Asian economies weigh impact of fresh Trump tariff moves, confusion

By Selena Li and Ben Blanchard

HONG KONG/TAIPEI, Feb 21 (Reuters) - U.S. trading partners in Asia started weighing fresh uncertainties on Saturday after President Donald Trump vowed to impose a new tariff on imports, hours after the Supreme Court struck down many of the sweeping levies he used to launch a global trade war.

The court's ruling invalidated a number of tariffs that the Trump administration had imposed on Asian export powerhouses from China and South Korea to Japan and Taiwan, the world's largest chip maker and a key player in tech supply chains.

Within hours, Trump said he would impose a new 10% duty on U.S. imports from all countries starting on Tuesday for an initial 150 days under a different law, prompting analysts to warn that more measures could follow, threatening more confusion for businesses and investors.

In Japan, a government spokesman said Tokyo "will carefully examine the content of this ruling and the Trump administration's response to it, and respond appropriately."

China, which is preparing to host Trump in late March, has yet to formally comment or launch any counter moves with the country on an extended holiday. But a senior financial official in China-ruled Hong Kong described the U.S. situation as a "fiasco".

Christopher Hui, Hong Kong's secretary for financial services and the treasury, Trump's new levy served to underscore Hong Kong's "unique trade advantages", Hui said.

"This shows the stability of Hong Kong's policies and our certainty ... it shows global investors the importance of predictability," Hui said at a media briefing on Saturday when asked how the new U.S. tariff's would affect the city's economy.

Hong Kong operates as a separate customs territory from mainland China, a status that has shielded it from direct exposure to U.S. tariffs targeting Chinese goods.

While Washington has imposed duties on mainland exports, Hong Kong-made products have generally faced lower tariff rates, allowing the city to maintain trade flows even as Sino-U.S. tensions escalated.

Before the Supreme Court's ruling, Trump's tariff push had strained Washington's diplomatic relations across Asia, particularly for export-reliant economies integrated into U.S.-bound supply chains.

Friday's ruling concerns only the tariffs launched by Trump on the basis of the International Emergency Economic Powers Act, or IEEPA, intended for national emergencies.

Trade policy monitor Global Trade estimated that by itself, the ruling cuts the trade-weighted average U.S. tariff almost in half from 15.4% to 8.3%.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

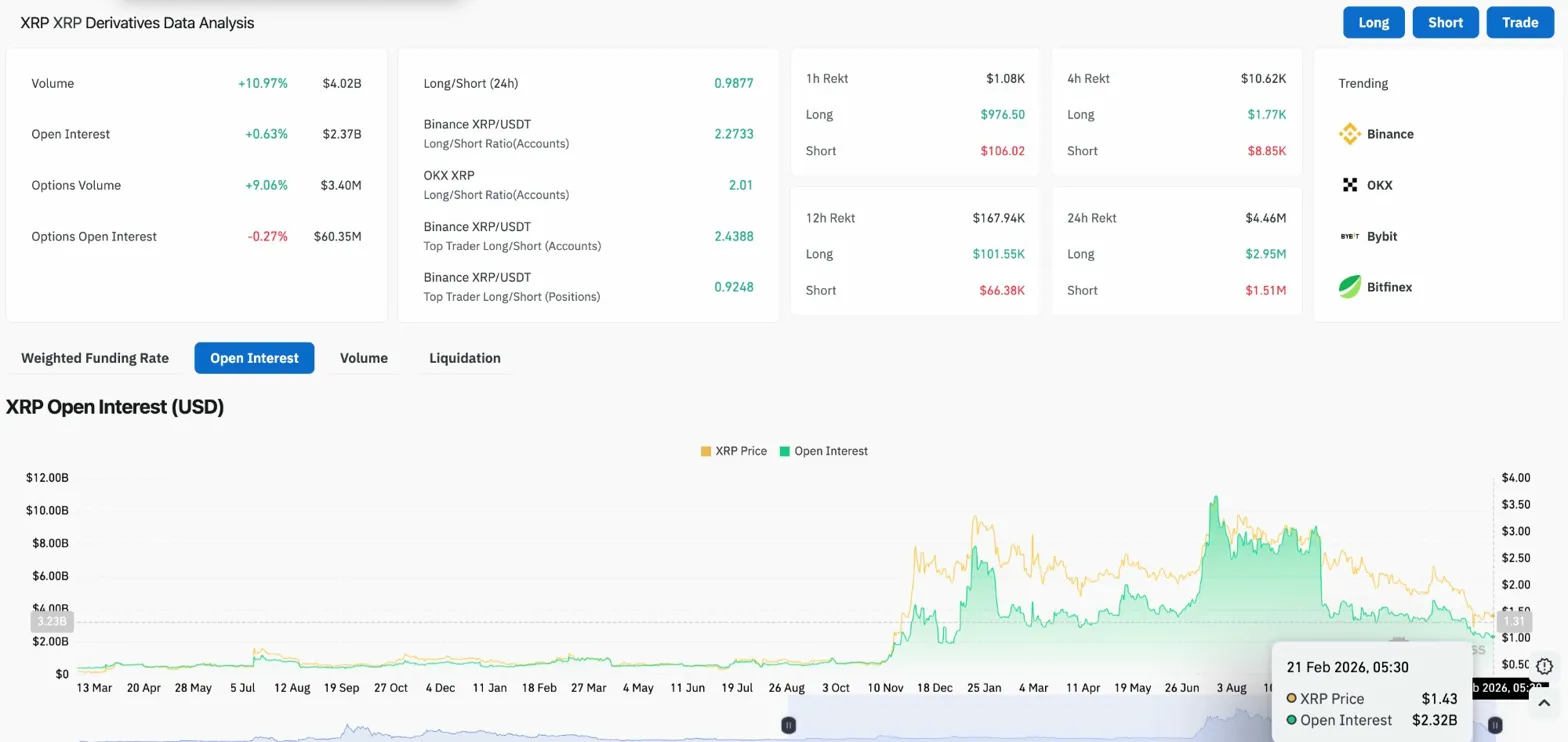

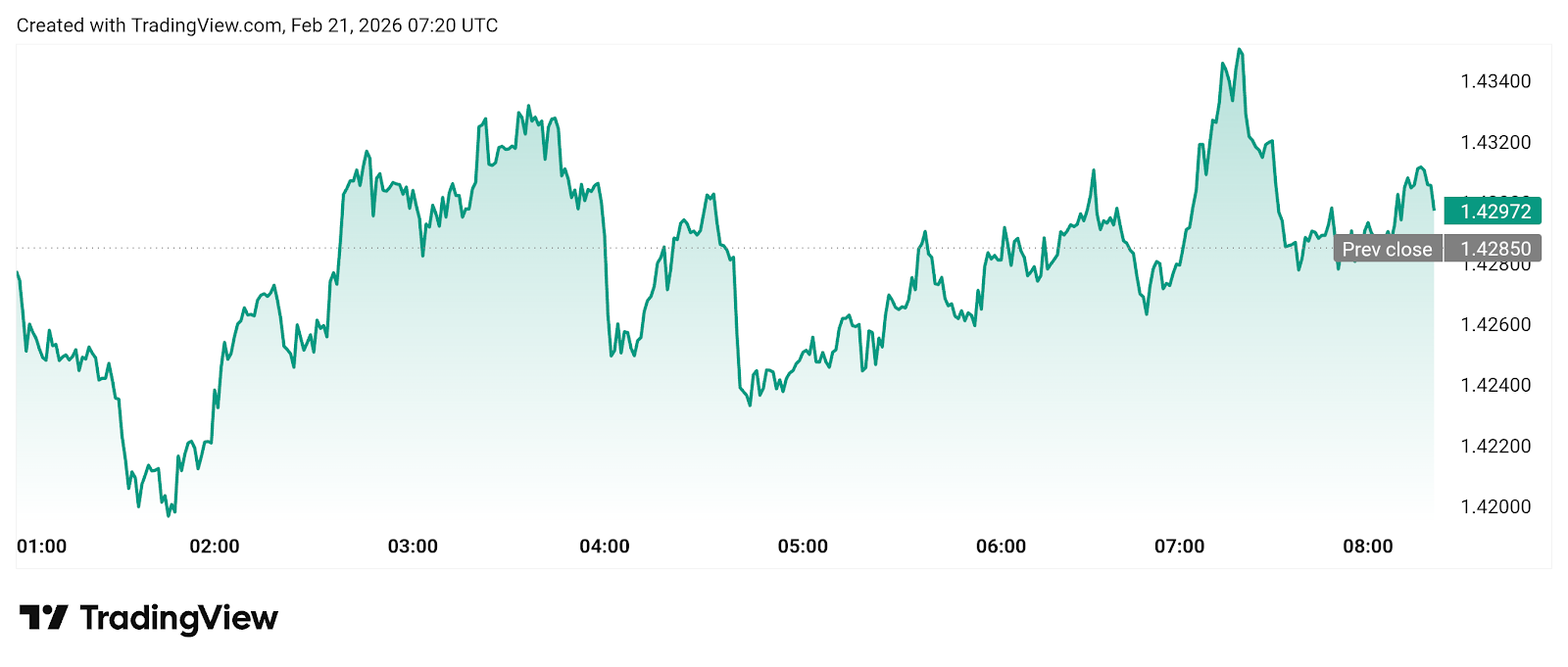

XRP Price Prediction: What Will Be the XRP Price at the End of February?

Large Bitcoin Holders Rebuild Reserves After Heavy Selling

If OpenAI is valued at $830 billion, how much should Google be worth?

XRP Price Prediction: XRP Holds $1.4306 As Deutsche Bank Expands Ripple Tech