Pinnacle West Capital Shares Forecast: Are Analysts Optimistic or Pessimistic?

Pinnacle West Capital Corporation: An Overview

Headquartered in Phoenix, Arizona, Pinnacle West Capital Corporation (PNW) stands out as a prominent energy holding company. With a market valuation near $11.9 billion, the company produces electricity through a diverse mix of nuclear, natural gas, oil, coal, and solar power plants. It also manages an extensive infrastructure of transmission lines, distribution networks, substations, and energy storage facilities.

Recent Stock Performance

In the last year, PNW shares have risen by 11.2%, just behind the S&P 500 Index ($SPX), which gained 11.8% over the same period. However, so far this year, Pinnacle West has quietly outperformed the broader market. Year-to-date, the stock has climbed 12.1%, while the S&P 500 has experienced a slight dip.

Related News from Barchart

Utilities Sector Comparison

The utilities sector as a whole has experienced a strong rally. The Invesco S&P 500 Equal Weight Utilities ETF (RSPU) surged 20% over the past year and is up 10.2% so far this year. In this context, Pinnacle West’s annual return appears more moderate, but its 12.1% year-to-date increase still surpasses the ETF’s performance.

Key Financial Developments

On January 27, just a day after Pinnacle West announced it would report its fiscal 2025 fourth-quarter results before the market opens on February 25, the stock jumped nearly 2%. Such a reaction to a routine scheduling update is uncommon, suggesting investors anticipate positive results.

This optimism is grounded in the company’s recent performance. In the third quarter of fiscal 2025, Pinnacle West reported $1.82 billion in revenue and earnings per share of $3.39, surpassing analyst forecasts on both counts. The strong results were driven by increased transmission revenues and robust sales.

Following these results, management raised its fiscal 2025 earnings guidance to a range of $4.90 to $5.10 per share, up from the previous estimate of $4.40 to $4.60. This upward revision reflects ongoing sales growth and a brighter outlook for transmission revenue.

For the entire fiscal year 2025, which concluded in December, analysts anticipate diluted earnings per share will fall by 7.4% year-over-year to $4.85. Nevertheless, Pinnacle West has consistently exceeded expectations, beating earnings estimates in three of the last four quarters.

Analyst Ratings and Market Sentiment

Wall Street maintains a cautiously optimistic view of Pinnacle West. The consensus rating for PNW stock is “Moderate Buy.” Out of 17 analysts covering the company, four recommend a “Strong Buy,” while the remaining 13 suggest holding the stock.

Recent Analyst Updates

Analyst sentiment has shifted only slightly compared to three months ago, when five analysts rated the stock as a “Strong Buy.”

On January 15, Barclays PLC (BCS) analyst Nicholas Campanella reiterated an “Equal-Weight” rating on PNW but reduced the price target from $95 to $90, signaling a focus on valuation rather than concerns about the company’s operations.

Currently, PNW shares are trading above their average price target of $96.57, indicating the stock has outperformed consensus expectations. However, with the highest analyst target set at $112, there remains an estimated upside potential of 12.7%, despite some mixed signals from the analyst community.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DirectBooking Technology Co., Ltd. Announces 16-for-1 Share Consolidation

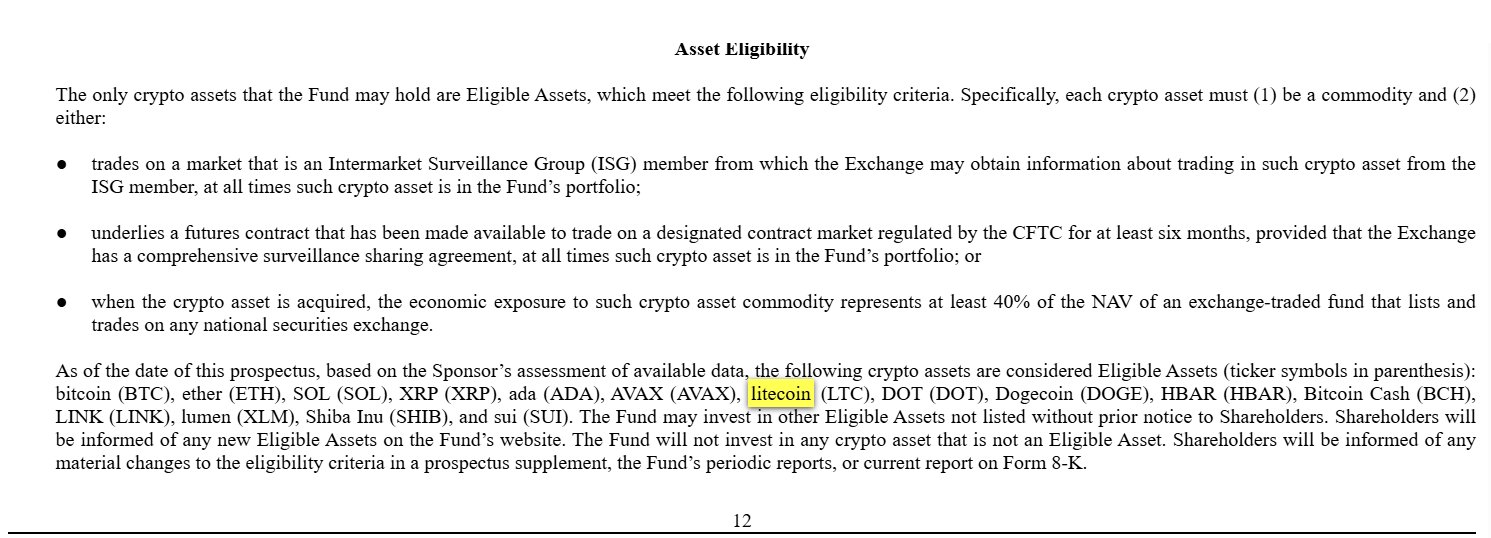

Litecoin’s ETF spotlight returns – Is $55 a bargain now for LTC?