Aave gave long-term investors a glimmer of hope with the price action of the past two weeks.

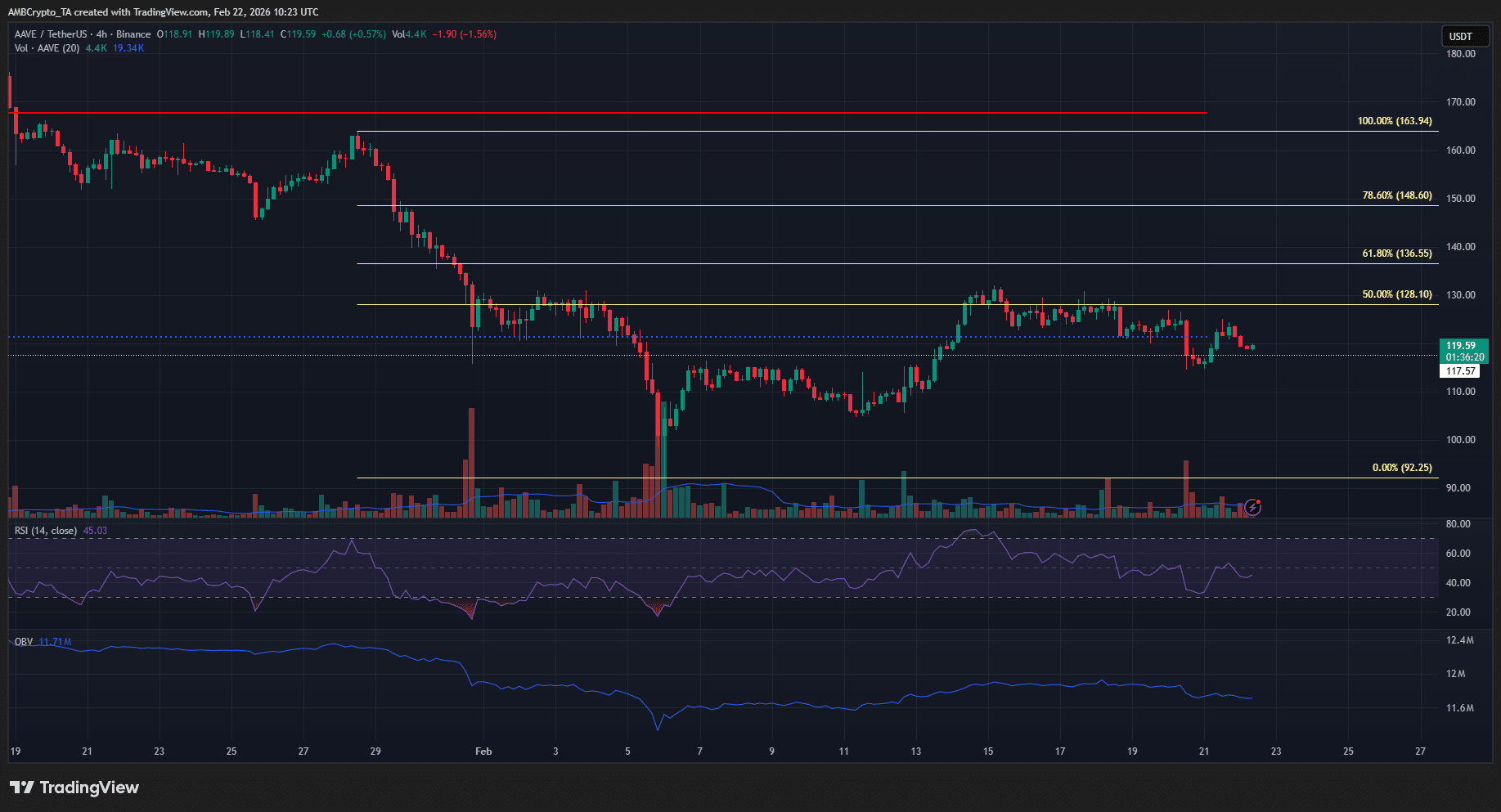

Since making a low of $92.25 on Friday, the 6th of February, the DeFi protocol token’s price has rallied 29.7%.

It was trading at $119.64 at the time of writing, but the long-term trend remained firmly bearish.

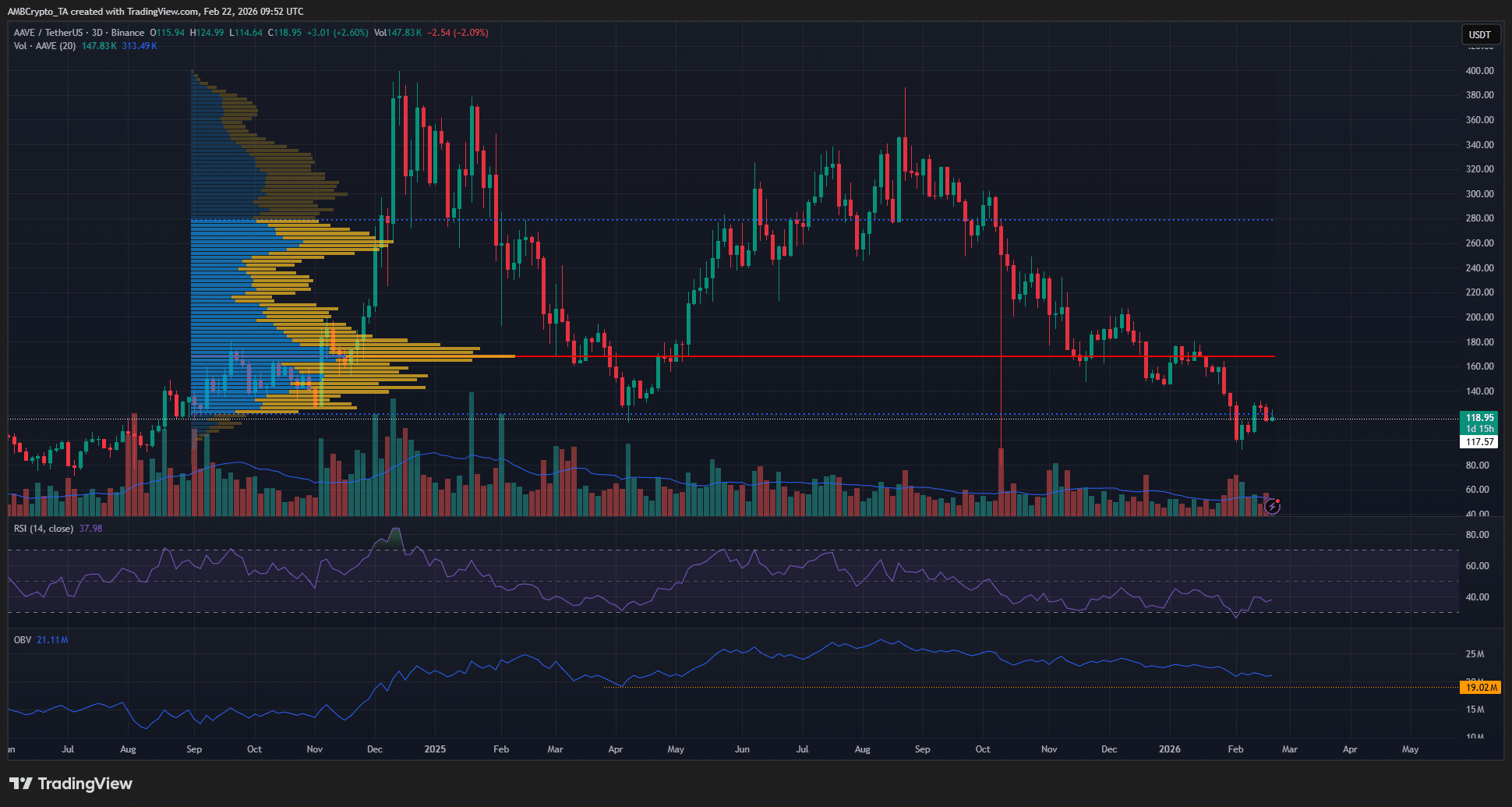

Moreover, the 3-day chart above highlights the series of lower highs and lower lows AAVE has made since the final week of September.

In the summer of 2024, the $117.57 level had been an obstacle to bulls’ attempts at recovery. They overcame the resistance in August 2024, kickstarting a rally that nearly reached $400 by the end of that year.

This was the same long-term level that AAVE was trading at once again.

In fact, the Fixed Range Volume Profile tool was used from August 2024, when the S/R flip occurred, to the present.

It showed that the Value Area Low (dotted blue) was at $121.2. The Point of Control (red) was at $168. The FRVP highlighted the long-term bearish pressure on AAVE. The bulls simply have to defend the $80-$100 demand zone if they want to prevent a slide to $50 later this year.

The OBV was above the April 2025 lows, which was a hopeful sign for the bulls. The protocol’s revenue-generating capacity remained strong, noted an AMBCrypto report.

The bearish warning signs for Aave

The Total Value Locked briefly climbed to $27.7 billion, but over the past ten days, it has receded to $26.3 billion. News that BGD Labs, one of the top service providers to the Aave DAO, would quit by early April highlighted the Aave ecosystem division.

The 4-hour chart reflected the market sentiment behind the altcoin. The $130 area has been a key supply zone in February. The repeated attempts to breach it suggested that some Bitcoin [BTC] bullish momentum could be enough to send AAVE beyond the local resistance.

To the north, the $148.6 was a pivotal resistance. Given the longer-term downtrend, a bearish continuation from this level is expected. On the other hand, a breakout past $163.9 would signal a bullish swing structure shift and the potential for recovery.

Final Summary

- The Aave price action remained firmly bearish, but short-term gains up to $148 appeared likely in the coming days.

- A bearish continuation at the $150 resistance, or a breakout past $164, would determine the next trend for the altcoin.