has evolved into a robust software suite powered by AI. Its cloud-based offerings help organizations streamline customer support, IT operations, sales, and marketing.

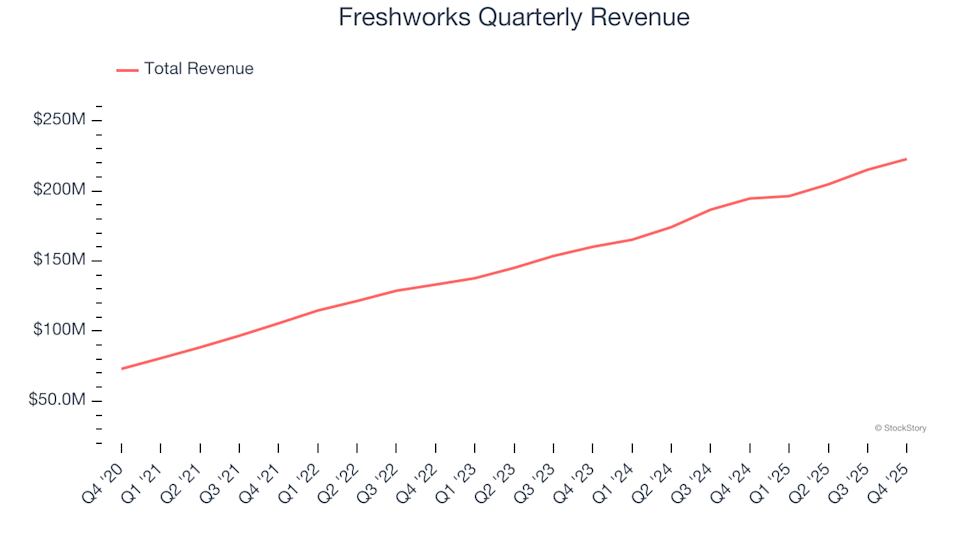

Examining Revenue Trends

Assessing a company’s long-term sales trajectory can reveal much about its underlying strength. While any business can post strong results for a short period, sustained growth is a hallmark of quality. Over the past five years, Freshworks achieved an impressive 27.4% compound annual revenue growth, outpacing the average software company and indicating strong market demand for its products.

Although Freshworks’s two-year annualized revenue growth of 18.6% trails its five-year average, it still reflects solid demand for its solutions.

Recent Revenue Performance

This quarter, Freshworks posted a 14.5% year-over-year revenue increase, bringing in $222.7 million—1.8% above Wall Street’s forecast. Management expects sales to rise by 13.9% year over year in the upcoming quarter.

Looking forward, analysts predict a 12.7% revenue increase over the next year, which is slower than recent years and may indicate some challenges in demand. Nevertheless, the company remains strong in other financial metrics.

Many industry giants, such as Microsoft and Alphabet, started as lesser-known growth stories. We’ve identified a promising AI semiconductor company that Wall Street is currently overlooking.

Understanding Billings

Billings, often referred to as “cash revenue,” represent the total amount collected from customers during a specific period, differing from revenue, which is recognized gradually over contract terms.

In Q4, Freshworks recorded $259.6 million in billings. Over the past year, billings grew by an average of 15.2% year over year, slightly outpacing the sector and aligning with overall sales growth. This strong performance boosts liquidity and positions the company well for future investments.

Customer Retention Insights

The software-as-a-service model is valued for its ability to generate increasing revenue from existing customers over time. Freshworks’s net revenue retention rate—a measure of how much existing customers spend compared to the previous year—stood at 105% in Q4. This means the company would have grown revenue by 5% even without acquiring new customers.

While Freshworks maintains a healthy retention rate, it falls short of the top-performing SaaS companies, which often achieve rates above 120%.

Summary of Q4 Results

Freshworks provided revenue guidance for the next quarter and full year that slightly exceeded analyst expectations. However, its earnings per share outlook for both periods fell short of Wall Street’s estimates. Following the results, the company’s stock price dropped 4.7% to $8.41.

Although Freshworks underperformed this quarter, investors may wonder if this presents a buying opportunity. Evaluating its valuation, business fundamentals, and recent performance is essential before making a decision.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Chainlink and Hedera Lead the Top 10 RWA Assets by Social Rankings

Saks is shutting down additional locations as its bankruptcy moves forward

Crypto Downturn Reveals Crucial Structural Shift, Not a Single Collapse, Says Galaxy CEO

Cathie Wood’s Strategic Leap: Joins LayerZero Advisory Board to Revolutionize Cross-Chain Connectivity