Warner Bros Discovery sees activist Sachem Head increase stake in Q4

By Svea Herbst-Bayliss

NEW YORK, Feb 13 (Reuters) - Warner Bros. Discovery attracted the attention of activist investor Sachem Head Capital Management in the fourth quarter when the media and entertainment giant agreed to sell its streaming and studios business to Netflix, according to a regulatory filing on Friday.

Sachem Head, one of last year's best-performing hedge funds, said in the Securities and Exchange Commission filing that it more than doubled its holding in Warner Bros. Discovery to own nearly 8 million shares at the end of the fourth quarter.

The company, which has a market value of roughly $70 billion, ranked among Sachem Head's 10 biggest investments in U.S. stocks at the end of last year.

The move is noteworthy at a time when media giant Paramount Skydance is also racing to buy Warner Bros. Discovery, having made a hostile bid that was rejected last month.

This week, Paramount increased pressure on Warner Bros. Discovery to try and persuade its intended target to at least sit down and discuss whether its bid could possibly become more attractive than what Netflix is offering.

Paramount hinted it may try to unseat Warner Bros. Discovery directors in a board fight and suggested the head of one of Warner Bros. Discovery's biggest investors, Pentwater Capital Management, might make an attractive director candidate.

Sachem Head's filing also showed that it made a new bet on telecommunications company EchoStar by buying 5.2 million shares. It also made a new bet on online used car retailer Carvana and entertainment company Live Nation Entertainment.

These filings, required from all sizable investment managers, show what they owned in U.S. stocks at the end of the previous quarter. While they are backward looking, they are still widely followed by other investors as hints on which stocks are in vogue or may be vulnerable.

(Reporting by Svea Herbst-Bayliss; Editing by Will Dunham)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

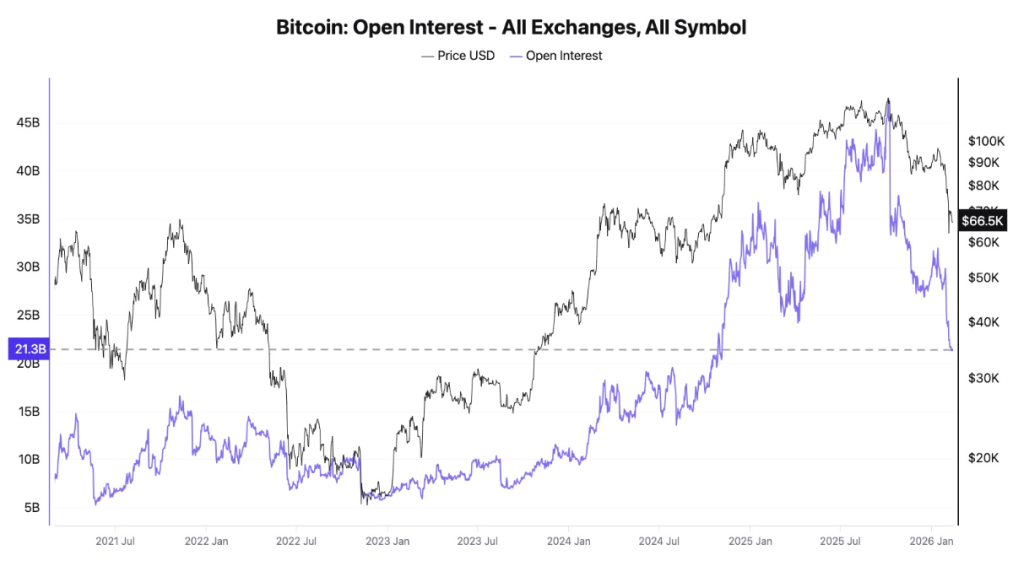

Bitcoin Price Bottom Not In Yet? Data Signals More Pain Ahead

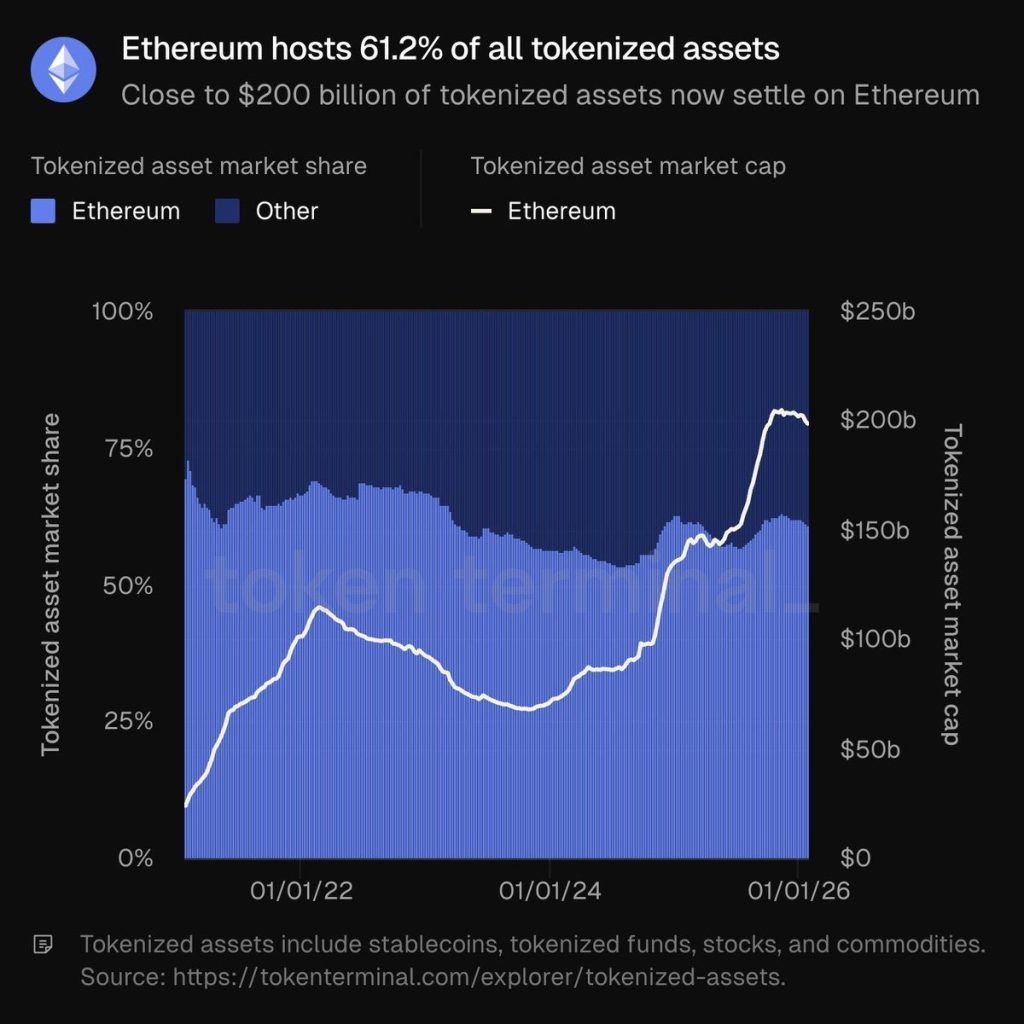

Ethereum’s Tokenization Boom Sparks $5,000 Speculation—Is an ETH Price Breakout Incoming?

MYX Finance Price Rebounds as Crypto Market Eases After CPI — Can It Rally 50%?

Top Altcoins to Stack for Possible 500x Gains