Caesars Entertainment (NASDAQ:CZR) Exceeds Q4 2025 Sales Expectations

Caesars Entertainment Surpasses Revenue Projections in Q4 2025

Caesars Entertainment (NASDAQ:CZR), a leading name in the hotel and casino industry, exceeded Wall Street’s revenue forecasts for the fourth quarter of calendar year 2025. The company posted $2.92 billion in sales, marking a 4.2% increase compared to the same period last year. However, its GAAP loss per share came in at $1.23, falling well short of analyst expectations.

Q4 2025 Performance Highlights

- Revenue: $2.92 billion, surpassing analyst estimates of $2.88 billion (4.2% year-over-year growth, 1.1% above expectations)

- GAAP EPS: -$1.23, missing analyst projections of -$0.19

- Adjusted EBITDA: $901 million, slightly ahead of the $896.3 million estimate (30.9% margin, 0.5% beat)

- Operating Margin: 11.4%, a decline from 23.9% in the prior year’s quarter

- Market Cap: $3.70 billion

About Caesars Entertainment

Previously known as Eldorado Resorts, Caesars Entertainment operates a global portfolio of casinos, hotels, and resorts, making it a major player in the gaming and hospitality sector.

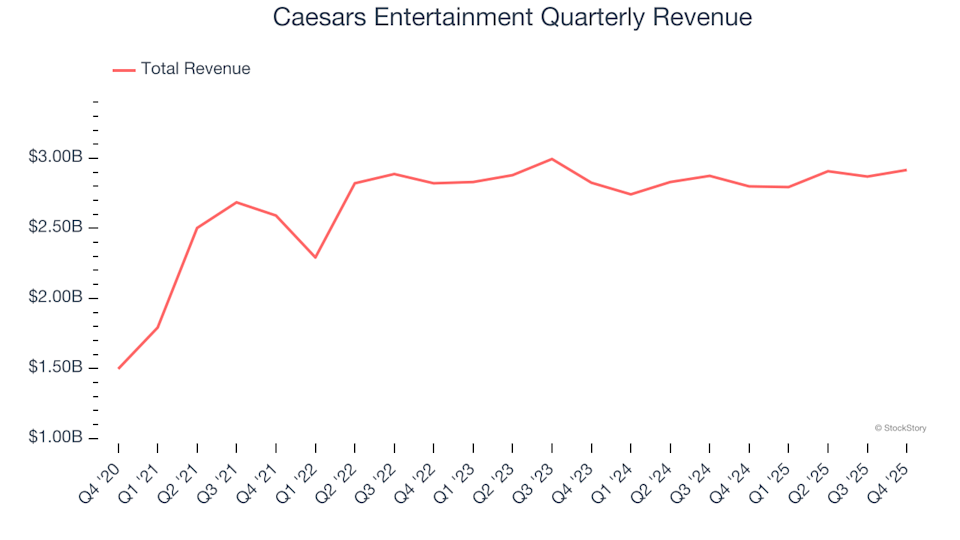

Examining Revenue Trends

Assessing a company’s long-term revenue trajectory offers valuable perspective on its overall strength. While short-term gains are possible, sustainable growth is a more telling indicator. Over the past five years, Caesars Entertainment achieved a compound annual growth rate (CAGR) of 26.5% in sales. While this is a solid figure, the consumer discretionary industry is known for its volatility, so consistent growth is especially important. It’s also worth noting that this five-year period began during the COVID-19 downturn, which temporarily suppressed revenues before a strong rebound.

Although long-term growth is crucial, it’s important to recognize that consumer discretionary companies can benefit from new trends or products. Caesars Entertainment’s recent results show that demand has plateaued, with revenue remaining steady over the past two years. The company experienced a significant recovery after the pandemic’s impact in 2020 and early 2021.

Revenue Breakdown by Segment

Caesars Entertainment’s business is divided into three main segments: Casino (58.7% of revenue), Dining (16.1%), and Hotel (14.2%). Over the last two years, Casino and Dining revenues grew by an average of 18.3% and 13.3% year-over-year, respectively. In contrast, Hotel revenue saw an average annual decline of 31.8%.

This quarter, the company delivered a modest 4.2% year-over-year revenue increase, outperforming Wall Street’s expectations by 1.1%.

Future Revenue Outlook

Looking ahead, analysts predict Caesars Entertainment’s revenue will rise by 2.1% over the next year. While this suggests some improvement from new offerings, the growth rate is expected to lag behind the industry average.

Some of the world’s most successful companies, like Microsoft and Coca-Cola, started as lesser-known growth stories. We’ve identified a promising AI semiconductor company that could be the next big thing.

Profitability: Operating Margin

Operating margin is a key indicator of a company’s profitability, reflecting earnings before taxes and interest. Over the past year, Caesars Entertainment’s operating margin has narrowed, averaging 18.3% over the last two years. This performance is average for the sector and suggests the company struggled to offset rising costs with higher prices.

In the latest quarter, the operating margin dropped to 11.4%, a decrease of 12.6 percentage points from the previous year, indicating that expenses grew faster than revenue.

Earnings Per Share (EPS) Analysis

Tracking long-term changes in EPS helps gauge whether a company’s growth is translating into profitability. Although Caesars Entertainment remains unprofitable on a full-year basis, it has reduced its losses, with EPS improving at an annual rate of 27.7% over the past five years. The upcoming quarters will be crucial for determining if this trend continues.

For Q4, the company reported an EPS of -$1.23, a decline from $0.05 in the same period last year and below analyst expectations. Nevertheless, Wall Street anticipates a turnaround, projecting that full-year EPS will improve from -$2.43 to $0.05 over the next 12 months.

Summary of Q4 Results

Caesars Entertainment managed to slightly exceed revenue forecasts this quarter, though its earnings per share fell short. Overall, the quarter was weaker than expected. Following the announcement, shares rose 4% to $19.70.

Is now the right time to buy? While quarterly results are important, long-term business fundamentals and valuation are even more critical when considering an investment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Costco sued over salmonella outbreak linked to its poultry facility

DeFi Revival: Analyst Reveals Compelling Signals for the Next Crypto Market Cycle

Bitwise ETF Application Sparks Revolutionary Shift with PredictionShares Fund