From ETF Buzz to Rising Network Activity: Why Litecoin Could Lead in Q4

Litecoin’s Q4 prospects strengthen as ETF optimism grows, large transaction volumes rise, and payment adoption surges, hinting at undervaluation.

Litecoin (LTC), an altcoin that uses the proof-of-work consensus mechanism and was once called “digital silver,” is working to regain its former glory. Fundamental factors strengthen the network’s resilience and utility, but the price does not reflect those underlying values.

A few signals suggest that Litecoin’s momentum is reviving and growing in the year’s final quarter.

Average Transaction Value, Litecoin ETF, and More

According to expert Nate Geraci, the US Securities and Exchange Commission (SEC) will soon issue final decisions on spot crypto ETF applications in the coming weeks.

The Canary Litecoin ETF application is the first in line. A decision is expected this week on October 2, followed by rulings on other altcoins such as SOL, DOGE, XRP, ADA, and HBAR.

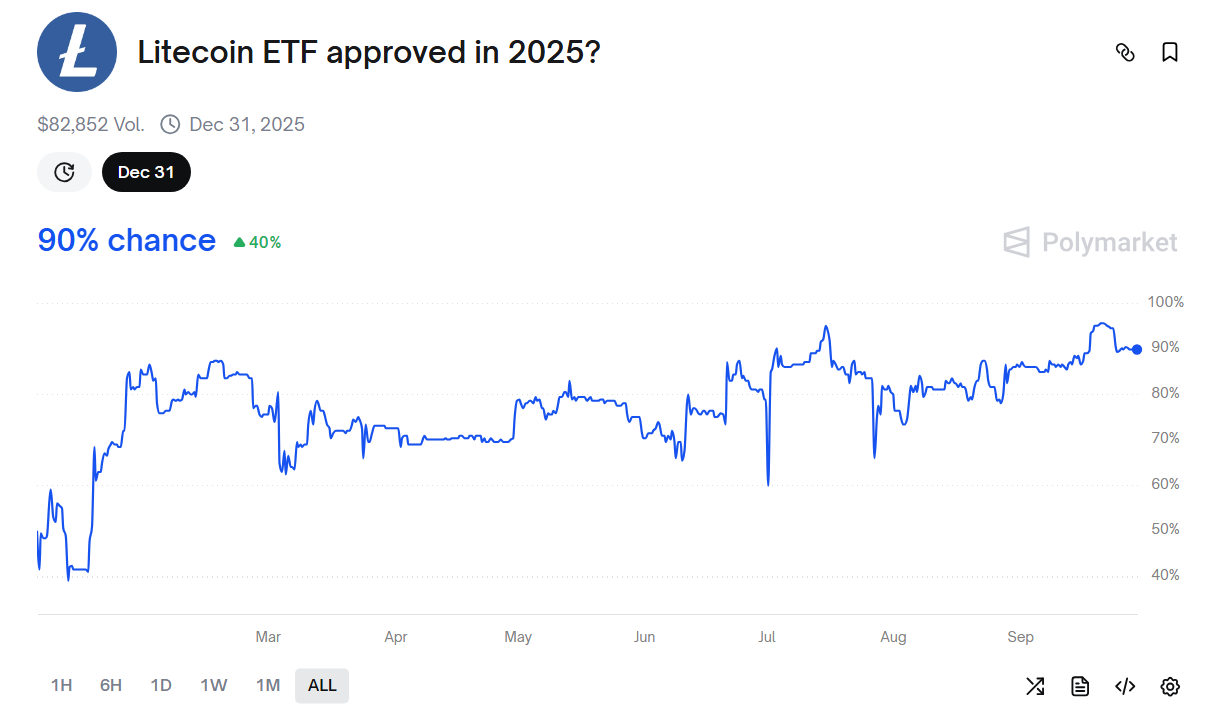

Prediction platform Polymarket currently assigns a 90% probability that regulators will approve a Litecoin ETF in 2025. Investors show strong confidence in this outcome.

Litecoin ETF Approval Possibility in 2025. Source:

Polymarket

Litecoin ETF Approval Possibility in 2025. Source:

Polymarket

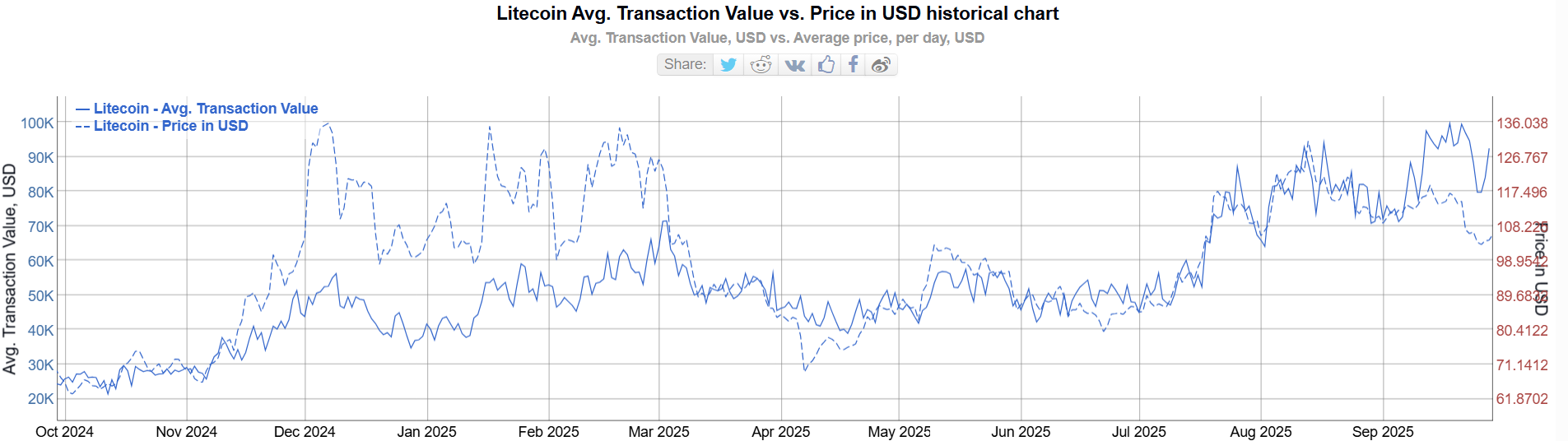

Second, Litecoin’s average transaction value has reached a two-year high, signaling a surge in large transactions across the network.

Data from BitInfoCharts shows that the average transaction value (solid line) climbed from $25,000 at the end of 2023 to nearly $100,000 in September 2025, four times higher and the highest level in two years.

Average LTC Transaction Value. Source:

Bitinfocharts

Average LTC Transaction Value. Source:

Bitinfocharts

The rise is noteworthy because LTC’s price remained stable at around $100 without hitting new highs. This suggests more LTC is moving across the network. These could be payment transactions or accumulation moves.

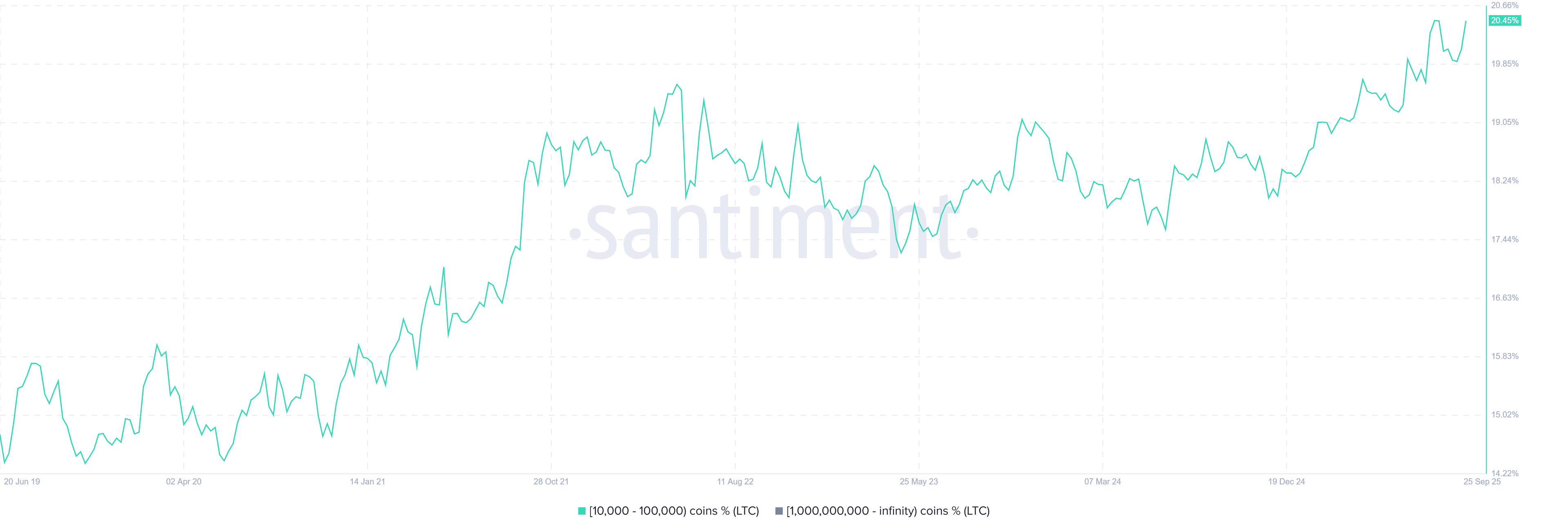

Recent Santiment data support the accumulation thesis. Wallet addresses holding between 10,000 and 100,000 LTC have grown steadily over the past five years, accounting for more than 20% of the supply.

Share of Supply Distribution of Wallet Addresses Holding Between 10,000 and 100,000 LTC. Source:

Santiment

Share of Supply Distribution of Wallet Addresses Holding Between 10,000 and 100,000 LTC. Source:

Santiment

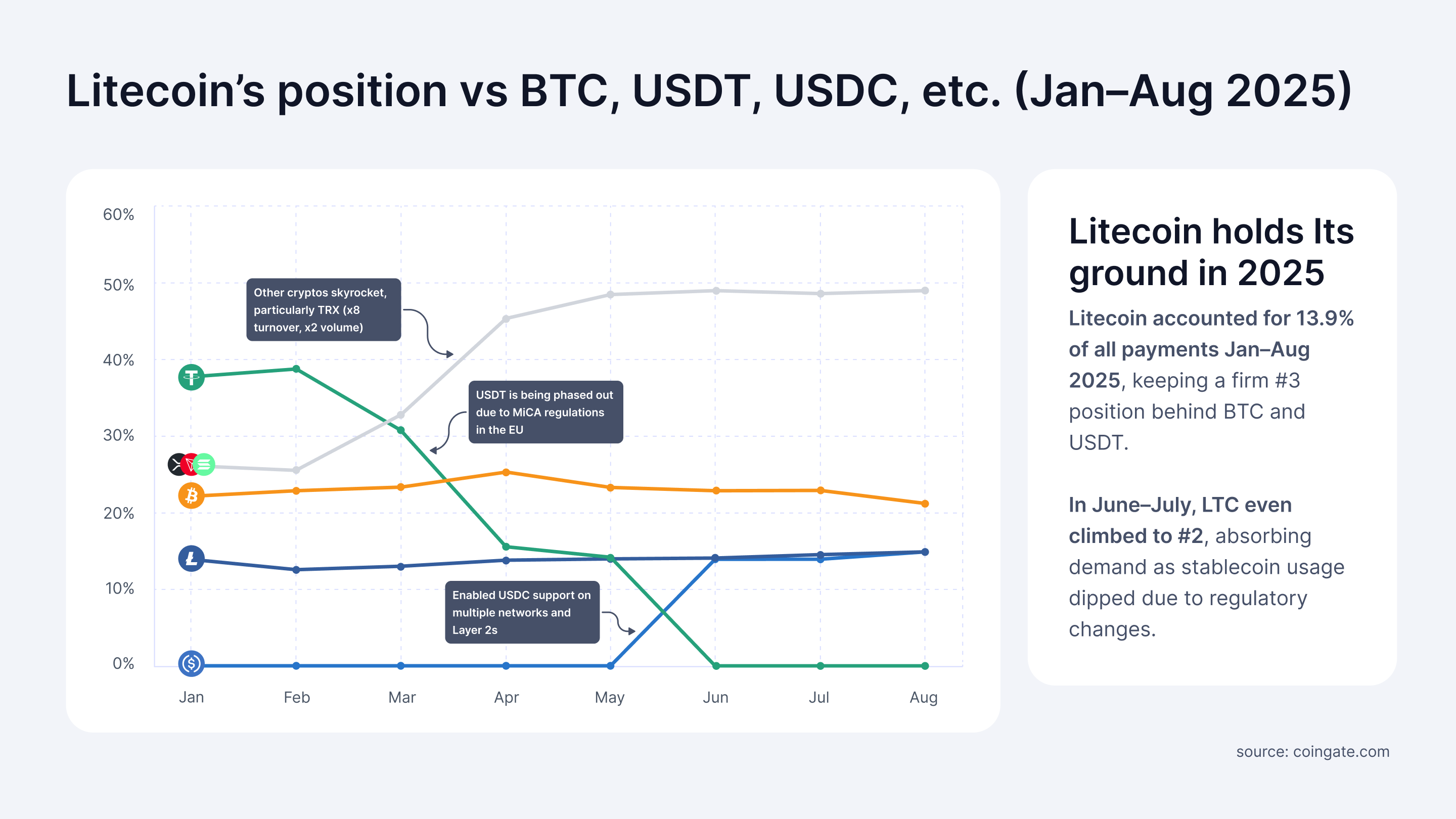

Third, a report from CoinGate highlights Litecoin’s dominance in consumer payments on its platform. From January to August 2025, LTC represented 13.9% of all transactions, ranking third behind Bitcoin (23%) and USDT (21.2%).

Litecoin’s Dominance in Consumer Payments. Source:

Coingate

Litecoin’s Dominance in Consumer Payments. Source:

Coingate

“Litecoin payments remain steady across the year, with higher usage when competing assets face headwinds. Rather than being a marginal alternative, Litecoin has proven it can capture meaningful share when circumstances change, which is a clear sign of resilience and user trust,” CoinGate reported.

These positive signs of adoption lead many analysts to argue that LTC is undervalued compared to the utility its network delivers.

“Litecoin is at least 50x undervalued… it’s actually more once price goes vertical and it catches the next wave of adoption, likely sending it another 10x… so 500x undervalued,” analyst Master predicted.

However, competition remains fierce. Other altcoins, such as ETH, SOL, XRP, and XLM, are also cementing their roles in the growth of DeFi and global payments. Investors, therefore, may find strong alternatives for their portfolios beyond LTC.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: Clearer Regulations Propel XRP ETFs to $628M as the Asset Earns Greater Legitimacy

- Canary Capital's XRPC ETF dominates XRP ETF market with $250M inflows, outpacing all competitors combined. - Grayscale's GXRP and Franklin Templeton's XRPZ drove $164M debut inflows, boosting total XRP ETF AUM to $628M. - 2025 SEC ruling cleared XRP's secondary sales as non-securities, enabling institutional adoption and $2.19 price rebound. - XRPC's 0.2% fee waiver and institutional focus fueled $6B+ ETF trading volumes, reversing prior outflows. - Analysts project $6.7B XRP ETF growth within 12 months

Bitcoin Updates: Anxiety Sweeps Crypto Market, Yet ETFs Ignite Optimism for Recovery

- Crypto Fear & Greed Index hits 20, signaling extreme fear as BTC/altcoins face renewed volatility amid Tether's "weak" stablecoin downgrade. - Tether CEO defends USDt stability with $215B Q3 assets, while Bitcoin-focused firms adopt defensive stances against mNAV risks. - Altcoin Season Index at 25/100 shows modest rebound, with Zcash surging 1,000% and Grayscale filing first U.S. Zcash ETF. - Upcoming spot altcoin ETF launches and potential Fed rate cuts (80% priced) spark optimism despite fragile on-ch

The Impact of Artificial Intelligence on Transforming Business Efficiency and Entrepreneurial Expansion

- AI-driven tools are becoming essential for SMEs and startups to enhance productivity and operational efficiency amid competitive pressures. - McKinsey reports 71% of organizations now use generative AI in 2025, but SMEs lag behind large enterprises in scaling AI adoption. - AI adoption delivers measurable ROI, with case studies showing 15-140% productivity gains in sectors like legal, sales, and customer service. - Investors are prioritizing AI-enhanced SaaS platforms that address SME pain points, enabli

The Federal Reserve's Policy Change and Its Effects on Solana (SOL): How Infrastructure Funding and Clearer Regulations Are Speeding Up Blockchain Adoption in 2025

- Fed's 2025 policy clarity and liquidity injections accelerated Solana's institutional adoption in blockchain finance. - Regulatory frameworks like OCC Letter 1186 and GENIUS Act enabled banks to engage with Solana's stablecoin and DeFi infrastructure. - Solana's Alpenglow upgrades (100ms finality) and $508M funding fueled partnerships with Visa , Western Union , and Coinbase . - $2B ETF inflows and $1T DEX volume highlight Solana's role in reshaping cross-border payments and DeFi ecosystems.