News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (5.09)|Bitcoin Reclaims $100K as Trade Tensions Ease, Ripple Reaches Settlement with SEC2Early Signs of Institutional Trust in Ethereum Staking Following Pectra Upgrade’s Announcement3Bitcoin Faces Liquidation Levels on Path Toward Potential New All-Time High

Ether clocks ‘insane’ 20% candle post Pectra — a turning point?

Ether has surged following the Pectra hard fork, with analysts suggesting a growing number of long positions could signal a turnaround for the asset.

Cointelegraph·2025/05/09 08:55

Sei Network Simplifies Crypto Infrastructure with Ethereum Focus

In Brief Sei Network accelerates efforts to reduce infrastructure complexity by focusing on Ethereum. The plan aims to simplify development and debugging processes for better efficiency. Focus on Ethereum compatibility could attract more developers and boost ecosystem growth.

Cointurk·2025/05/09 05:44

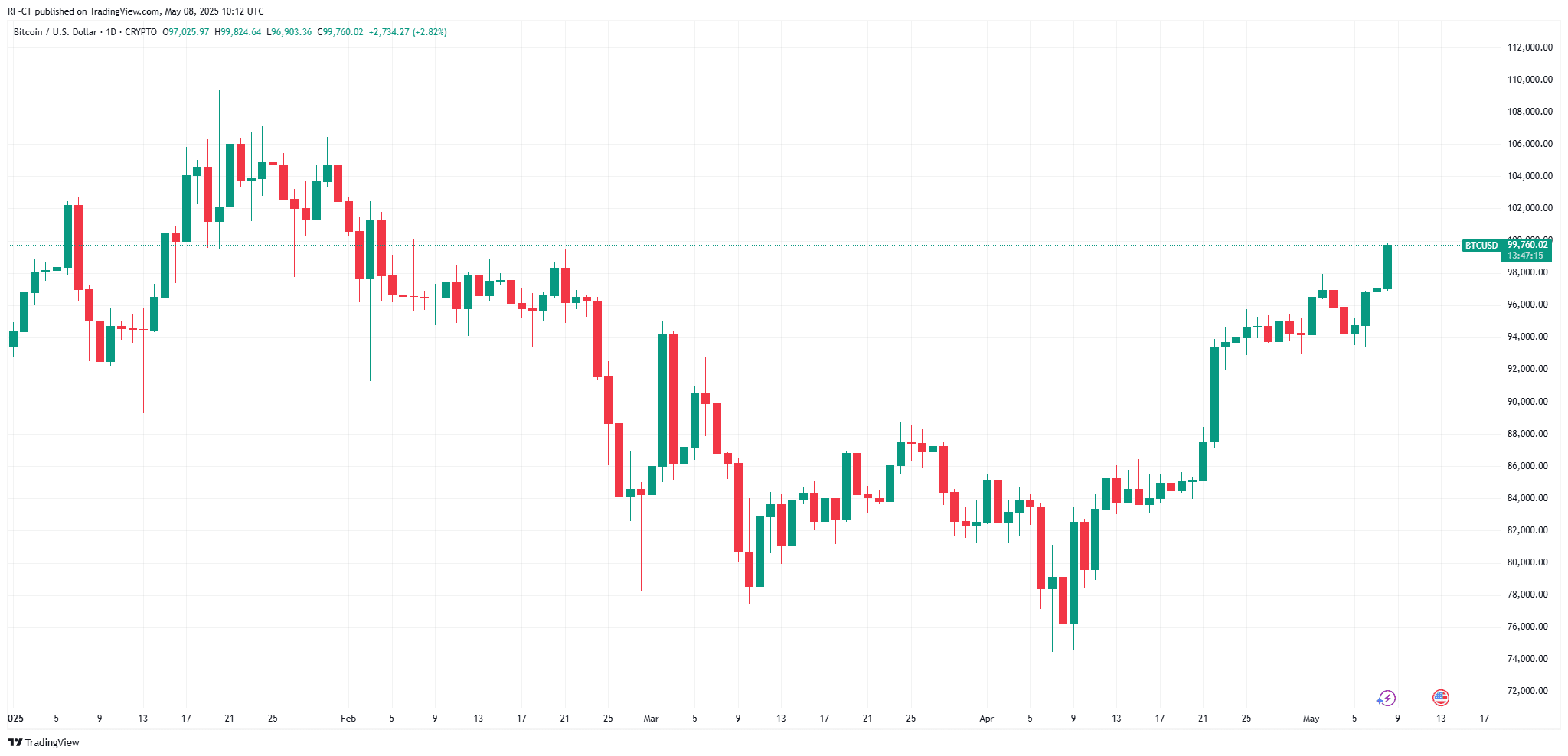

Bitcoin Breaks $100K as BTC Nears New ATH with Bulls Roar in May 2025

Cryptoticker·2025/05/09 01:33

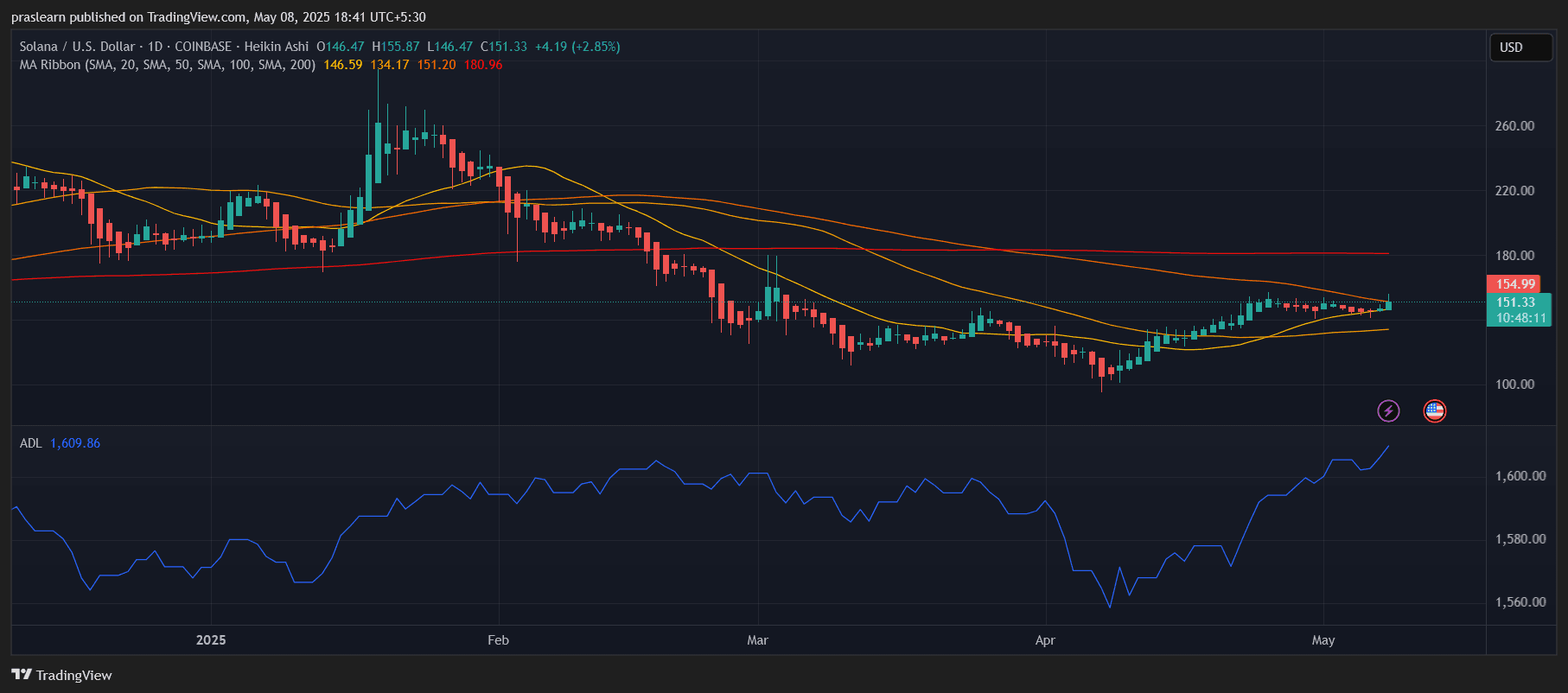

SOL Price Explodes Past $150—What’s Next?

Cryptoticker·2025/05/09 01:33

Ethereum Price Prediction: ETH Surges Above $2,000 as Crypto Market Soars

Cryptoticker·2025/05/09 01:33

PEPE Coin Price Prediction: Could PEPE DOUBLE After 33% Daily Surge?

Cryptoticker·2025/05/09 01:33

XRP Price Prediction: $4 Target in Sight as Bitcoin Breaks $100K

Cryptoticker·2025/05/09 01:33

Space and Time debuts $SXT token as mainnet goes live

Grafa·2025/05/09 01:20

SUI price breakout? Technical pattern signals move toward $4.25

Coinjournal·2025/05/08 23:33

Memecoin rally gains momentum: MOG jumps 40% as Bitcoin approaches $100,000

Coinjournal·2025/05/08 23:33

Flash

- 10:15A whale deposits 1 million USDC into HyperLiquid and shorts Bitcoin with 40x leveragePANews reported on May 9 that, according to Onchain Lens monitoring, a certain whale deposited 1 million USDC into HyperLiquid and opened a Bitcoin short position with 40x leverage.

- 10:14Sygnum: Solana Lacks Sufficient Evidence to Replace Ethereum as the Preferred Blockchain for InstitutionsPANews reported on May 9, according to Cointelegraph, that the latest research from cryptocurrency bank Sygnum indicates that Solana has not yet shown sufficient evidence to replace Ethereum as the preferred blockchain for institutions. The report shows that Solana's revenue is highly dependent on meme coin transactions, raising concerns about its revenue stability. In contrast, Ethereum still holds a significant advantage in terms of security, stability, and institutional recognition. Data indicates that Ethereum's actual revenue scale is 2-2.5 times that of Solana. Notably, the fees generated by the Solana network mainly flow to validation nodes and have not effectively translated into SOL token value growth. In March this year, the Solana community rejected a proposal to reduce the inflation rate, reflecting its conservative attitude towards token economic reform. The report also points out that if Solana can make breakthroughs in more stable revenue areas such as stablecoins and tokenization, there is still an opportunity to catch up with Ethereum. Currently, Ethereum maintains a lead in institutional application scenarios, which have received widespread support from traditional financial institutions.

- 10:14The Bitcoin options market on the Deribit platform shows a surge in institutional confidence in BitcoinPANews reported on May 9, according to CoinDesk, that the Bitcoin options market shows increased institutional confidence. Data from the Deribit exchange indicates that institutions have increased their bullish bets through BTC options over the past week. Traders have been focusing on buying call options expiring in June/July with a strike price of $110,000, and have established calendar spread combinations with call options expiring in September at $140,000 and in December at $170,000, suggesting that the market expects BTC prices to potentially rise further to $140,000. CoinDesk data shows that BTC surpassed $104,000 on May 9, rebounding nearly 40% from the early April low, mainly driven by the positive impact of the UK-US trade agreement and continuous capital inflows into spot ETFs. Ethereum showed strong performance during the same period, with ETH prices rising 30% in two days to $2,411. There was a surge in demand on Deribit for call options expiring in June at $2,400 and for long-term bullish spread contracts betting on price levels between $2,600 and $2,800. Deribit pointed out that the adjustment of institutional positions indicates that the bullish sentiment towards mainstream crypto assets is strengthening in the market.