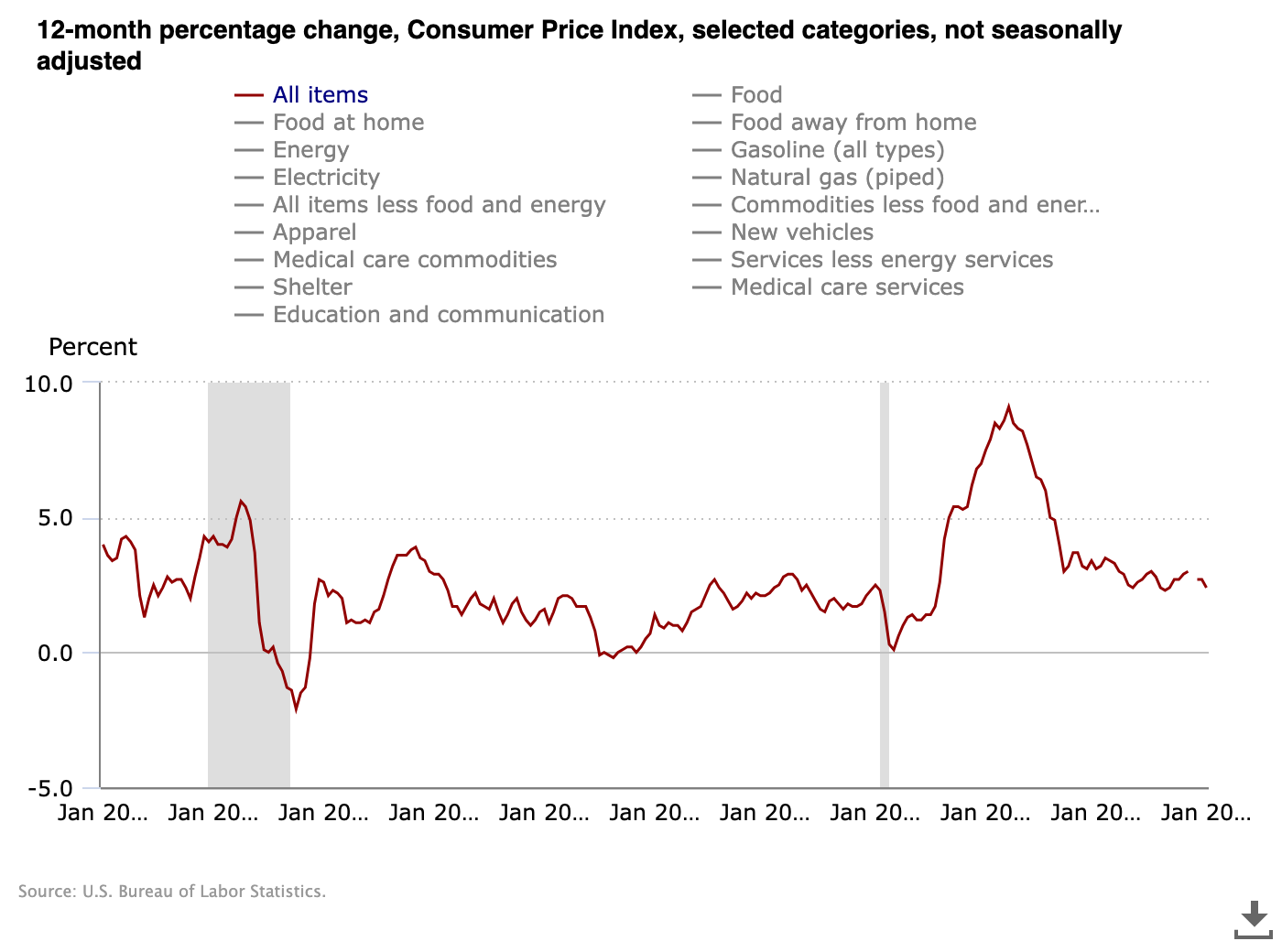

Inflation eased in January, with consumer prices increasing by 2.4% compared to the previous year at the beginning of 2026

January Inflation Slows More Than Predicted

According to new figures released Friday by the Bureau of Labor Statistics, inflation in January eased more than analysts had anticipated.

The Consumer Price Index (CPI) indicated that prices paid by consumers edged up 0.2% from December and were 2.4% higher than a year ago. This report, which was postponed due to a short government shutdown, marks the first official update on price trends for the beginning of 2026, following a year where inflation consistently exceeded the Federal Reserve’s 2% goal.

Expectations vs. Reality

Economists polled by Bloomberg had forecasted a 0.3% monthly rise and a 2.5% annual increase in consumer prices. When excluding more unpredictable categories like food and energy, so-called "core" inflation climbed 0.3% for the month and 2.5% over the past year.

Comparing to December's Data

This latest report shows an improvement over December’s numbers, when core inflation was at 2.6%—the slowest annual pace since March 2021. Overall inflation in January also slowed more sharply compared to the 2.7% annual rate recorded in December.

Persistent Price Pressures

Despite the overall slowdown, some expenses remain stubbornly high. Food costs, particularly for items like coffee and beef, have surged over the past year, pushing the food category up by 2.9% year-over-year in January.

Coffee displayed at a Chicago grocery store, February 9, 2026. (AP Photo/Erin Hooley / ASSOCIATED PRESS)

Tariffs and Their Impact

Another factor under scrutiny is the ongoing effect of President Trump’s broad tariffs, which were largely absorbed by businesses and consumers last year.

Analysts at Bank of America noted last week that they anticipate core goods prices to pick up from December’s levels, citing both increased costs passed on from tariffs and the usual trend of higher inflation in January compared to other months.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin passes $68K on slower US CPI print, but Fed rate-cut odds stay low

Cohere’s $240 million year paves the way for an IPO

Pi Network steadies as Feb 15 node upgrade deadline nears