Key Notes

- CoinGlass liquidation heatmap shows that $19.35 billion was liquidated from 1,666,361 traders.

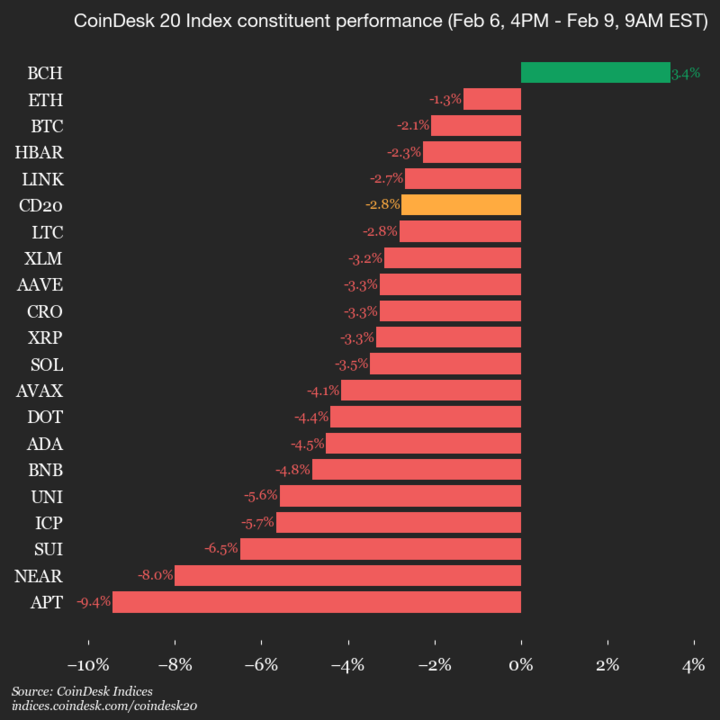

- Bitcoin, Ethereum, Solana, and XRP were impacted, as their prices have dipped.

- Bitcoin price slipped below $110,000, dragging most altcoins along.

Within the past 24 hours, the broader cryptocurrency market has seen 1,666,361 traders suffer liquidations. The total liquidations currently amount to $19.35 billion, according to data from Coinglass. This comes off as the largest liquidation that the digital asset sector has ever seen, coming right after an exciting market rebound.

Donald Trump Warns of 100% Tariffs on Chinese Imports

On October 11, the crypto market recorded liquidation of roughly $19.35 billion , with long traders suffering the major loss.

Top digital assets such as Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and even memecoins were impacted by the situation. Noteworthy, the largest single liquidation order was seen on Hyperliquid at a value of $203.36 million.

Coincidentally, the President of the United States, Donald Trump, had earlier hinted at 100% tariffs on Chinese imports.

His post on social media warning the public of the tariff met with mixed feelings and reactions, which moved from the Traditional Finance (TradFi) sector and extended to crypto. There are great concerns that the US and China may be entering a new season in the trade war that started earlier this year.

The subject of the US government shutdown is another contributor to this unfortunate market condition. So far, it has delayed the release of key economic data.

Bitcoin Price Slipped Below $110,000

The prices of most cryptocurrencies have declined significantly, starting with the flagship coin, Bitcoin.

This crypto fell below $110,000 in the wake of the downtrend before slightly recovering. According to CoinMarketCap data, BTC price is currently $111,845.05 with a 24-hour dip of 8.17%. This is a notable fall for a coin that hit a new All-time High (ATH) above $126,000, less than a week ago.

From a price level of over $4,800, Ethereum is now trading at $3,829.24, corresponding with an 11.93% dip in 24 hours. Also, Solana has seen a greater loss of 14.87%, pushing its price to $186.54. Binance Coin (BNB), which was the star of the season, has incurred a 10.54% loss within the same time to now trade at $1,125.58.

Given how the market began the week, it’s unsurprising that long traders are the most affected. They clearly believed that the positive momentum would continue, but ended up disappointed.