Is Wall Street Taking a Positive or Negative Stance on ServiceNow Shares?

ServiceNow, Inc.: Company Overview and Stock Performance

Headquartered in Santa Clara, California, ServiceNow, Inc. (NOW) specializes in cloud-based platforms that streamline digital workflows. With a market capitalization of $112 billion, the company empowers organizations to connect disparate systems, minimize manual tasks, and enhance efficiency through AI-powered automation.

Recent Stock Trends

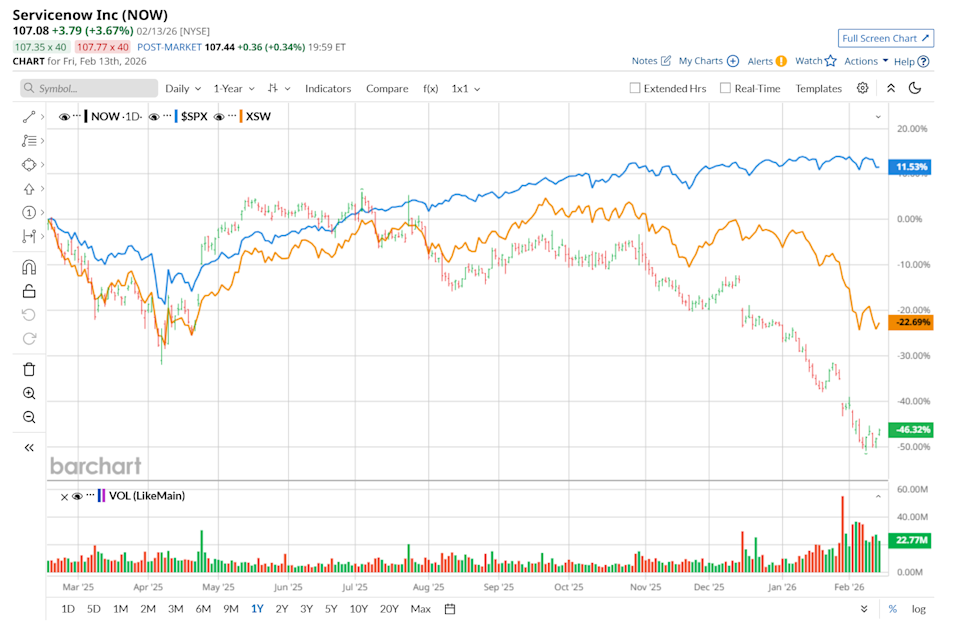

Over the past year, ServiceNow's stock has significantly underperformed the broader market. In the last 52 weeks, NOW shares have dropped by 45.9%, while the S&P 500 Index ($SPX) has climbed 11.8%. Year-to-date, NOW is down 30.1%, compared to a slight decline in the SPX.

Additional Headlines from Barchart

Looking more closely, NOW has also trailed the State Street SPDR S&P Software & Services ETF (XSW), which fell 23.2% over the past year and 19.1% so far this year.

Market Sentiment and Analyst Insights

On February 9, NOW shares jumped 3.1% after analysts suggested that the recent downturn in the SaaS sector, dubbed the “SaaSpocalypse,” had pushed valuations to attractive lows, prompting renewed buying interest. The SaaS industry faced considerable headwinds in early 2026 due to worries that autonomous AI agents might disrupt traditional subscription models. Despite these challenges, major institutional investors began reallocating funds to established companies with strong customer loyalty and consistent recurring revenues. Barclays PLC (BCS) highlighted in a report that enterprise transitions away from legacy systems are typically lengthy, often taking years, which helps leading providers maintain a strong competitive edge—especially in compliance and governance sectors.

Financial Outlook

For the fiscal year ending December 2026, analysts project that ServiceNow’s earnings per share will rise by 26.5% year-over-year to reach $2.48. The company has a solid track record of surpassing consensus earnings estimates in each of the last four quarters.

Analyst Ratings

Among the 44 analysts tracking the stock, the consensus is overwhelmingly positive, with 35 recommending a “Strong Buy,” three suggesting a “Moderate Buy,” five advising to “Hold,” and one issuing a “Strong Sell.”

Compared to a month ago, sentiment has grown more optimistic, as previously 34 analysts rated the stock as a “Strong Buy.”

Price Targets and Recommendations

On February 9, Matthew Hedberg of RBC Capital reaffirmed his “Buy” rating for NOW, setting a price target of $150, which implies a potential 40.1% increase from current levels.

The average price target stands at $194.46, representing an 81.6% premium over the current share price. The highest target on Wall Street is $260, which would mean a possible upside of 142.8%.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Vitalik Buterin: Using Prediction Markets for Hedging Might 'Supplant Traditional Currencies'

CareDx Reports Positive Data for AlloHeme in AML and MDS Post HCT

Amid the "SaaS Apocalypse", These 3 Names Are Boosting Buybacks

Investment Giant Standard Chartered Updates Its 2026 XRP Price Target! Here Are the Details