Following President Donald Trump’s announcement of a sweeping new 10% general import tariff, cryptocurrency markets exhibited far less volatility than many observers anticipated. Despite parallels to earlier periods of economic uncertainty, and the implementation of the policy after a Supreme Court ruling curbed the administration’s emergency economic powers, digital asset traders largely adopted a wait-and-see approach, with no dramatic sell-off or surge in prices.

Trump Announces Broad Import Tariffs

Well-known for his forceful stance on trade, Donald Trump again thrust economic policy into the spotlight by introducing a 10% tariff on all imports into the United States. The measure, intended to shield the American economy, was unveiled shortly after the Supreme Court restricted the executive branch’s emergency authority over economic interventions. The move echoes previous Trump-era trade actions, although this latest decision was prompted by changes in legal context and aims for comprehensive coverage.

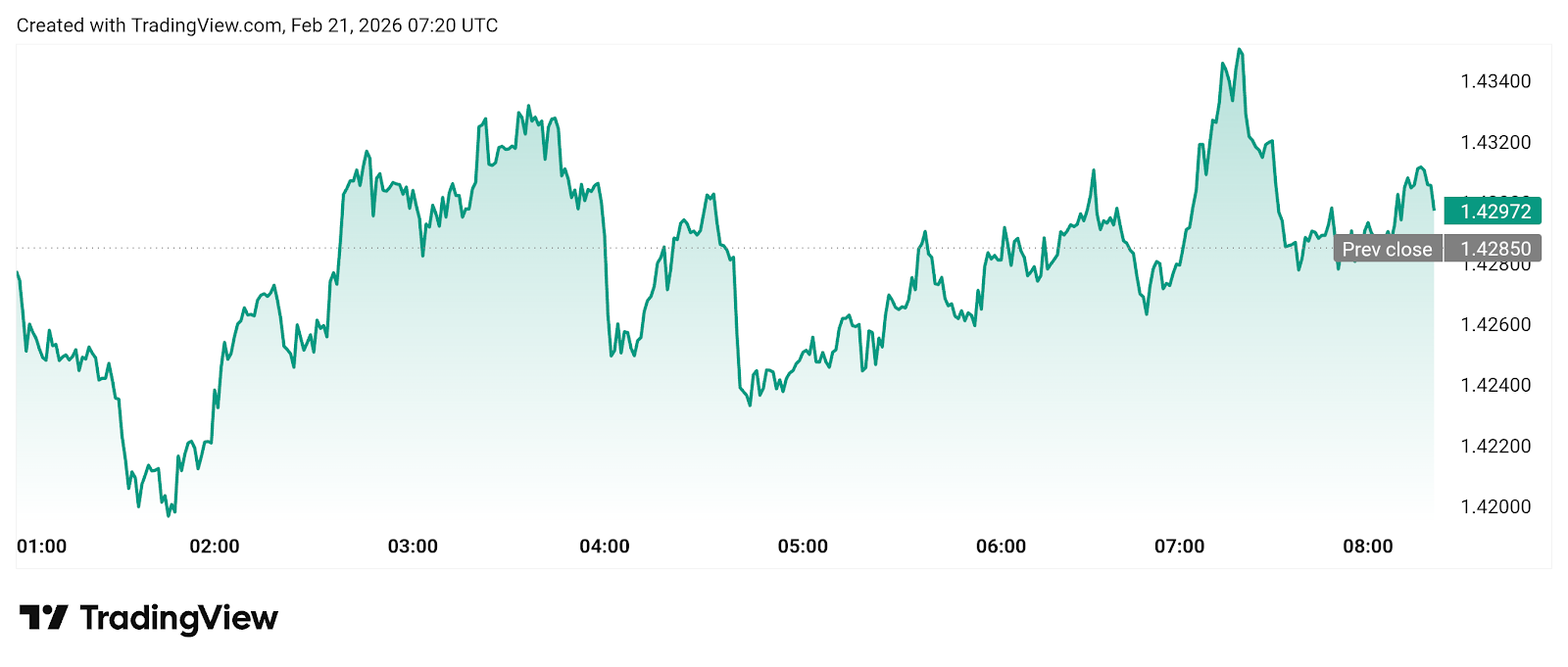

Cryptocurrency Prices Defy Expectations

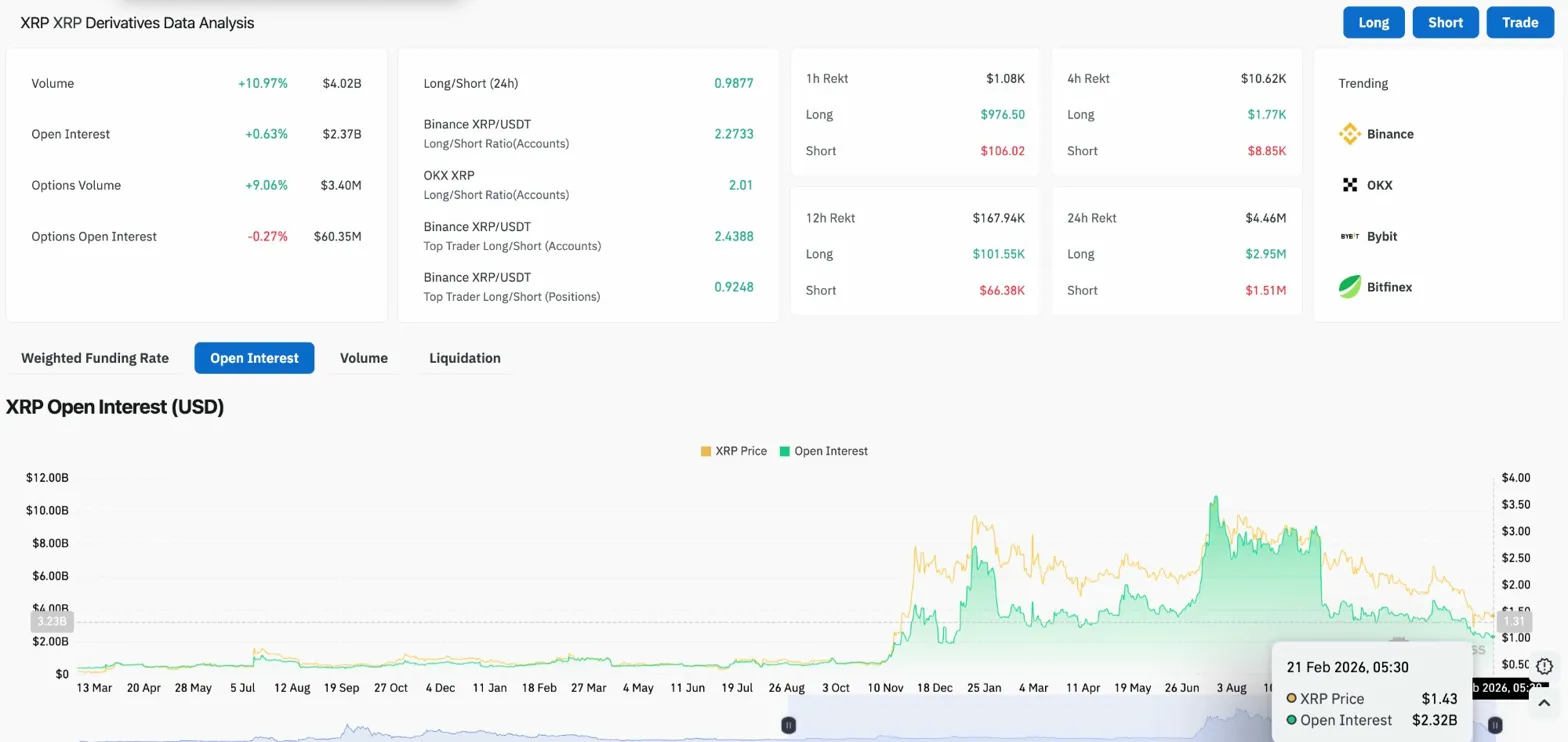

In the immediate aftermath of Trump’s policy announcement, Bitcoin steadied near $67,800, with Ethereum trading close to $1,960. The aggregate digital asset market hovered around $2.33 trillion, registering only minor fluctuations. Leading cryptocurrencies, including Bitcoin and Ether, showed little evidence of panic selling or major price swings, reinforcing the impression that cautiousness, rather than aggressive trading, characterized market sentiment.

Although global trade tensions often spark sharp moves in riskier assets, this episode saw subdued crypto market volatility. Large tokens such as XRP and BNB also experienced only marginal price shifts, confirming that fear-driven trading did not dominate investor behavior following the tariff news.

Trump’s earlier tenure saw the introduction of tariffs on Canadian and Mexican imports at rates up to 25%, and on Chinese goods at 10%. The current tariff package was enacted within the framework of the Trade Expansion Act and the Trade Act of 1974. While the Supreme Court recently found the use of emergency economic powers for tariff implementation to be an overreach, it reiterated that such measures require explicit Congressional approval, emphasizing the limits of executive action on trade policy.

Number of Bitcoin Millionaires Declines

Blockchain analytics indicate a roughly 16% decrease in the number of wallets holding at least $1 million in Bitcoin since the start of Trump’s new term. Approximately 25,000 addresses dropped below this threshold, with major holders seeing losses of around 12.5%. The data suggests that large investors have weathered price swings with greater resilience than smaller participants.

Analysts attribute the sharp growth in million-dollar accounts before Trump’s return to a year-end 2024 rally, driven largely by speculation about forthcoming regulatory frameworks. Despite Trump’s reputation for being crypto-friendly, observers noted that his policies have not resulted in sustainable on-chain asset growth or redistribution among large holders.

The tariff decision also drew criticism from political figures. California Governor Gavin Newsom voiced opposition, arguing that tariffs effectively impose an extra tax burden on American workers and should be refunded.

Gavin Newsom characterized the tariffs as an unfair burden on U.S. employees, emphasizing that any collected revenues ought to be returned.

For cryptocurrency traders, the absence of extreme volatility or a dramatic market sell-off following the latest tariff announcement reflects a cautiously neutral stance. Unlike in previous episodes of macroeconomic turbulence, broad-based new trade restrictions failed to trigger major upheaval—suggesting that digital asset markets have matured, or are at least prepared to weather policy uncertainty with more restraint.