Jefferies Sets a $28 PT for enGene Holdings Inc. (ENGN)

We recently published an article titled 10 Best Low Volatility Canadian Stocks to Buy.

On January 30, Jefferies initiated coverage of enGene Holdings Inc. (NASDAQ:ENGN) with a Buy rating and a $28 price target, highlighting the company’s ongoing pivotal study in high-risk non-muscle invasive bladder cancer (NMIBC), with a key data update expected in the second half of 2026.

enGene Holdings Inc. (NASDAQ:ENGN) is positioning itself as a differentiated player in the bladder cancer treatment landscape as it advances detalimogene voraplasmid, its lead non-viral gene therapy candidate, into late-stage development. Beyond clinical momentum, enGene has strengthened its financial footing. On January 21, the company expanded its debt facility with Hercules Capital to up to $125 million, securing additional non-dilutive financing to support its planned Biologics License Application and potential U.S. commercialization. The amended agreement provides $25 million immediately to refinance existing debt and up to $100 million in additional tranches tied to clinical, regulatory, and commercial milestones. This capital structure enhances flexibility as enGene transitions from a development-stage biotech to a potential commercial-stage company in a competitive but high-need oncology market.

Founded in 1999 and headquartered in Saint-Laurent, Quebec, enGene Holdings Inc. (NASDAQ:ENGN) leverages its proprietary Dually Derivatized Chitosan (DDX) platform to develop non-viral genetic medicines targeting mucosal diseases. With pivotal data on the horizon, strengthened liquidity, and a differentiated therapeutic approach, enGene represents a high-risk, high-reward opportunity for investors seeking exposure to innovative oncology platforms with meaningful upside potential.

Disclosure: None.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

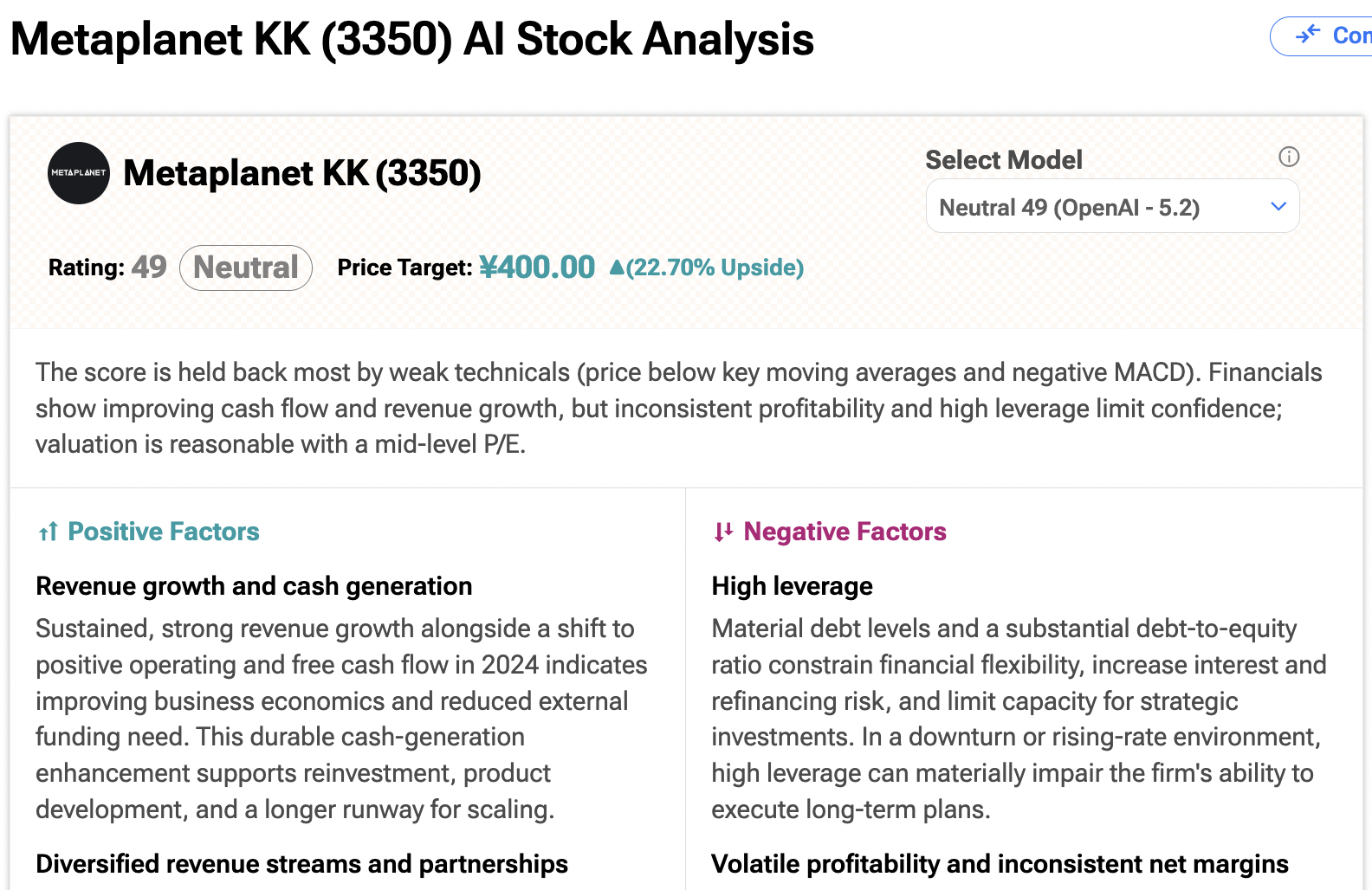

Is Metaplanet Stock a Buy? Profit Surges 81%, but Stock Is Down 63% in 6 Months on Bitcoin Losses

Mark Cuban Says 'Software Is Dead'-And What's Replacing It Will Change Everything

Large-Scale Infrastructure Provider Enters EU Digital Assets Market