Do financial experts on Wall Street have a favorable view of W. R. Berkley shares?

Overview of W. R. Berkley Corporation

W. R. Berkley Corporation (WRB), headquartered in Greenwich, Connecticut, stands among the leading commercial property and casualty insurance providers, boasting a market capitalization of $26.5 billion.

Stock Performance Highlights

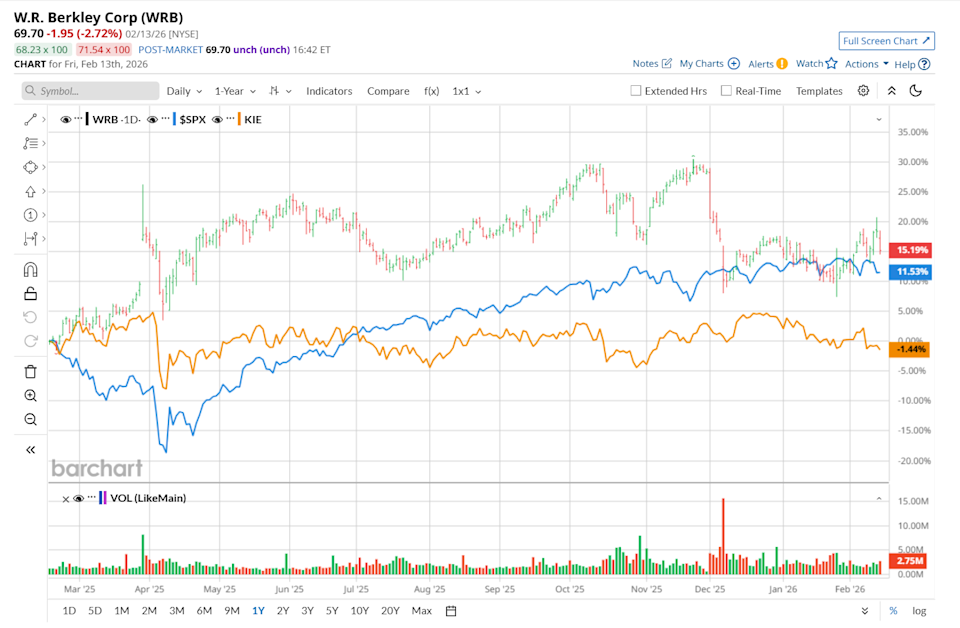

Over the past year, WRB's stock has outperformed the broader market, climbing 13.4% compared to the S&P 500 Index's 11.8% gain. Year-to-date, WRB's performance has been relatively flat, mirroring the movement of the S&P 500.

Related News from Barchart

WRB has also outshined the State Street SPDR S&P Insurance ETF (KIE), which saw a 1.5% decline over the last 52 weeks and a 4.5% drop year-to-date.

Recent Earnings and Analyst Expectations

On January 26, WRB reported fourth-quarter results that fell short of expectations, yet the stock edged higher in the following trading session. The company’s total revenue rose 1.5% year-over-year to $3.7 billion, slightly missing analyst forecasts. Operating income per share reached $1.13, representing a 10.8% increase from the same period last year, but came in just below consensus by one cent.

Looking ahead to fiscal year 2026, analysts project WRB’s earnings per share will rise by 5.5% to $4.57. The company’s track record for earnings surprises is mixed, having met or exceeded expectations in three of the past four quarters and missing once.

Analyst Ratings and Price Targets

Of the 20 analysts tracking WRB, the consensus recommendation is "Hold." This includes four "Strong Buy," eleven "Hold," and five "Strong Sell" ratings.

Compared to a month ago, sentiment has become more negative, with four analysts now issuing a "Strong Sell" recommendation.

On February 2, Cantor Fitzgerald’s Ryan Tunis reiterated an "Overweight" rating on WRB but reduced the price target to $75, suggesting a potential upside of 7.6% from current levels.

Although WRB is currently trading above its average price target of $69.65, the highest target on Wall Street stands at $80, implying a possible 14.8% increase from its present price.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Vitalik Buterin: Using Prediction Markets for Hedging Might 'Supplant Traditional Currencies'

CareDx Reports Positive Data for AlloHeme in AML and MDS Post HCT

Amid the "SaaS Apocalypse", These 3 Names Are Boosting Buybacks

Investment Giant Standard Chartered Updates Its 2026 XRP Price Target! Here Are the Details