Goldman Sachs launches "AI-Resistant" U.S. Stock Investment Portfolio

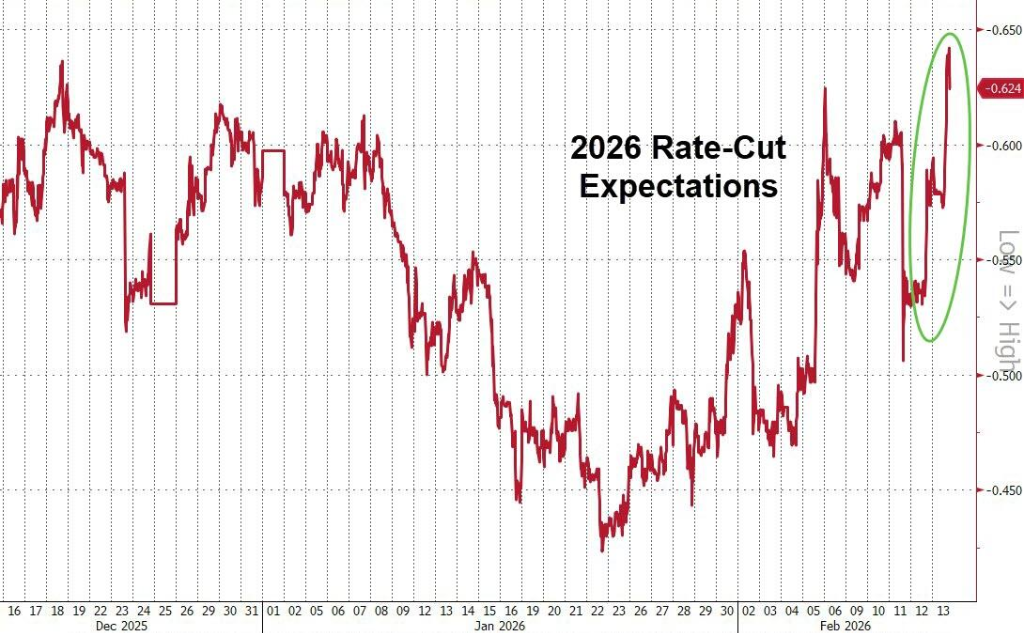

After the release of the US January CPI data on Friday, the market's initial reaction was a sigh of relief.

Year-on-year, it was 2.4%, lower than expected; core CPI continued to decline, reaching the lowest level in recent years. Traders immediately increased their bets on rate cuts within the year, with the market now implying a total rate cut of about 60 basis points for the year, and US Treasury yields fell accordingly.

However, the improved interest rate expectations did not lead to a rebound in tech giants.

While most major companies in the index rose with the inflation data, the tech "Magnificent Seven" became a drag, with the related index falling 1.1% in a single day. Amazon, in particular, has declined for nine consecutive trading days, setting its longest losing streak in nearly 20 years. The collective weakness of heavyweight stocks directly suppressed the Nasdaq, which ultimately closed down 0.22% on Friday.

(Amazon’s nine-day losing streak hit a new low since May last year)

From a technical perspective, the S&P 500 found support near the 100-day moving average, but had already fallen below the important short-term 50-day moving average. Goldman Sachs traders noted that market fatigue is starting to emerge. Although Goldman Sachs’ AI risk investment portfolio rebounded for the first time after five consecutive days of decline, it seems more like a short-term correction rather than a trend reversal.

The real point of interest is the change in the internal structure of the market.

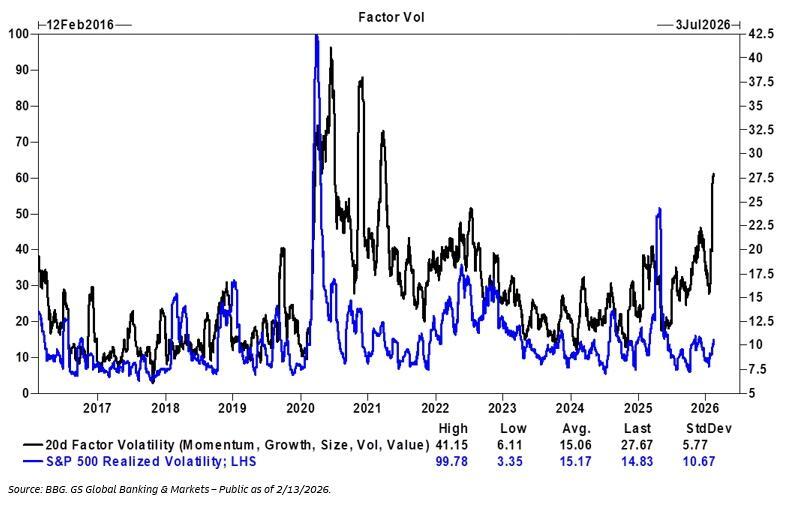

In the last 20 trading days, the trading volume of style factors surged to 27.7 times, while the overall trading volume of the S&P 500 increased less than 15 times.

The so-called “style factor” can be simply understood as classifying stocks by characteristics, such as growth stocks, value stocks, large-cap, small-cap, profitability, etc. When funds frequently switch between these different types, factor trading will be significantly amplified.

Currently, factor trading is much more active than the index itself. This indicates that the market is not withdrawing as a whole, but rather accelerating rotation among different styles.

This shows that funds are not leaving the market entirely, but are accelerating position rotation. The previously crowded tech sector continues to cool down, and some funds are beginning to flow into more stable-valued defensive sectors.

Defensive sectors outperform: In this week’s turmoil, traditional defensive industries performed relatively steadily.

Growth style under pressure: Financial sectors and some growth stocks affected by the so-called “AI shock” narrative have shown significantly increased volatility.

SaaS stocks rebound: The software services sector showed some resilience on Friday, closing basically flat.

Goldman Sachs launches “anti-AI shock” thematic investment portfolio

To cope with increasing turbulence in US tech software stocks, Goldman Sachs has launched a specialized custom stock portfolio aimed at helping investors identify true safe havens amid the wave of AI disruption through a “long-short paired trading” strategy.

Goldman’s strategy is very clear: go long on companies with “physical barriers, regulatory moats, or responsibilities that must be handled by humans,” and short those whose workflows can be easily replaced by AI automation.

In the long camp (AI beneficiaries), Goldman is optimistic about companies building AI foundations and providing security defenses:

Core infrastructure: Microsoft, Oracle—hyperscale cloud service providers and database giants.

Cybersecurity: Cloudflare (NET), CrowdStrike (CRWD), Palo Alto Networks (PANW). These companies possess the underlying computing power or essential security compliance interfaces for AI operations and are seen as difficult to replace by general-purpose AI models.

In the short camp (potential AI casualties), Goldman targets companies focusing on process management but with weak moats:

Target list: Monday.com (MNDY), Salesforce (CRM), DocuSign (DOCU), Duolingo (DUOL).

Core logic: The core value of these companies lies in optimizing existing administrative or entry-level intellectual workflows, which happen to be the application scenarios where generative AI is most disruptive. As enterprises begin to use AI to build similar tools in-house, the necessity of such software is being greatly reduced.

Faris Mourad, Vice President of Goldman Sachs’ US Custom Basket team, clearly pointed out in the report that as the sell-off comes to an end, the software industry will see obvious polarization.

We must admit that although the software sector’s expected growth rate of 14.1% is higher than the S&P 500 overall, compared to the semiconductor industry’s approximately 31.7% (driven by hardware expansion), the software industry has lost its “tech leader” shine. The current market logic is no longer “buy the whole sector,” but rather refined “stock-picking survival.”

SpaceX’s rights arrangement after listing structure

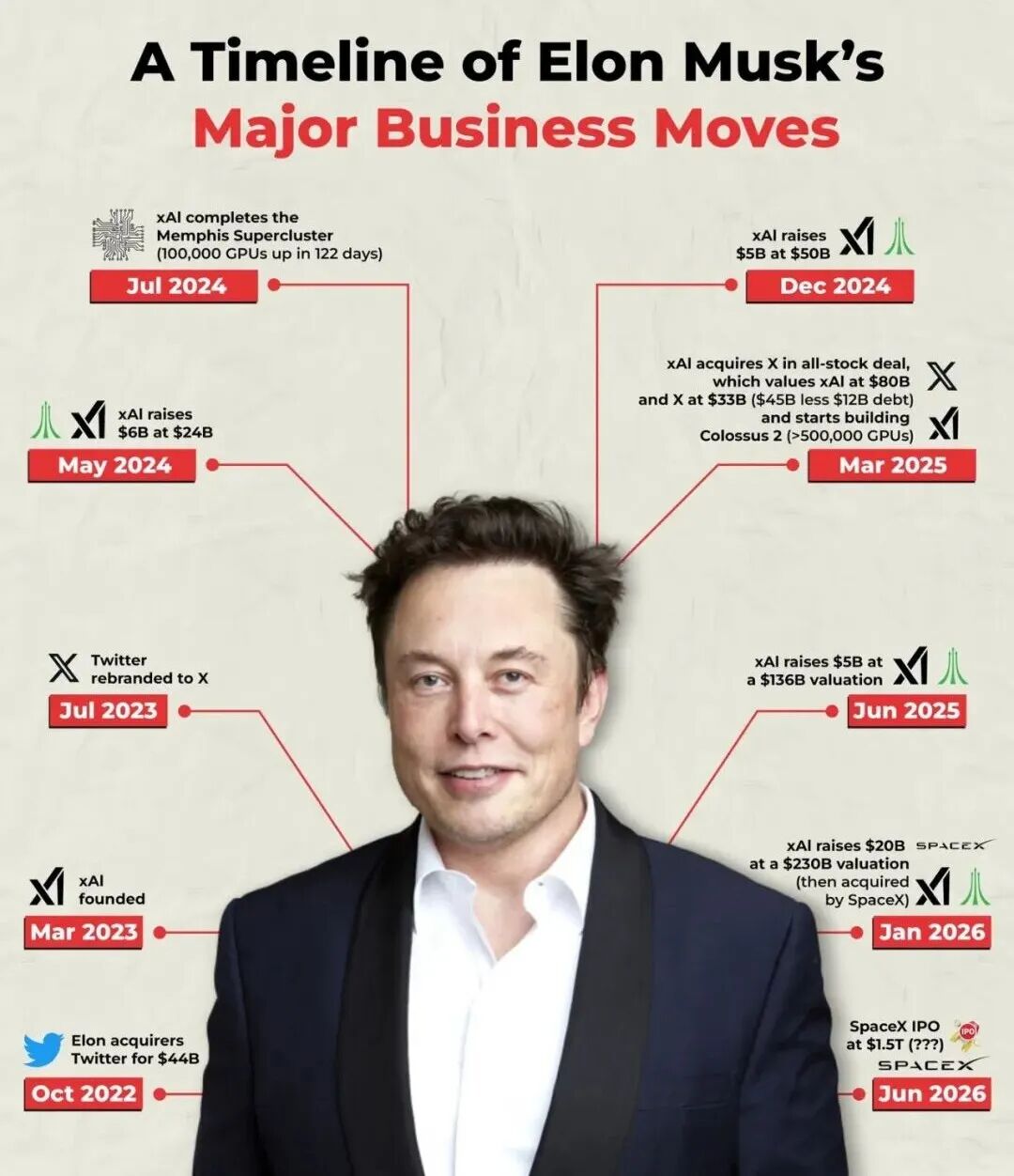

Latest market news shows that SpaceX is considering adopting a dual-class share structure at the time of IPO, while also pushing a financing plan to restructure the debt issues left after the merger with xAI. These two moves will directly determine the future power structure and financial flexibility of this trillion-dollar company.

The “moat” effect of a dual-class share structure

SpaceX is considering using a dual-class share structure for its IPO. Simply put, there are two types of shares:

One class with high voting rights, mainly for the founding team;

One class with ordinary voting rights, for public market investors.

This way, even if Musk’s shareholding is diluted in the future, he can still control company decisions. This practice is not uncommon among US tech companies; both Meta and Alphabet have done this. The core logic is simple: when a company is undergoing major transformation, founders want to ensure the strategic direction is not swayed by short-term performance fluctuations.

This is especially important for Musk.

SpaceX is no longer just a rocket and satellite company. With the integration of xAI, the company is betting on a “Space + AI” direction, including orbital computing power, space data centers, and more. These are high-investment, high-risk businesses. If short-term profits are under pressure, the capital market will be under significant strain.

Dual-class shares essentially lock in control in advance.

Clearing financial hurdles for IPO premium

Compared to the long-term arrangement of shareholding structure, debt issues are the real pressure that must be prioritized before the IPO.

The total debt related to the acquisition of X (formerly Twitter) and xAI financing is estimated by the market to be close to $18 billion. Of this, about $13 billion in leveraged loans were introduced during the 2022 acquisition of Twitter, which is the most crucial part; thereafter, xAI raised about $5 billion through debt financing for model training and computing power investment. Combined, they form the current debt scale.

The bank financing for the acquisition of X was once stuck on the underwriters’ balance sheets, and part of the debt was eventually sold at a fixed rate of about 9.5% and close to face value. Although the creditors have changed, the interest costs have not disappeared.

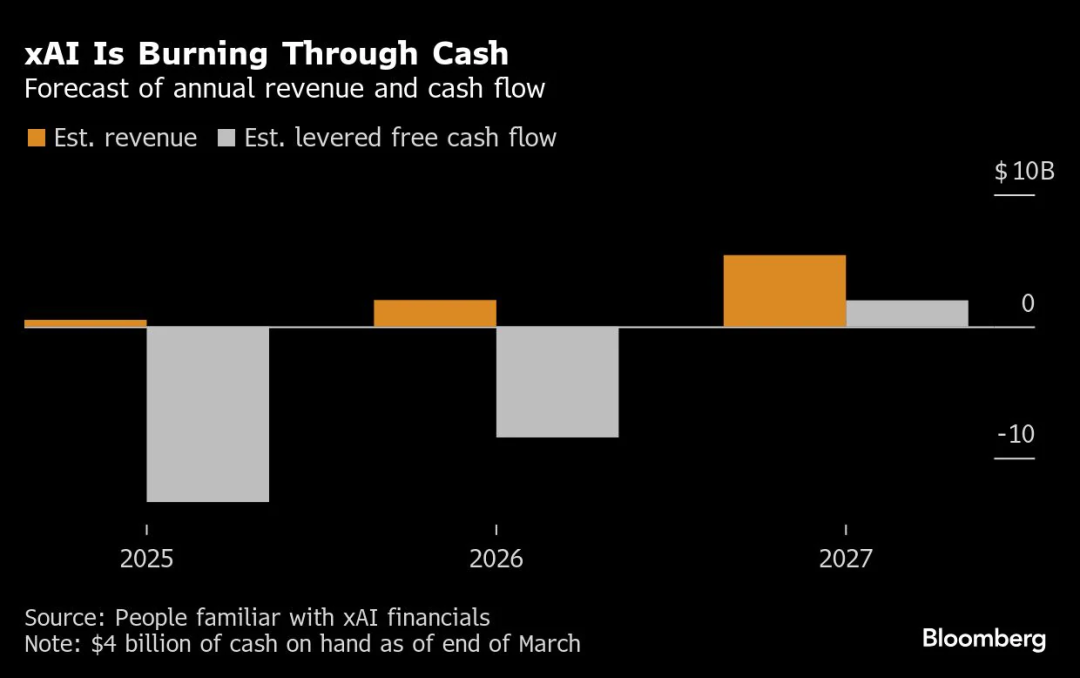

Meanwhile, according to Bloomberg’s financial forecast, xAI is expected to have a negative free cash flow of about $8–10 billion in 2025, equivalent to a monthly burn of $600–800 million, and is still in a heavy investment phase.

This means a real issue: AI business has not yet formed stable cash flow, but interest expenses are ongoing.

In this situation, banks led by Morgan Stanley are researching new financing arrangements, aiming to optimize debt maturity and cost structure before the IPO. If the merged entity has too much debt and insufficient interest coverage, the market will inevitably apply a discount in pricing.

The capital market can pay a premium for growth expectations, but only if the financial structure is clear and risks are controllable. The progress of debt restructuring will directly affect SpaceX’s final valuation range.

Obvious profitability gap

The merged company is valued at about $1.25 trillion, of which:

SpaceX about $1 trillion;

xAI about $250 billion.

But the profitability gap is very obvious.

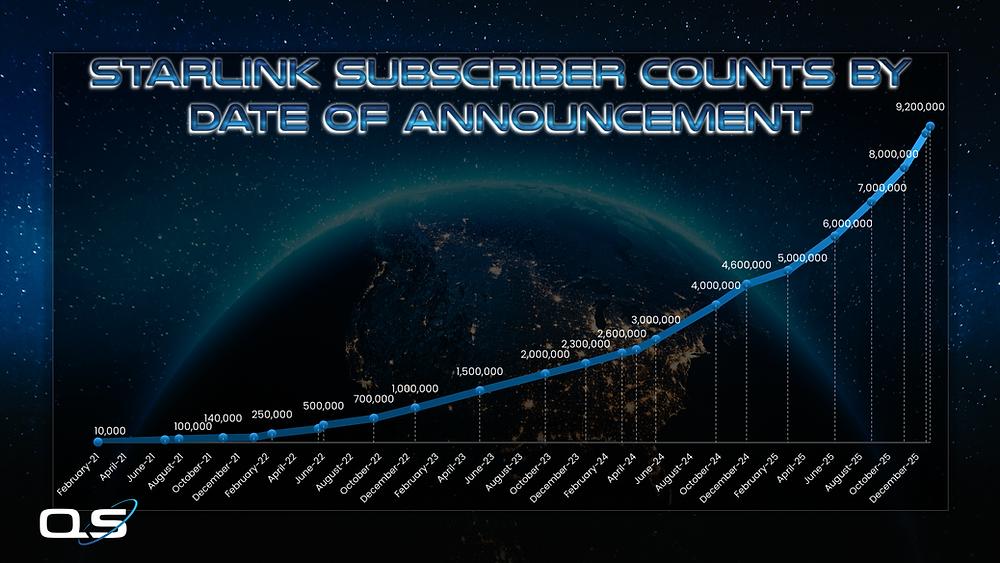

SpaceX itself has grown into an extremely robust cash flow engine. 2025 revenue is expected to be $15–16 billion, with an EBITDA margin close to 50%. This financial performance is due to Starlink’s absolute dominance in the global satellite internet market and control of more than half of the global launch market share.

In contrast, xAI shows strong early-stage characteristics. Revenue in the first three quarters of 2025 is about $200 million, and capital expenditures far exceed revenue levels. Its valuation is more based on future technology potential than current profitability.

This gives the merged entity a structural feature:

One part is mature cash flow assets;

One part is high-investment, high-uncertainty growth assets.

The combination of the two makes for a more compelling story, but also greater volatility.

Can the vision logic of orbital AI be self-consistent?

Musk is trying to hedge market concerns about financial burdens through the concept of “orbital AI.” The core logic is to deploy distributed data centers in low Earth orbit via the Starlink network, thereby achieving a closed loop of computing power and communications at the physical layer.

Although SpaceX has applied to the FCC to launch as many as 1 million satellites with computing capabilities, the implementation of this strategy still faces both technical and commercial tests:

On the demand side: AI computing power demand is currently mainly concentrated in terrestrial hyperscale data centers, and the business model for orbital computing power has not yet been validated.

Redundancy: Analysts believe that SpaceX, as an infrastructure provider, can provide services to all AI companies and does not necessarily need to be deeply bound to xAI.

This means that such a strongly coupled merger is more of a financial consolidation than a business necessity.

IPO timeline

The market generally expects SpaceX to officially proceed with its listing in mid to late June 2026. If it ultimately achieves a fundraising scale of over $50 billion, it will break the historical record set by Saudi Aramco.

But before ringing the bell, SpaceX still needs to face strict regulatory audits, a global roadshow, and a complex macroeconomic environment. Under the backdrop of Trump administration tariff policies and the Fed’s uncertain interest rate path, the IPO window remains unpredictable.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

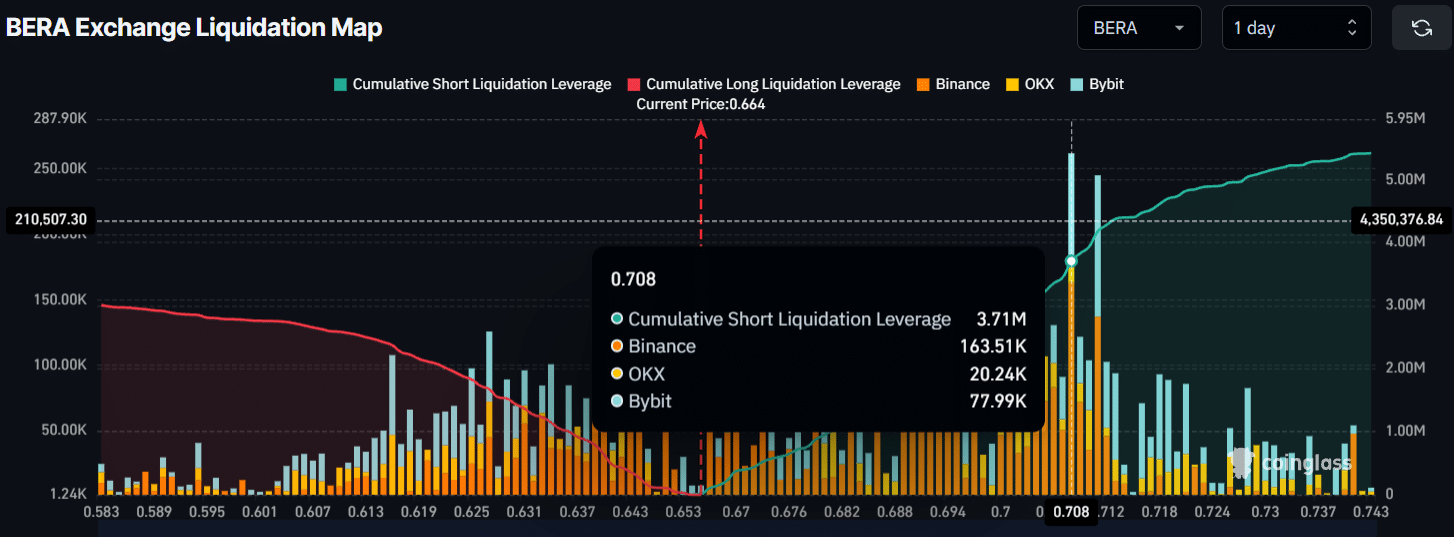

Berachain (BERA) could fall by another 45% IF these conditions are met!

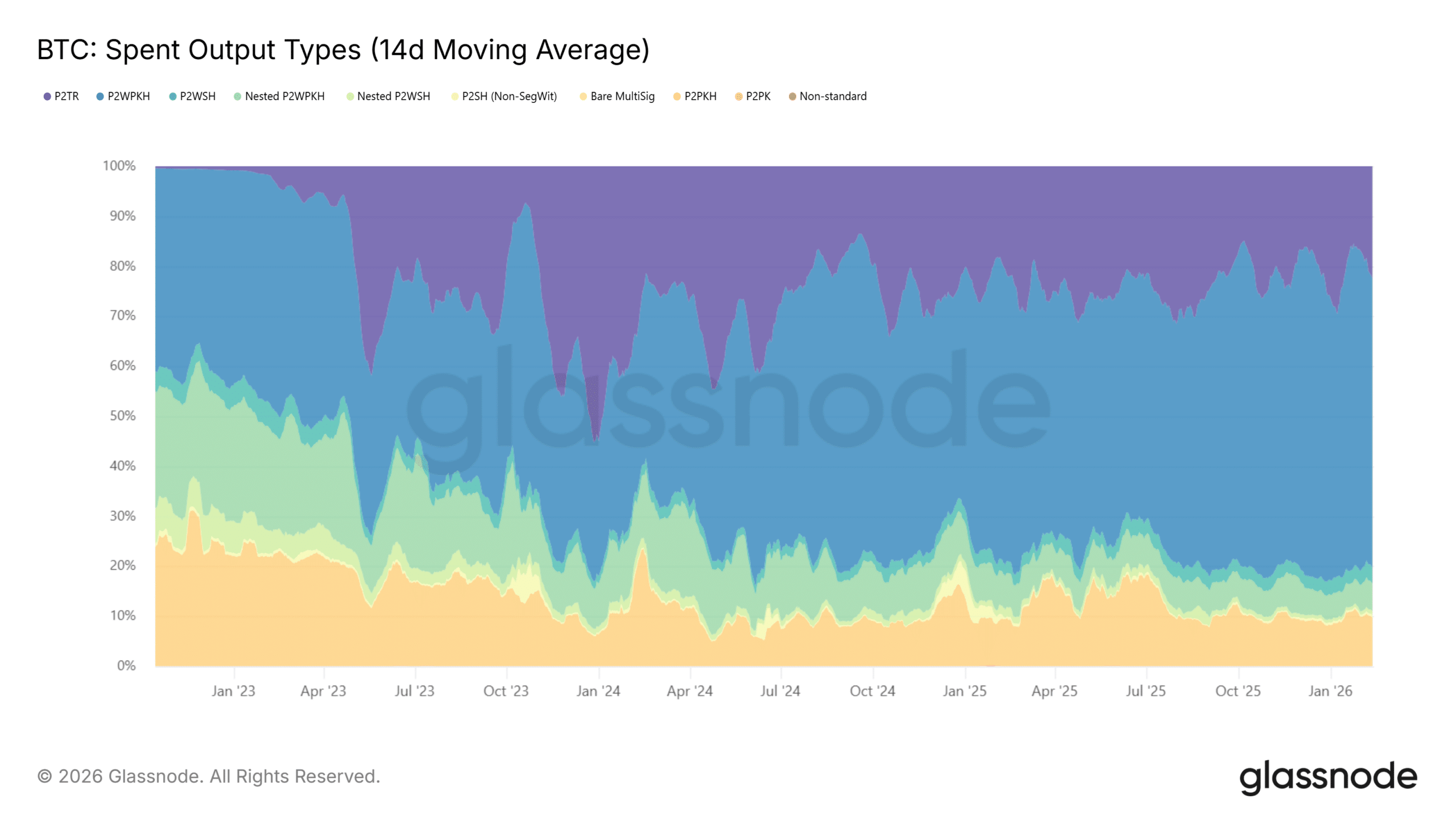

Bitcoin’s post-quantum plan BIP-360 gains traction, but will it reverse market sell-off?

Fastly (FSLY) Climbs to 2-Year High on Earnings Blowout, Double-Digit Growth Targets

Armlogi Holding Corp. Announces Second Quarter and First Half of Fiscal Year 2026 Results