Options Corner: Palantir Stock's Brutal Start Is Finally Showing Signs Of Improvement

Palantir Technologies Inc (NASDAQ:PLTR) was looking promising as it looked to close out 2025 on a high. Instead, sharp volatility that started from the Christmas Eve session saw investors rush for the exits. Ordinarily, that would cause panicked downside hedging, as professional and institutional traders have plenty of capital locked up in PLTR stock. Yet with risk management not being a glaring priority, this circumstance may provide information by omission.

As options traders, one of the most important tools to consider is the volatility skew. In many financial articles, it's common for analysts to assume smart money sentiment. But by analyzing the skew yourself, which identifies implied volatility (IV) across the strike price spectrum of a given options chain, you can assess the general positioning of the most sophisticated market participants.

The key driver for the skew is IV, which is a residual metric derived from actual order flows. As the name suggests, IV shows what is likely to be the dispersed range of movement of the target security given the order flows that are circulating in the system. With the skew, a trader can see how much IV is priced into calls and puts for a specific expiration date.

Looking at the March 20 expiration, the overall posture is one of standard downside hedging. Most importantly, nothing about the skew suggests urgent downside mitigation, let alone panic.

In particular, the skew for strikes near the spot price is relatively flat, with the IV spread between calls and puts being extremely tight. For the strikes that are likely to be triggered due to proximity, the smart money is relaxed.

Yes, the skew does rise on both ends, with the left end suggesting some protection against downside tail risk and the right side indicative of possible synthetic short positioning — perhaps to protect actual long exposure.

As previously stated, there is hedging going on; it's just that the hedging is controlled and hardly remarkable. While the skew isn't overtly declaring that the sophisticated players are bullish, it does seem to communicate that bearishness is not the overwhelming motivation.

Estimating The Trading Parameters Of PLTR Stock

While we now have a basic framework of how the smart money is positioning its exposure, we still need to figure out how this may translate into actual price outcomes. For that, we may turn to the Black-Scholes-derived expected move calculator. Wall Street's standard mechanism for pricing options anticipates that Palantir stock will land between $119.83 and $147.81 for the March 20 expiration date.

Where does this dispersion come from? Black-Scholes assumes a world where stock market returns are lognormally distributed. Under this framework, the above range represents where PLTR stock may symmetrically fall one standard deviation away from spot (while accounting for volatility and days to expiration).

Mathematically, Black-Scholes asserts that in 68% of cases, Palantir stock would be expected to trade within the prescribed range 30 days from now. It's a reasonable assumption, if only for the fact that it would take an extraordinary catalyst to drive a security beyond one standard deviation from spot.

However, the conceptual sticking point with the expected move calculation is that we only know how the market is pricing uncertainty, not whether this pricing is rationally justified. To extract even more insights, we need to gravitate toward second-order analyses, which condition observed data based on some empirical anchor.

It's here that the search-and-rescue (SAR) analogy does much of the cognitive heavy lifting. If PLTR stock were a lone shipwrecked survivor, then Black-Scholes would represent the satellite system that identified a distress signal somewhere in the Pacific Ocean. Through theoretical drift patterns, we can establish a realistic search radius based on the signal's location.

However, we still don't know where within the radius the survivor is likely to be found. Since we live in a world of limited resources, we can't dedicate a full-on search indefinitely for one person. At some point, we need to use probabilistic math to best estimate where the survivor is likely to be.

It's here that the Markov property comes into frame.

Narrowing The Probability Space For Palantir Stock

Under Markov, the future state of a system depends entirely on the present state. Colloquially, forward probabilities should not be calculated independently but be assessed in context. Extending the SAR analogy, different ocean currents — such as choppy waves versus calm waters — can easily influence where a shipwrecked survivor is likely to drift.

Here's how the Markov property is relevant to Palantir stock. In the past five weeks, PLTR printed only two up weeks, leading to an overall downward slope. Now, there's nothing special about this 2-3-D sequence, per se. However, this quantitative signal represents a unique ocean current — and survivors caught in these waters would be expected to drift in a particular manner.

From here, we can apply enumerative induction and Bayesian-inspired inference to best estimate where PLTR stock is likely to drift given the environment the security finds itself in. Basically, the idea is to take the median pathway associated with the 2-3-D quant signal and apply it to the current spot price, thereby mapping out a forward distribution.

In the spirit of full transparency, David Hume famously critiqued induction, effectively stating the future is not necessarily compelled by the past. However, such a philosophical take would apply to all inductive processes, including gravity. My counterargument is that relative to second-order analyses, the Markov approach arguably uses the fewest assumptions.

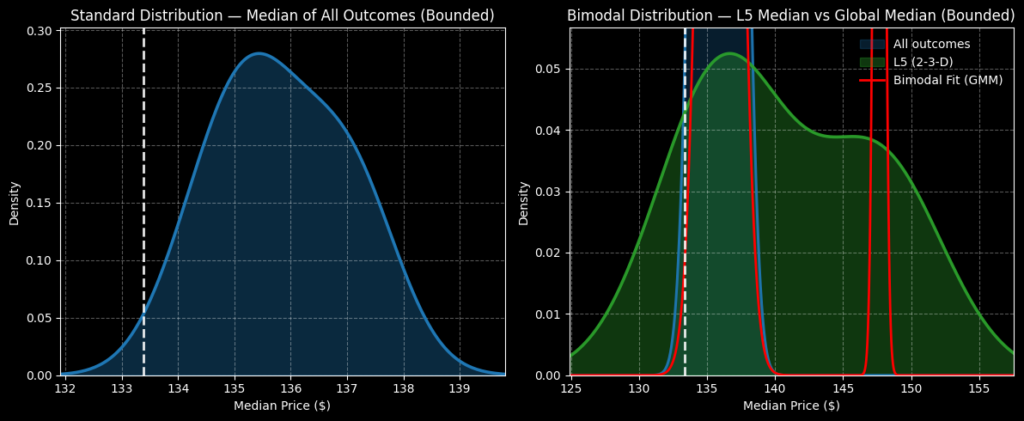

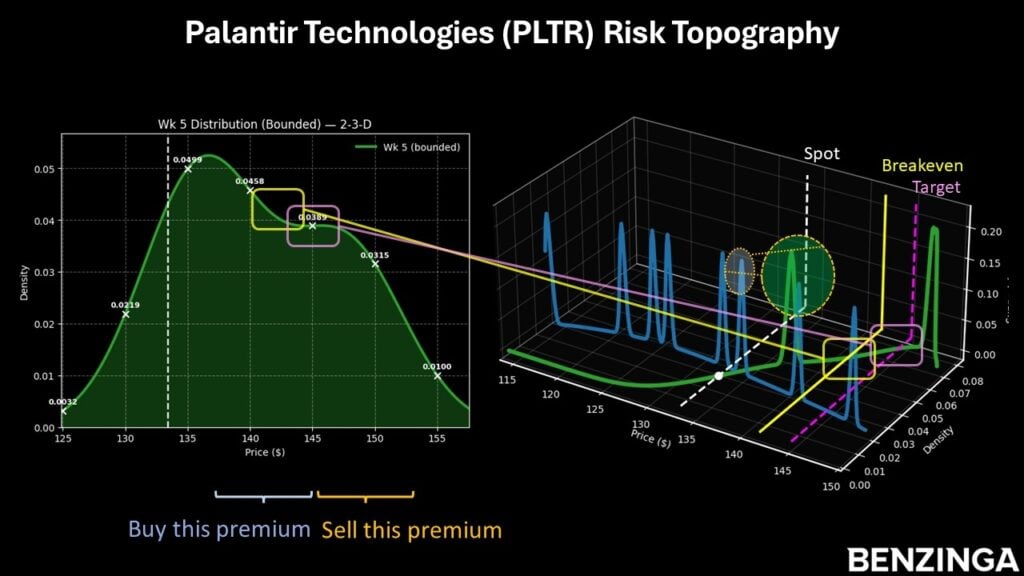

If you accept the premise, we can calculate the expected forward five-week return of PLTR stock to be somewhere between $120 and $160, with probability density peaking at around $137. However, density should be relatively elevated between $133 and $147, thus significantly narrowing our target area relative to the Black-Scholes dispersion.

Based on the market intelligence above, I'm tempted by the 140/145 bull call spread expiring March 20. This wager requires PLTR stock to rise through the $145 strike at expiration to generate the maximum payout of almost 178%. Breakeven lands at $141.80, helping to improve the trade's probabilistic credibility.

Image: Shutterstock

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Casella (CWST) Q4 Earnings and Revenues Top Estimates

Extra Space Storage (EXR) Q4 FFO and Revenues Surpass Estimates

Gold Prices Stalemate Amid Iran War Risks and Hawkish Fed Minutes