Bitcoin whales participate in V-shaped accumulation, offsetting 230K BTC sell-off

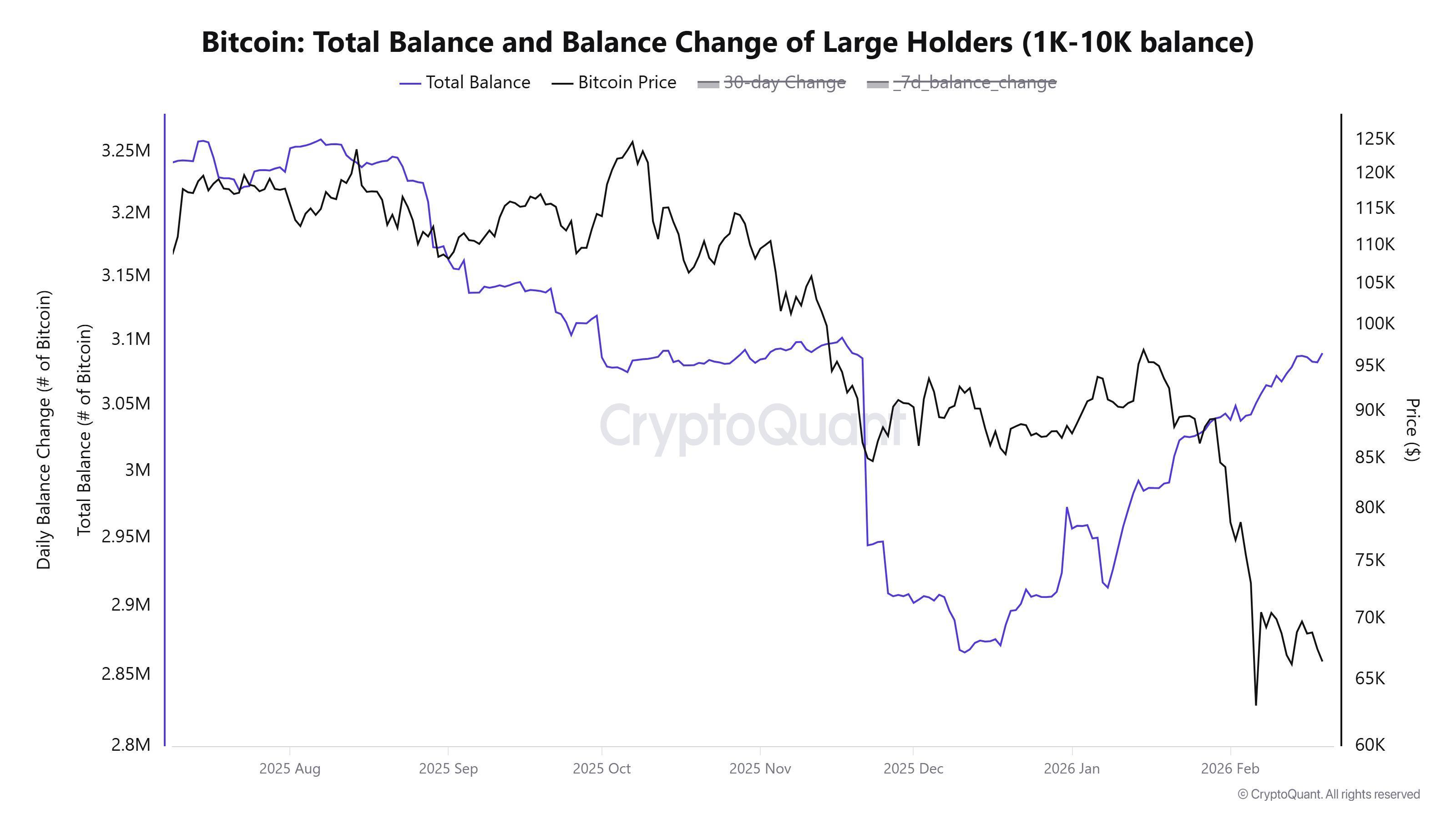

Large Bitcoin (BTC) holders have steadily increased their holdings in recent months, with the total balance climbing back to levels last seen before the October 10, 2025, market crash.

At the same time, crypto exchange data shows whale-related outflows averaging 3.5% of exchange-held BTC over a 30-day rolling period, the highest since late 2024.

BTC whale reserves return to pre-October peak

Bitcoin wallets or “whales”, holding between 1,000 and 10,000 BTC, have rebuilt reserves over the past three months. The cohorts increased their total balance to 3.09 million, from 2.86 million BTC on Dec. 10, 2025, a 230,000 BTC addition that restores their balance to pre-October 2025 levels.

Total BTC balance of large holders (1K-10K). Source: CryptoQuant

Total BTC balance of large holders (1K-10K). Source: CryptoQuant

Crypto analyst ‘Caueconomy’ said the full drawdown in whale reserves has been reversed over the past 30 days with the accumulation of 98,000 BTC. The broader distribution phase began in August 2025 (after BTC hit $124,000), after which Bitcoin struggled to sustain a rally significantly higher.

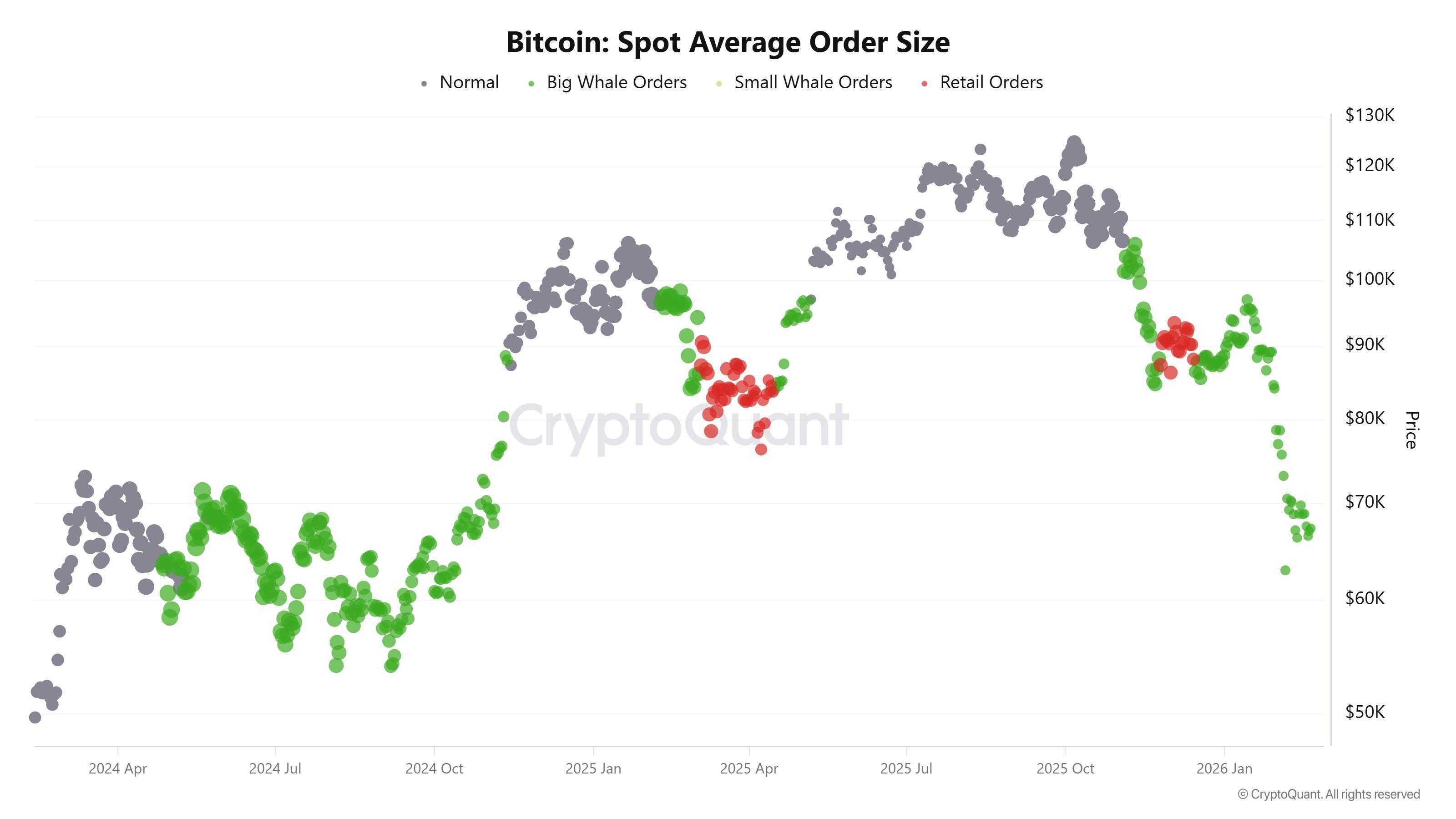

BTC spot market data supports the recovery. Throughout 2026, the average BTC order size has ranged between 950 BTC and 1,100 BTC, the most consistent stretch of large-ticket activity since September 2024.

Similar clusters appeared during the February–March 2025 correction. During that phase, retail orders accounted for the majority of activity, while large blocks appeared more intermittently and in smaller clusters.

Bitcoin spot average order size. Source: CryptoQuant

Bitcoin spot average order size. Source: CryptoQuant

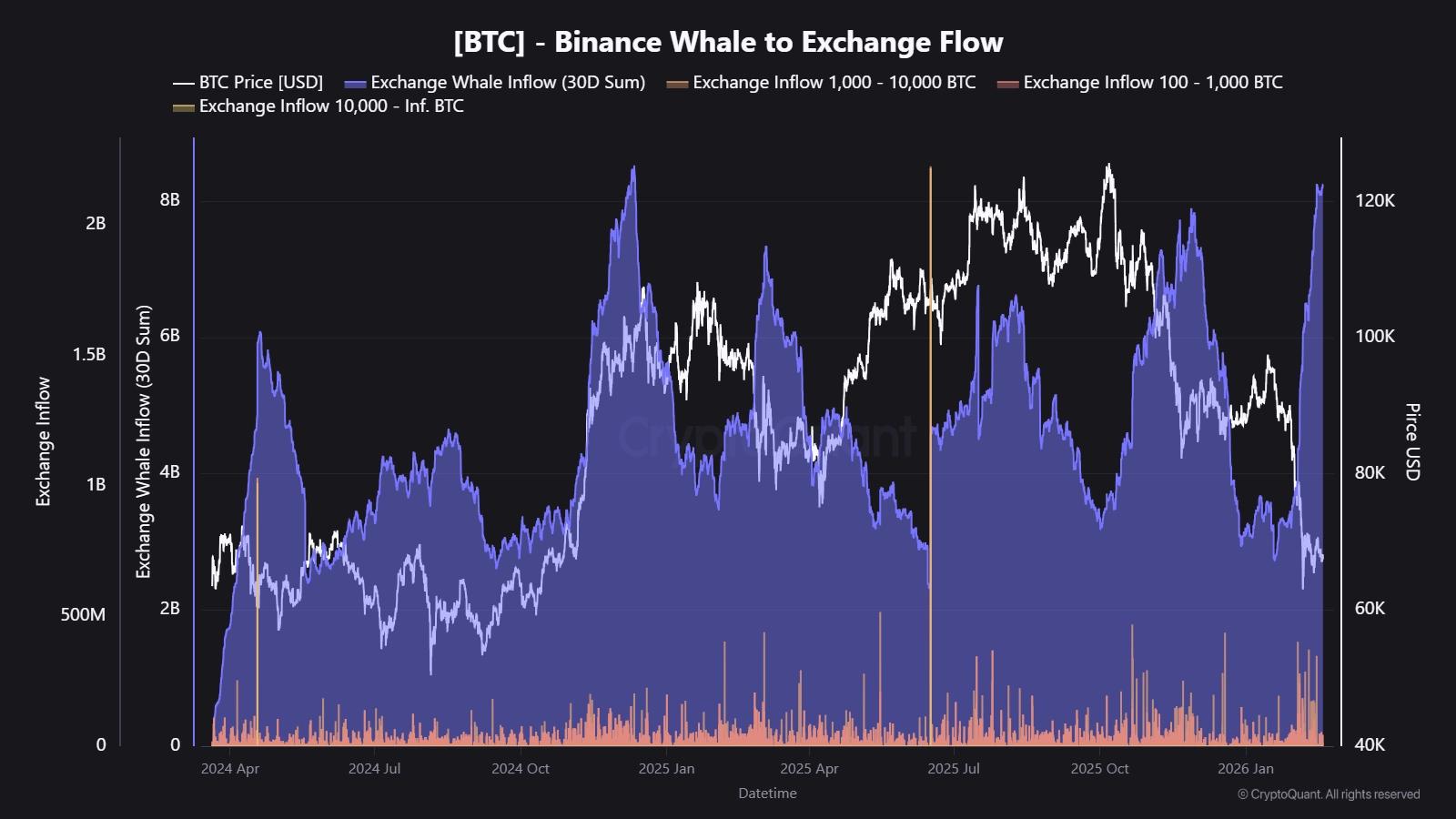

BTC exchange flows spike to 14-month highs

CryptoQuant analyst Maartunn reported $8.24 billion in whale BTC exchange flows moved into Binance over the past 30 days, marking a 14-month high. Retail flows reached $11.91 billion and have flattened over the same period. The retail-to-whale ratio now sits at 1.45, and it continues to drop as the larger-size deposits increase.

Binance whale to exchange flows. Source: CryptoQuant

Binance whale to exchange flows. Source: CryptoQuant

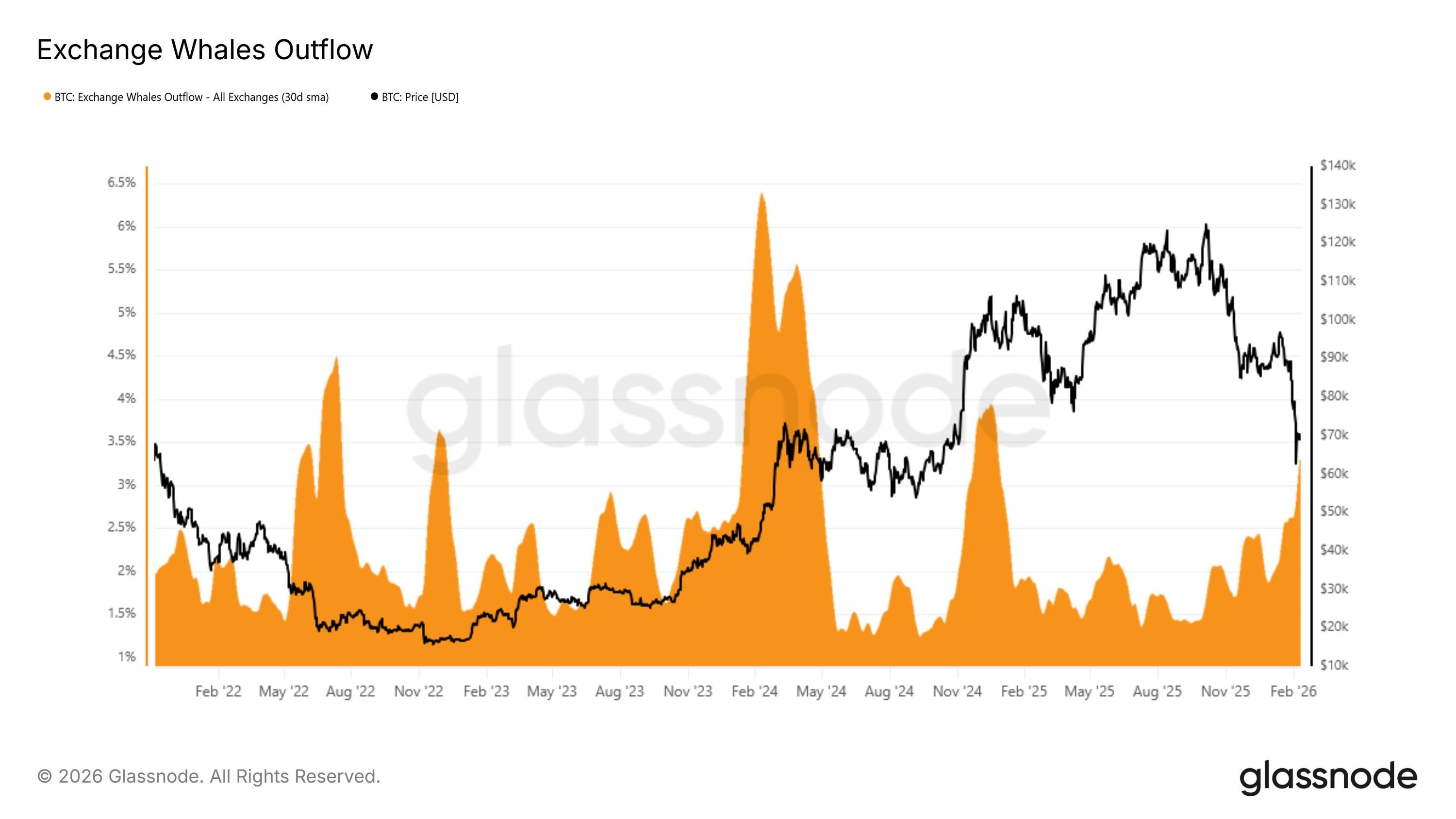

Parallel to these inflows, Glassnode data shows gross exchange whale withdrawals averaging 3.5% of total exchange-held BTC supply over a 30-day period, the strongest pace since November 2024.

Based on current exchange balances, that translates to roughly 60,000–100,000 BTC in withdrawals over the past month.

While gross inflows into exchanges have also increased, the elevated withdrawal ratio suggests that much of that incoming BTC is being offset by strong outbound transfers, leaving net exchange balances relatively stable.

BTC exchange whales outflow. Source: Glassnode

BTC exchange whales outflow. Source: Glassnode

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

United Airlines intensifies the competition over credit card benefits

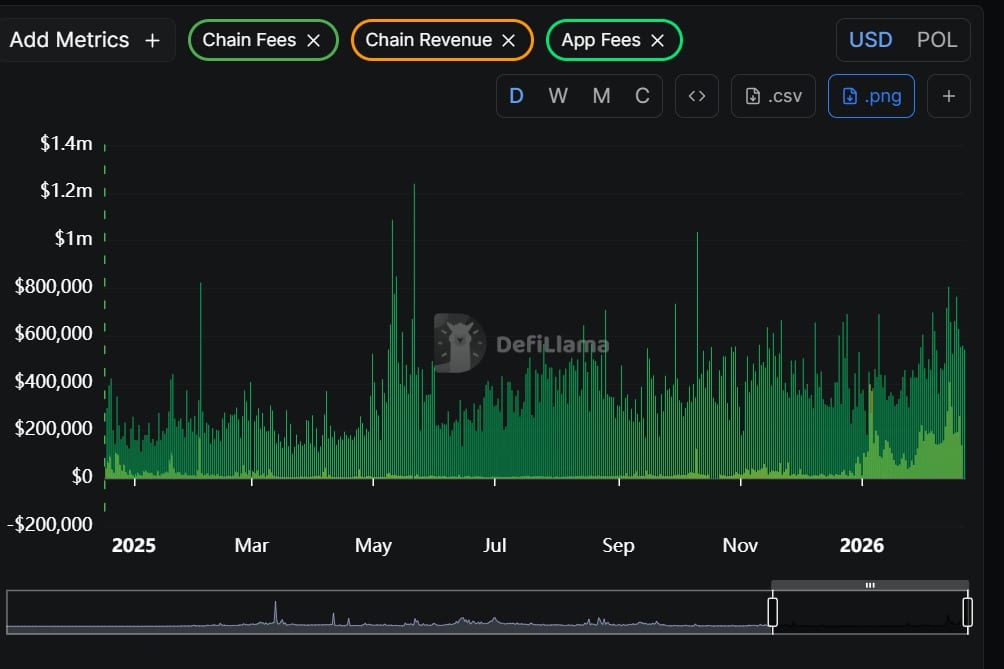

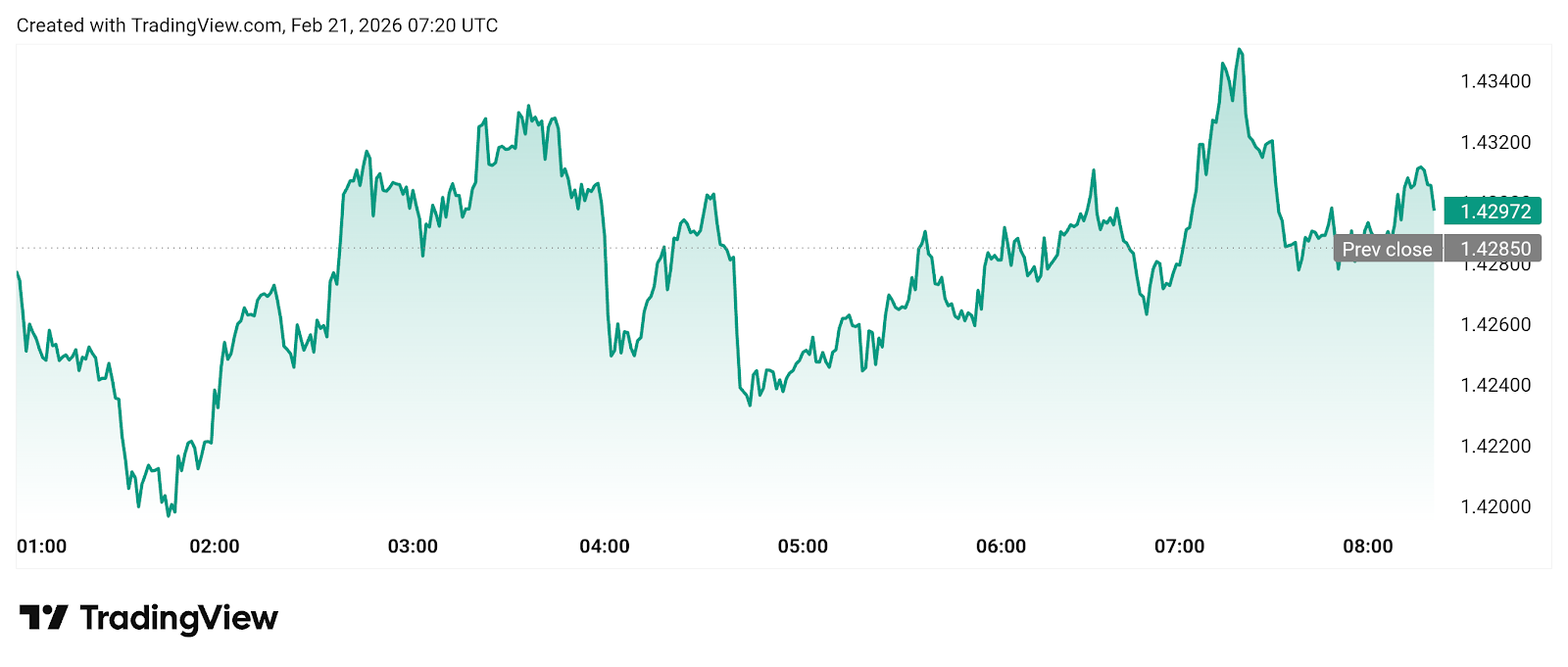

Polygon holds KEY support after 100M POL burn: What’s next?

XRP Price Prediction: What Will Be the XRP Price at the End of February?

Large Bitcoin Holders Rebuild Reserves After Heavy Selling