Hoping to receive a tariff reimbursement? According to Trump administration officials, they are awaiting guidance from lower courts. ‘This is a situation of their own making’

Supreme Court Ruling Leaves Tariff Refunds Unresolved

The Supreme Court recently overturned President Donald Trump’s global tariffs, but did not specify how refunds should be managed. As a result, administration officials have stated they will wait for lower courts to provide further instructions.

White House Awaits Court Guidance

During an appearance on , U.S. Trade Representative Jamieson Greer was questioned about whether the administration would oppose refund claims or compensate those affected. Greer responded that the matter is now in the hands of the courts, highlighting that the U.S. Court of International Trade has previously played a significant role in shaping refund procedures.

“It’s up to the courts to decide,” Greer explained. “They created this scenario, and we’ll comply with their directives.”

Background on the Tariffs

Trump had invoked the International Emergency Economic Powers Act (IEEPA) for the first time to introduce his “Liberation Day” tariffs last year. These measures were swiftly contested in court. While defending the tariffs, Justice Department attorneys conceded that if the levies were found unlawful, the government would reimburse those who paid them.

The Department of Justice also argued that, given the possibility of refunds, the courts should not grant immediate relief to plaintiffs, allowing the tariffs to remain in effect during litigation.

Supreme Court Decision and Its Aftermath

On Friday, the Supreme Court affirmed lower court rulings that declared the IEEPA tariffs illegal. In response, Trump announced a new round of global tariffs under a different statute.

Treasury Secretary Scott Bessent, who had previously indicated that a loss in court would require issuing refunds, also deferred to the lower courts for guidance. “I’m not going to get ahead of the court,” he told CNN on Sunday. “We will follow the court’s direction. But as I said, that could be weeks or months away. That decision was not rendered on Friday.”

Financial Stakes and Legal Challenges

Over $130 billion collected through the IEEPA tariffs is now in question. Research from the New York Fed revealed that U.S. consumers and businesses have borne 90% of these import taxes, despite claims that foreign countries were paying the costs.

In anticipation of the Supreme Court’s ruling, companies such as that had paid the tariffs filed lawsuits to secure potential refunds.

Dissent and Concerns Over Refund Process

Justice Brett Kavanaugh, one of three dissenters, criticized the majority for sidestepping the refund issue and cautioned that the process could become chaotic. “The Court says nothing today about whether, and if so how, the Government should go about returning the billions of dollars that it has collected from importers,” he remarked.

Looking Ahead: Refunds and Legal Hurdles

The government has previously issued refunds in similar situations, and Customs and Border Protection has established procedures for returning duties when importers can demonstrate an error.

However, trade attorney Joyce Adetutu, a partner at Vinson & Elkins, told the Associated Press that the government is likely to make the refund process as challenging as possible for importers. “I can imagine a scenario where they shift as much responsibility as possible onto the importer,” she added, suggesting that businesses may need to pursue legal action to recover their funds.

This article was originally published on .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CME Group to launch 24/7 crypto futures

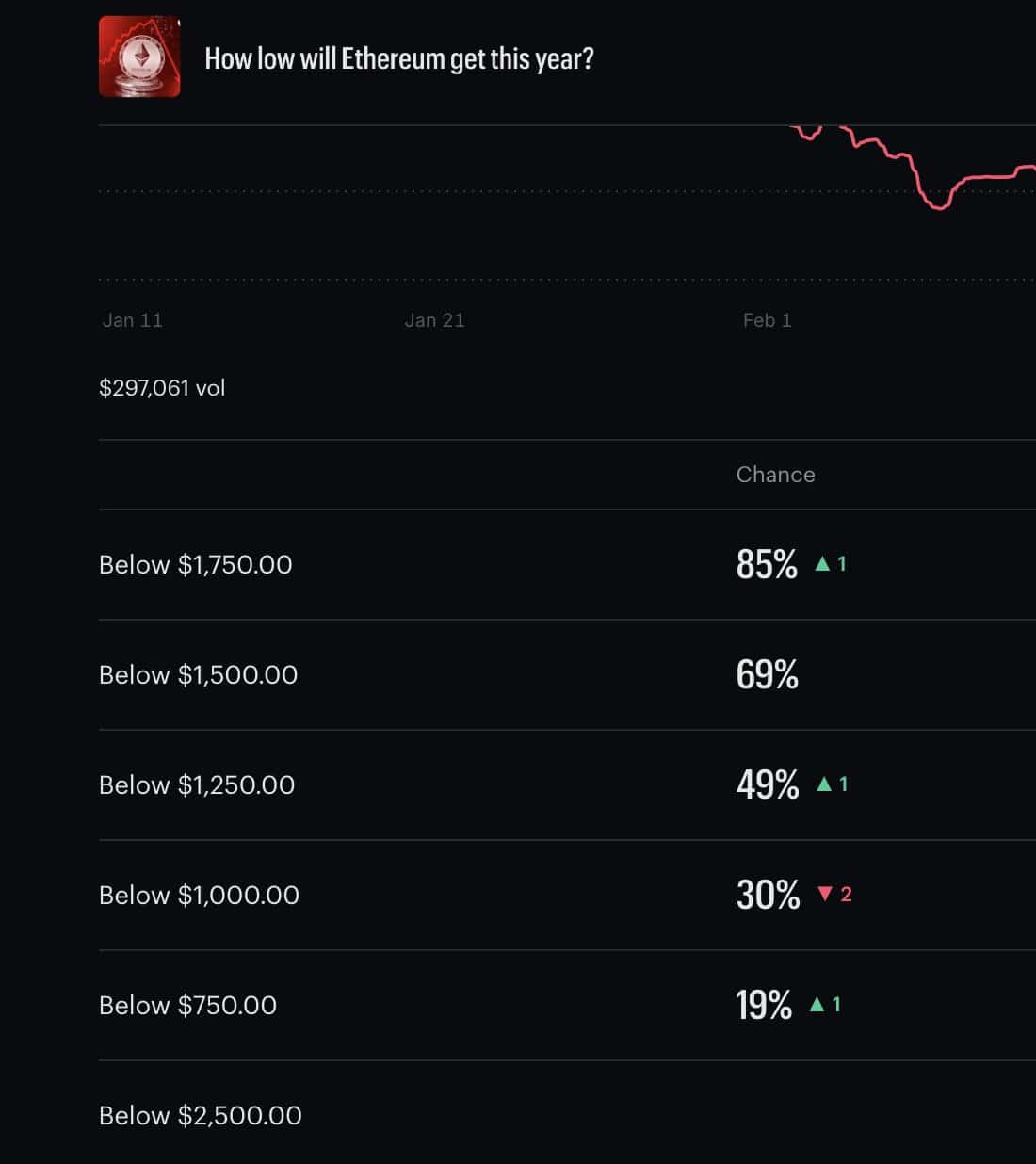

Ethereum under pressure: Founder sales, whale losses, and bearish odds collide

SEC leaders signal clarity on tokenised securities

Bitcoin Lightning tops $1B monthly volume