KyberSwap Taps Lithos to Fortify Liquidity Infrastructure

KyberSwap, a multi-chain DEX aggregator as well as liquidity provider, has partnered with Lithos, a Plasma-based decentralized exchange. The partnership aims to integrate the liquidity provided by Lithos into KyberSwap, letting consumers leverage unparalleled trading marked by the best rates within the Plamsa network. As per Kyber Network’s official social media announcement, the move aligns with its objective of broadening liquidity infrastructure in the decentralized market. Hence, the consumer can anticipate a boost in the ecosystem activity along with improved capital efficiency and a relatively efficient DeFi experience.

KyberSwap 🤝 Lithos@lithos_to is the native ve(3,3) DEX launching on Plasma, designed to be the chain’s liquidity hub.

— Kyber Network (@KyberNetwork) October 10, 2025

KyberSwap will seamlessly integrate Lithos’s liquidity to deliver the best rates on Plasma. pic.twitter.com/VA3lkVyoJG

KyberSwap and Lithos Partnership Boosts Liquidity via Plasma

The partnership between KyberSwap and Lithos takes into account the enhancement of liquidity access and efficient trading availability on Plasma network. Particularly, KyberSwap will integrate Lithos’ liquidity. This will include the establishment of liquidity pools while also guaranteeing that consumers carrying out trades via Plasma enjoy the most competitive costs possible. Thus, with the merger of the strengths of both the companies, the partnership minimizes slippage and enhances decentralized trading efficiency for institutional and retail participants.

Leading toward Wider DeFi Expansion with Robust Cross-Chain Liquidity

According to Kyber Network, KyberSwap’ collaboration with Lithos underscores its wider strategy of broadening its footprint across diverse blockchain networks. Now, while Lithos is working as the liquidity hub for Plasma, the development elevates KyberSwap’s position in evolving DeFi ecosystem. This is anticipated to attract more consumers, DeFi projects, and liquidity providers seeking reliable solutions for liquidity aggregation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How Crypto Casinos Are Powering New Zealand’s Digital Gambling Revolution

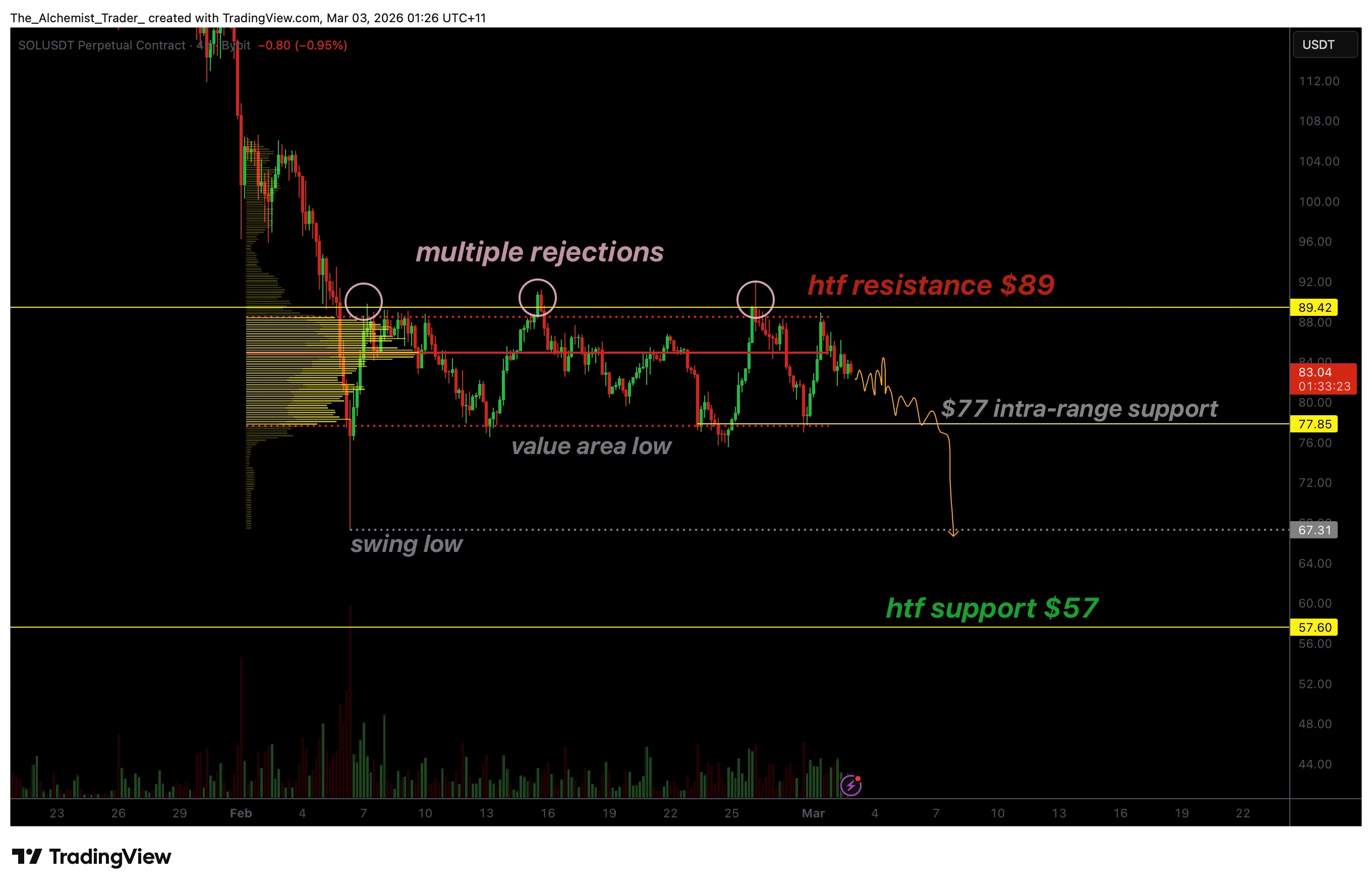

Solana price risks fall to $57 amid ongoing bearish rejections

Alibaba Unifies AI Brand, Goes All-In On 'Qwen'

3 Lesser-Known Stocks We Have Doubts About