Iron Mountain's Shares Rise on Q4 AFFO Beat, Revenues Rise Y/Y

Iron Mountain Incorporated IRM reported fourth-quarter adjusted funds from operations (AFFO) per share of $1.44, beating the Zacks Consensus Estimate of $1.39. This figure jumped 16.1% year over year.

Reflecting investors’ positive sentiments, shares of the company gained around 9% during the initial hours of today’s trading session. Iron Mountain’s results reflect solid performances across all segments, including the storage, service, global RIM and data center business. However, higher interest expenses in the quarter undermined the performance to an extent.

Total quarterly revenues of $1.84 billion outpaced the Zacks Consensus Estimate of $1.80 billion. The figure improved 16.6% year over year.

For the full year 2025, IRM reported AFFO per share of $5.17, up 13.9% year over year. The figure also beat the Zacks Consensus Estimate of $5.11. Revenues of $6.90 billion climbed 12.2% year over year and beat the consensus mark of $6.86 billion.

IRM’s Q4 in Detail

Storage rental revenues were $1.06 billion in the fourth quarter, up 12.6% year over year.

Service revenues increased 22.4% from the prior-year quarter to $782 million.

The Global RIM business’s revenues grew 9.1% year over year to $1.37 billion.

The Global Data Center business reported revenues of $236.7 million in the fourth quarter, rising 39.1% year over year.

Adjusted EBITDA rose 16.6% year over year to $705.3 million. The adjusted EBITDA margin remained unchanged at 38.3%.

However, interest expenses increased 13% year over year to $219.8 million in the quarter.

IRM’s Balance Sheet Position

IRM exited the fourth quarter with $158.5 million of cash and cash equivalents, down from $195.2 million as of Sept. 30, 2025.

As of Dec. 31, 2025, the company has net debt of $16.39 billion, up from $16.11 billion as of Sept. 30, 2025, with a weighted average years to maturity of 4.6 years and a weighted average interest rate of 5.6%.

IRM’s Dividend

Concurrently with the fourth-quarter earnings release, IRM announced a cash dividend of 86.4 cents per share for the first quarter of 2026. The dividend will be paid out on April 3, 2026, to its shareholders on record as of March 16, 2026.

First Quarter & 2026 Guidance by IRM

For the first quarter of 2026, Iron Mountain expects AFFO per share of $1.39. Revenues are estimated to be $1.855 billion.

It expects 2026 AFFO per share between $5.69 and $5.79. The Zacks Consensus Estimate for the same is pegged at $5.69, which lies within the company’s guided range.

For 2026, revenues are estimated to be in the range of $7.625-$7.775 billion, while adjusted EBITDA is anticipated to be between $2.875 and $2.925 billion. The Zacks Consensus Estimate for 2026 revenues is pegged at $7.58 billion.

IRM’s Zacks Rank

Iron Mountain currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

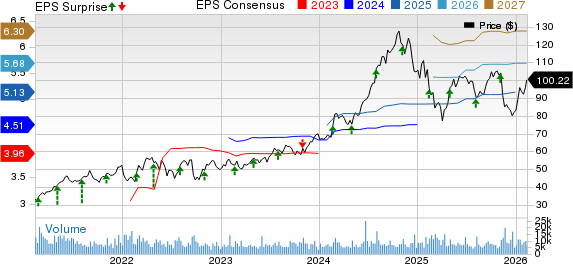

Iron Mountain Incorporated Price, Consensus and EPS Surprise

Iron Mountain Incorporated price-consensus-eps-surprise-chart | Iron Mountain Incorporated Quote

Performance of Other REITs

Cousins Properties CUZ reported fourth-quarter 2025 FFO per share of 71 cents, in line with the Zacks Consensus Estimate. The figure increased 2.9% on a year-over-year basis.

CUZ experienced healthy leasing activity in the quarter. The weighted average occupancy decreased, while interest expenses increased and marred the growth tempo.

Crown Castle Inc. CCI reported fourth-quarter 2025 AFFO per share of $1.12, which topped the Zacks Consensus Estimate of $1.07 per share. However, the figure declined nearly 6.7% year over year.

Results reflected a rise in services and other revenues year over year. A decrease in site rental revenues affected the results to some extent.

Note: Anything related to earnings presented in this write-up represents FFO, a widely used metric to gauge the performance of REITs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Blockchain-based identity could empower or imprison us

Snow Lake Completes Acquisition of Global Uranium and Enrichment Limited