Bitcoin Still Below Peak as Gold Climbs—Is a Catch-Up Rally Imminent?

Gold’s record-breaking rally has renewed comparisons with Bitcoin. While gold thrives as a safe-haven asset, analysts debate if Bitcoin will catch up in Uptober or continue to diverge, balancing long-term upside against higher volatility.

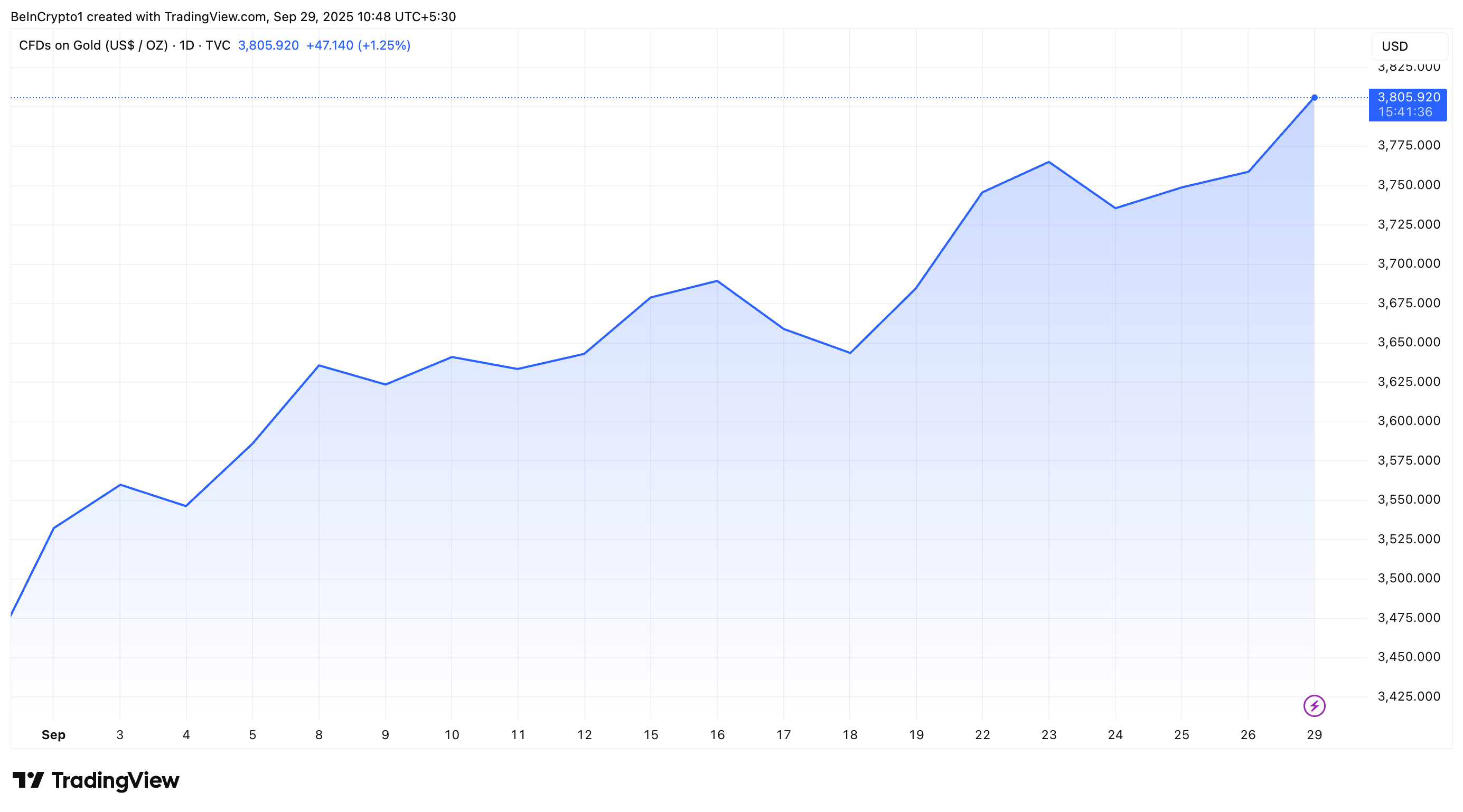

Gold prices climbed to a new all-time high in Asian trading hours on Monday, with spot prices surging to $3,800 per ounce. The surge came as the US dollar weakened following recent Federal Reserve rate cuts, while ongoing geopolitical tensions continued to drive demand for safe-haven assets.

The milestone has sparked debate over what it could signal for Bitcoin (BTC). Many analysts suggest that the ‘digital gold’ may soon follow the precious metal’s lead and attempt to reclaim its own all-time high.

Gold’s 2025 Rally Could Be Its Strongest Since 1979

Market data shows that gold gained 9.43% in September, extending its year-to-date rise to 45.2%. Just a few hours ago, the precious metal set a new all-time high of $3,811 per ounce, before easing to a press-time level of $3,805.

“Gold just traded above $3,800. Silver is above $47. Gold isn’t shattering record after record because the Fed’s decision to lower interest rates was correct, or because Trump’s economic policies are a success. It’s indicative of the abject failure of fiscal and monetary policy,” economist Peter Schiff posted.

Gold Performance. Source:

Gold Performance. Source:

Brian Rose, former banker and founder of London Real, pointed out that gold has already logged 38 record highs this year.

“This could be gold’s strongest run since 1979, fueled by Fed rate cuts while inflation still sits above 3%,” he said.

Will Bitcoin Hit an All-Time High in Uptober?

Meanwhile, Bitcoin managed to navigate one of its weakest months with notable resilience, posting a 3.2% gain. Despite this uptick, the largest cryptocurrency still trades 9.9% below its all-time high, leaving the question open as to whether it can close that gap in October.

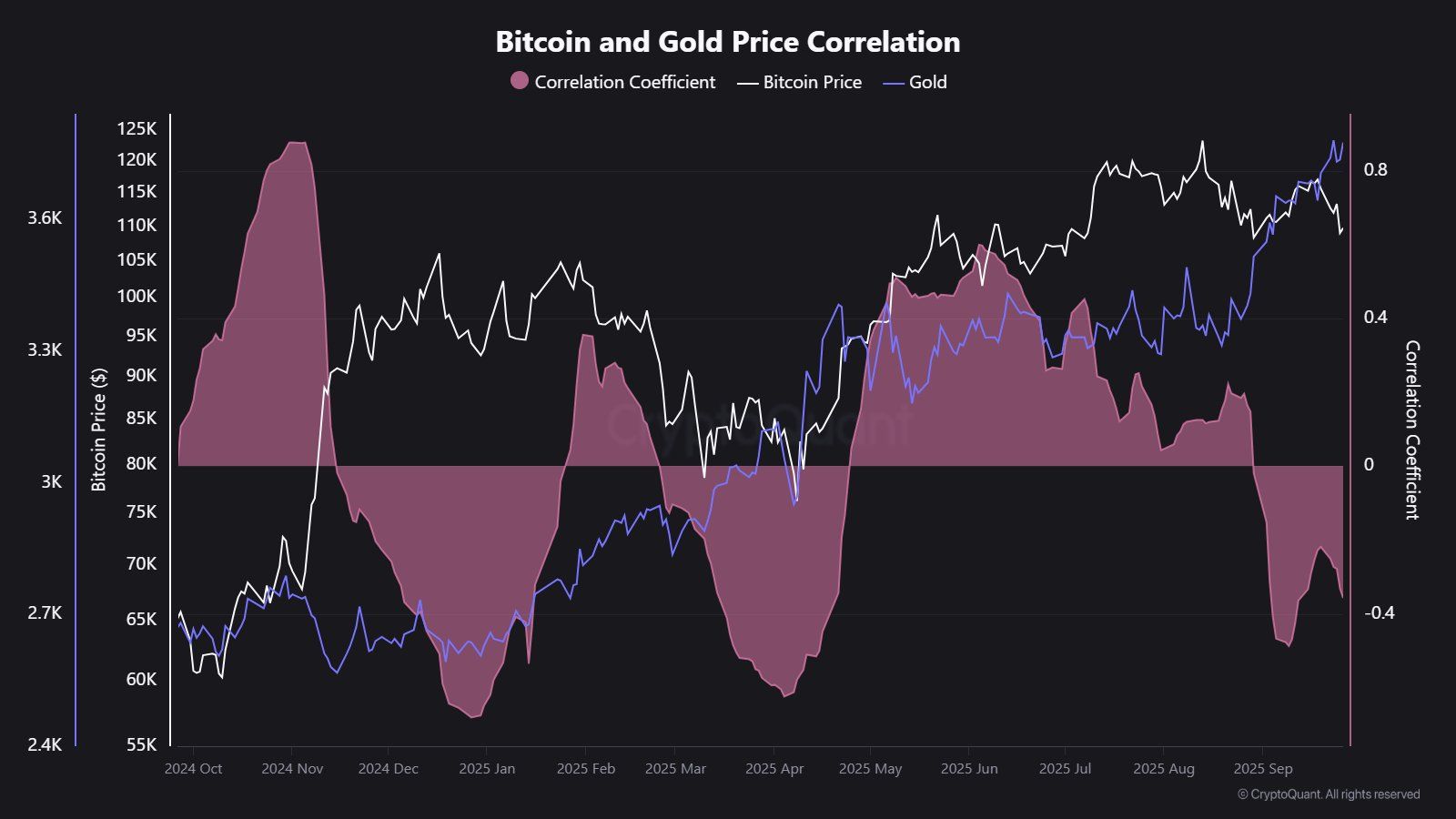

While October is often viewed as a bullish month for Bitcoin—earning the name ‘Uptober’—its current correlation with gold sends mixed signals. CryptoQuant’s community analyst Maartunn highlighted that the Bitcoin and gold correlation has turned negative. A negative correlation suggests that gold strength is no longer a bullish signal for BTC in the short term.

“Gold surges while Bitcoin dips. The negative correlation between the two persists,” he wrote.

Bitcoin and Gold Correlation. Source:

Bitcoin and Gold Correlation. Source:

Furthermore, Joe Consorti noted that gold has tracked global M2 money supply with near 1:1 sensitivity, while Bitcoin has decoupled from this metric since early May.

“Bitcoin has not tracked global M2 with a ~70-day lag since early May. Gold is high beta risk-off, BTC is high beta risk-on,” Consorti stated.

He attributed this to gold being a safe-haven asset that reacts strongly when investors seek safety amid dollar weakness and geopolitical risks. In contrast, Bitcoin aligns more as an asset that reacts strongly when investors feel confident and take on risk.

Nonetheless, many analysts still believe that a gold rally will be followed by a Bitcoin one. Ted Pillows, an investor and analyst, forecasted that Bitcoin tends to follow gold’s rallies and could reach $150,000 by the end of Q4.

However, he cautioned that a 10%–15% correction may occur first, which would flush out overleveraged long positions before the next leg higher.

Furthermore, some analysts highlight longer time frames, noting that Bitcoin may mirror gold’s moves with a lag of 100 to 200 days.

“With the Fed cutting rates, the dollar weakening, and Q4 (Bitcoin’s most bullish quarter) around the corner, the stage is set. The gap won’t last forever. Bitcoin is next,” another market watcher added.

Bitcoin parabolic rally starts after GoldSoon money will flow from gold to BTCjust like 2017 and 2021 bull run.

— Ash Crypto September 28, 2025

Gold vs. Bitcoin: Which Is the Better Asset to Hold?

Whether BTC will trace gold’s footsteps or diverge entirely remains to be seen. Yet with optimism running high around both assets, the real question is: which one provides greater value?

In a post on X, a market watcher illustrated the difference between saving in Bitcoin and gold over the past few years. According to him, Bitcoin stands out as a more effective long-term vehicle for savings.

“It’s officially been 300 weeks since 2020 began. Saving $50/week in bitcoin during that time would’ve turned $15,000 into 0.58 BTC, now worth over $63,000. Saving in gold instead would’ve yielded 7.45 oz of gold, worth just over $28,000,” the post read.

Contrastingly, Bob Elliott, CIO of Unlimited, argued that gold has been the steadier option. Over the past four years, returns between the two assets have been broadly similar, but gold’s ride has been far smoother.

He noted that gold’s volatility and drawdowns are only about a quarter of Bitcoin’s, and its correlation with stocks stands near 14%, compared to Bitcoin’s much higher ~60%.

“Over the last 5 years, Bitcoin has not outperformed gold and is where it’s at relatively in 2021. In the meantime, gold has had a 15% historical volatility, whereas Bitcoin at 55%. So with gold you could have had a similar return with a fraction of the volatility,” another analyst highlighted.

Yet, he emphasized that owning both gold and Bitcoin makes sense because each asset brings different advantages. Gold delivers steady returns with far lower volatility.

Moreover, Bitcoin offers much higher upside thanks to its volatility. In the analyst’s view, this balance makes them a powerful pair when held side by side.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: Clearer Regulations Propel XRP ETFs to $628M as the Asset Earns Greater Legitimacy

- Canary Capital's XRPC ETF dominates XRP ETF market with $250M inflows, outpacing all competitors combined. - Grayscale's GXRP and Franklin Templeton's XRPZ drove $164M debut inflows, boosting total XRP ETF AUM to $628M. - 2025 SEC ruling cleared XRP's secondary sales as non-securities, enabling institutional adoption and $2.19 price rebound. - XRPC's 0.2% fee waiver and institutional focus fueled $6B+ ETF trading volumes, reversing prior outflows. - Analysts project $6.7B XRP ETF growth within 12 months

Bitcoin Updates: Anxiety Sweeps Crypto Market, Yet ETFs Ignite Optimism for Recovery

- Crypto Fear & Greed Index hits 20, signaling extreme fear as BTC/altcoins face renewed volatility amid Tether's "weak" stablecoin downgrade. - Tether CEO defends USDt stability with $215B Q3 assets, while Bitcoin-focused firms adopt defensive stances against mNAV risks. - Altcoin Season Index at 25/100 shows modest rebound, with Zcash surging 1,000% and Grayscale filing first U.S. Zcash ETF. - Upcoming spot altcoin ETF launches and potential Fed rate cuts (80% priced) spark optimism despite fragile on-ch

The Impact of Artificial Intelligence on Transforming Business Efficiency and Entrepreneurial Expansion

- AI-driven tools are becoming essential for SMEs and startups to enhance productivity and operational efficiency amid competitive pressures. - McKinsey reports 71% of organizations now use generative AI in 2025, but SMEs lag behind large enterprises in scaling AI adoption. - AI adoption delivers measurable ROI, with case studies showing 15-140% productivity gains in sectors like legal, sales, and customer service. - Investors are prioritizing AI-enhanced SaaS platforms that address SME pain points, enabli

The Federal Reserve's Policy Change and Its Effects on Solana (SOL): How Infrastructure Funding and Clearer Regulations Are Speeding Up Blockchain Adoption in 2025

- Fed's 2025 policy clarity and liquidity injections accelerated Solana's institutional adoption in blockchain finance. - Regulatory frameworks like OCC Letter 1186 and GENIUS Act enabled banks to engage with Solana's stablecoin and DeFi infrastructure. - Solana's Alpenglow upgrades (100ms finality) and $508M funding fueled partnerships with Visa , Western Union , and Coinbase . - $2B ETF inflows and $1T DEX volume highlight Solana's role in reshaping cross-border payments and DeFi ecosystems.