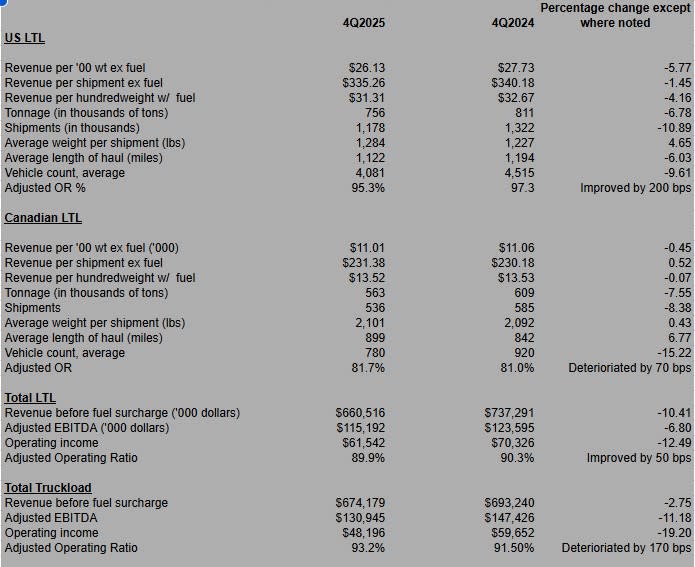

First glance: Certain US LTL metrics at TFI International begin to rise

TFI International’s US LTL Division Shows Mixed Performance in Q4 2025

During the final quarter of 2025, TFI International made some progress in its US less-than-truckload (LTL) segment—a key focus area for the company’s leadership.

However, the latest TFI (NYSE: TFII) earnings release on Tuesday also highlighted ongoing challenges in other aspects of the business.

The backbone of TFI’s US LTL operations is the former UPS Freight business, which TFI acquired in 2021.

Key Operational Metrics

- The US LTL segment’s adjusted operating ratio improved to 95.3%, down from 97.3% in the previous year.

- Average shipment weight increased by 4.6%, reaching 1,284 pounds compared to 1,227 pounds last year—a metric CEO Alain Bedard has prioritized.

Bedard has also commented on the routing efficiency of the US LTL network, noting that the average distance between stops remains less favorable than in the Canadian LTL division. The Canadian LTL business reported an adjusted operating ratio of 81.7% for the quarter, though this represented a 170 basis point decline.

In the US, the average length of haul dropped by 6%, moving from 1,194 miles to 1,122 miles.

Financial Highlights and Market Conditions

- Revenue per hundredweight, excluding fuel, fell by 5.8% to $26.13 from $27.73.

- Total tonnage decreased by 6.8% to 756, yet the improved operating ratio in the face of lower volumes could be seen as a positive development.

- TFI does not provide separate adjusted EBITDA figures for its US and Canadian LTL units. Overall, adjusted EBITDA for the LTL segment dropped to $115.1 million from $123.5 million.

- Despite a 9.5% reduction in total LTL revenue and a 7.1% decrease in operating income, the EBITDA margin improved to 17.4%, up from 16.8% a year earlier.

Profitability and Earnings Overview

Persistent softness in the freight market continued to impact TFI’s bottom line. GAAP earnings per share declined to $0.87 from $1.03 year-over-year. On an adjusted basis, non-GAAP EPS reached $1.09, surpassing analyst expectations by $0.24 per share, according to SeekingAlpha. Revenue for the quarter totaled $1.91 billion, just $10 million below consensus estimates.

The company’s overall adjusted operating ratio worsened to 92.3%, compared to 91.2% the previous year. The truckload division’s operating ratio also slipped, rising to 93.2% from 91.5%.

Upcoming Events and Further Reading

TFI International is scheduled to hold its earnings call with analysts on Wednesday at 8:30 a.m. EST.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Costco sued over salmonella outbreak linked to its poultry facility

DeFi Revival: Analyst Reveals Compelling Signals for the Next Crypto Market Cycle

Bitwise ETF Application Sparks Revolutionary Shift with PredictionShares Fund