UK-US trade faces turmoil following ruling that Trump tariffs were unlawful

US Supreme Court Ruling Throws UK-US Trade Into Disarray

A recent decision by the US Supreme Court to overturn significant portions of Donald Trump’s tariffs has created major uncertainty for trade between the United Kingdom and the United States.

The court’s verdict, which declared the president’s “reciprocal” tariffs from last year invalid, has effectively removed the sweeping 10% duty on all British exports to the US. This change impacts a wide range of products, from industrial equipment and scientific devices to whisky and cooking oils.

Although this might initially seem beneficial, the ruling has left UK businesses in a state of confusion, unsure about the future of their dealings with American partners.

On Friday evening, Trump announced plans to swiftly replace the country-specific tariffs, including those on the UK, with a universal 10% tariff on all imports.

This new tariff would be implemented under section 122 of the 1974 Trade Act, which is still legally valid. However, tariffs imposed through this provision can only remain in effect for 150 days unless extended by Congress, leaving the long-term outlook for UK exporters unclear.

British companies now face uncertainty regarding their pricing and revenue streams in the US, a market that accounts for 16% of the UK’s exports—valued at approximately £6 billion in 2025.

While the Supreme Court left in place Trump’s targeted tariffs on British cars, steel, and pharmaceuticals, the broader trade environment remains unsettled.

Uncertainty Looms Over Exporters

William Bain, who leads trade policy at the British Chambers of Commerce, warns that some UK exporters may abandon the US market altogether due to the unpredictable situation.

“The current climate is extremely uncertain for British businesses. Many are growing weary and may start exploring opportunities in other international markets,” Bain commented.

Exporters are now unsure what tariff rates will apply to their shipments in the latter half of the year. The new 10% tariff could be extended beyond five months, but only if Congress agrees. Should Congress reject the extension, tariffs could revert to zero.

There’s also the possibility that Trump could respond to a congressional veto by introducing a new, potentially higher tariff rate for British goods.

Trump hinted at this possibility, stating, “Now I’ll pursue an even stronger approach than before.”

Business Leaders Voice Concerns

Sean McGuire, director for Europe and international affairs at the Confederation of British Industry, expressed concern over the president’s intention to implement alternative tariffs that could have equal or greater impact.

He urged the UK government to maintain favorable conditions for British firms, continue efforts to lower tariffs on steel and aluminum, and provide clear guidance as the US administration moves forward.

Government and Industry Reactions

A UK government spokesperson stated that officials would collaborate with the Trump administration to determine how the ruling will affect tariffs for the UK and other nations.

Thomas Pugh, chief economist at RSM UK, noted, “In theory, removing tariffs could boost trade and slightly benefit the UK economy. However, the Supreme Court’s decision raises more questions than it answers.”

Despite ongoing uncertainty, businesses are already taking orders for the second half of the year without knowing what prices to set.

Stability and Guidance Needed

Richard Rumbelow, international business director at Make UK, emphasized the importance of stable trade relations between the UK and US for the manufacturing sector, which exported £53.9 billion to the US last year.

He stressed the need for clear, practical advice on how the Supreme Court’s decision will be implemented, as well as progress on resolving the remaining Section 232 tariffs on UK steel and aluminum.

The UK government maintains that Britain enjoys the lowest reciprocal tariffs worldwide and expects its advantageous trading position with the US to continue under any scenario.

The recent judgment does not appear to impact the trade agreement Prime Minister Sir Keir Starmer reached with Trump last year, as the now-invalid 10% baseline tariff was not formally included in the deal. The agreement instead focused on reducing sector-specific tariffs on steel, cars, and pharmaceuticals.

However, the UK no longer enjoys a competitive edge over other countries. Previously, British goods had a tax advantage compared to EU and Indian exports, which faced 15% and 18% tariffs, respectively. That advantage has now disappeared.

Implications of Section 122 Tariffs

The president’s authority under section 122 allows for tariffs up to 15%, but only if applied equally to all countries. As Paul Ashworth of Capital Economics explains, this means a single tariff rate for everyone. Consequently, the UK’s previous efforts to secure a lower rate no longer provide a unique benefit.

Moreover, if Trump decides to increase the section 122 tariff to 15% in the future, the UK would be unable to avoid it. While the president could attempt to target specific countries with higher tariffs, he would need to convince Congress that those nations are imposing unfair restrictions on US trade—a challenge he has faced even with a Republican majority, as seen with tariffs on Canada.

Complexities Around Refunds

Adding to the confusion, UK businesses are uncertain not only about future tariffs but also about whether and how they might receive refunds for tariffs paid over the past year. The Supreme Court did not address the issue of refunds, leaving companies in legal limbo.

George Riddell, managing director at Goyder, a trade consultancy, warns that any refund process is likely to be complicated and lengthy, requiring businesses to actively apply to US customs rather than receiving automatic repayments.

Paul Ashworth of Capital Economics is skeptical about the prospects for refunds, noting that Trump has not offered to return the estimated $110 billion collected in tariffs, suggesting a prolonged legal battle may ensue.

Basil Woodd-Walker, a partner at Simmons & Simmons, advises UK businesses to recognize that they can no longer rely as heavily on US trade policy or the American market.

“The message for UK and European companies is clear: we are entering a new era marked by significant uncertainty over US trade policy and the global legal framework,” he said. “Businesses must continually adapt their strategies, diversify supply chains, and consider bringing operations closer to home.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

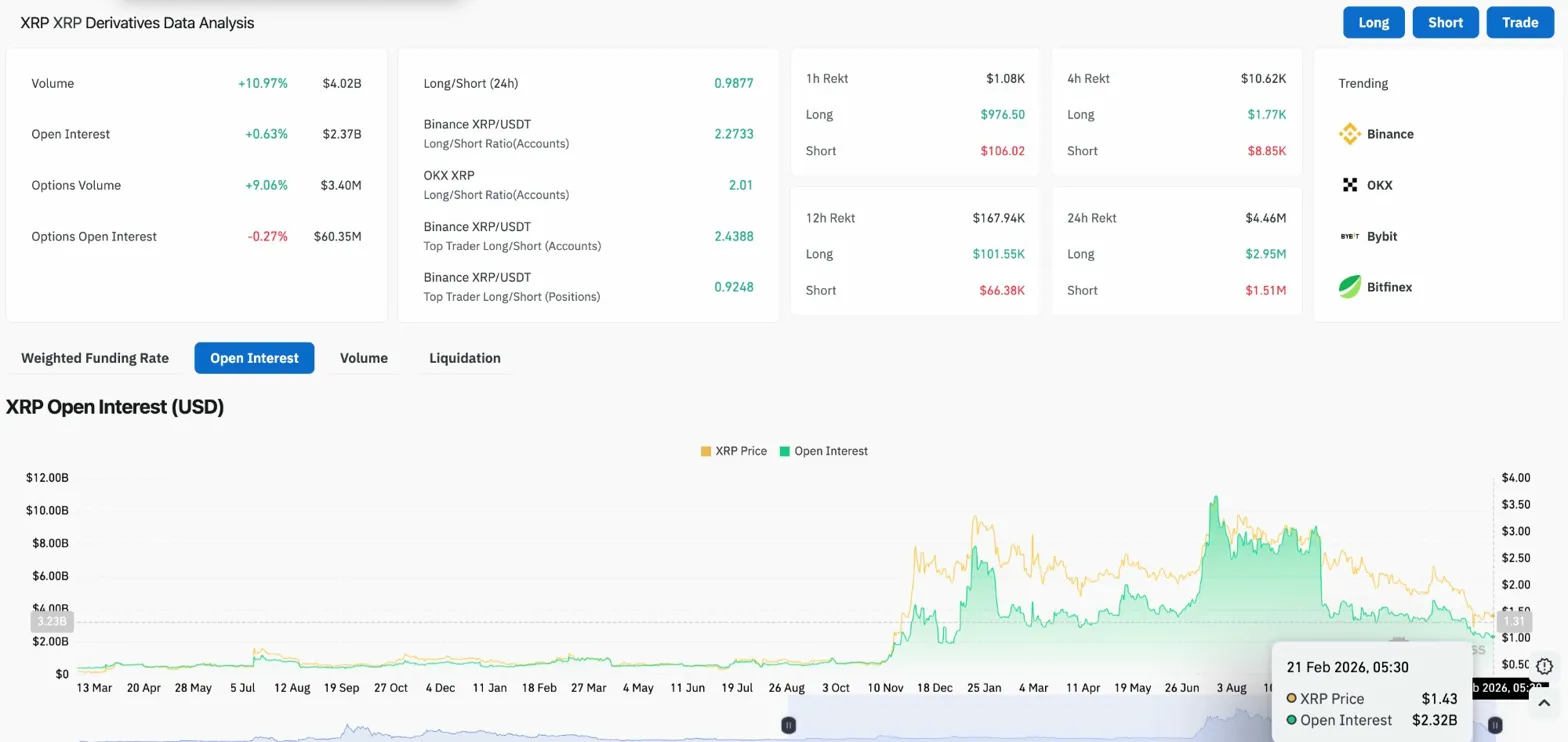

XRP Price Prediction: What Will Be the XRP Price at the End of February?

Large Bitcoin Holders Rebuild Reserves After Heavy Selling

If OpenAI is valued at $830 billion, how much should Google be worth?

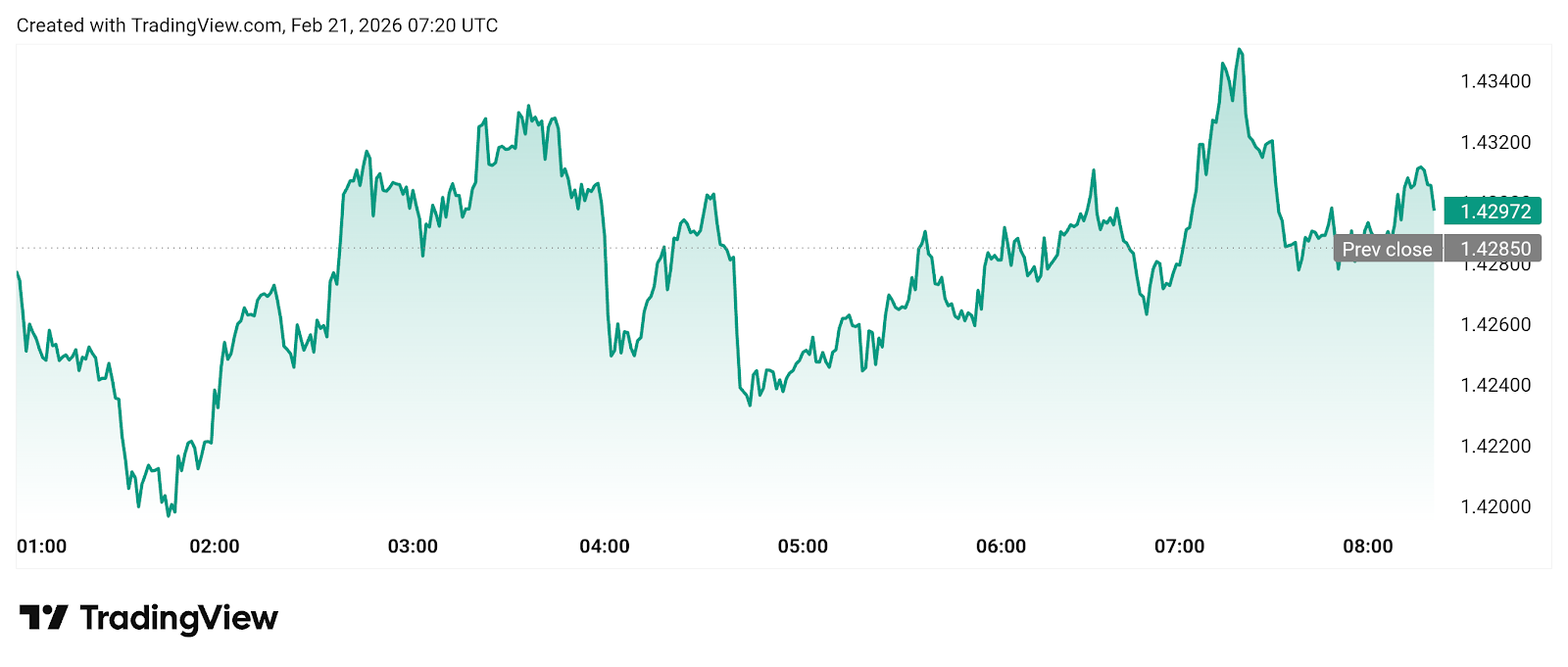

XRP Price Prediction: XRP Holds $1.4306 As Deutsche Bank Expands Ripple Tech