Pundit Claims XRP Had a 1,200x Multiplier During the Friday Crash

An XRP community commentator recently suggested that XRP had an unusually large market cap multiplier during the Friday crash, but the analysis had limitations.

For context, the crypto market faced one of its worst selloffs on Friday, October 10, when a massive liquidation wave wiped out more than $19 billion across the market. This marked the biggest single-day wipeout in crypto’s history.

XRP Slumps in the Market Crash

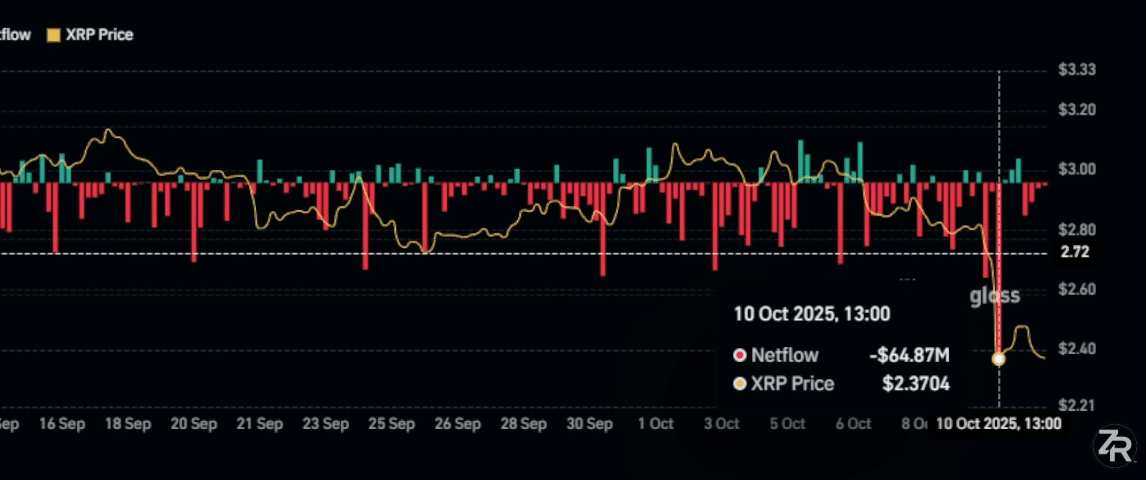

Notably, XRP took a hit, with about $700 million in total liquidations, including roughly $610.5 million from long positions. It plunged from $2.8 to $1.58 within hours, losing over 43% of its value before bouncing back to close the day at $2.37. Currently, XRP has climbed slightly to $2.55.

Rector Presents a 1,200x Multiplier

The market pundit claimed that during the most volatile hour of the crash, XRP recorded net outflows of around $55.79 million while its market cap plunged from $152 billion to $83 billion. This marked a $69.97 billion drop.

Based on this difference, he calculated a “multiplier” of about 1,254x. According to him, this was the largest multiplier he had seen since he began tracking market inflows and order book data in 2024.

Meanwhile, looking at a wider four-hour window, Rector found $64.87 million in total outflows and a decline in market cap from $162 billion to $82 billion, a $78.85 billion loss. This data produced a slightly smaller multiplier of 1,215x.

Minor Inflows Could Push XRP Price Northward

According to him, these huge ratios showed how a relatively small amount of money moving in or out of XRP could trigger massive swings in its market value. He argued that thin order books and limited liquidity made XRP’s market extremely sensitive. This allowed even minor sell pressure to cause outsized effects.

Rector concluded that XRP features a fragile market structure dominated by a few large players. He said the same multiplier effect could also drive major rallies once institutional money starts flowing in through upcoming XRP exchange-traded funds (ETFs).

He compared it to Bitcoin’s surge after ETF approval, predicting a similar scenario for XRP. The market pundit referenced projections from Canary Capital CEO Steven McClurg, who suggested that XRP ETFs could attract between $5 billion and $10 billion in inflows during the first month.

Using these predictions, Rector highlighted “conservative” multipliers of 100x to 200x and estimated that XRP’s market cap could grow by $500 billion to $1 trillion on top of its existing value.

Some Fundamental Limitations

While Rector’s analysis was interesting, it has some fundamental limitations. The data he used shows exchange flows, which refer to the movement of XRP tokens into and out of exchanges, not actual money entering or leaving the overall XRP market.

For context, exchange flow data only shows how traders move their holdings between wallets and exchanges, often as a reaction to price swings, rather than indicating true capital movement.

Specifically, a better way to assess real buying and selling pressure is through the Cumulative Volume Delta (CVD). This metric tracks the balance between buy and sell orders over time. Unlike exchange flow data, CVD shows how actual trading activity affects price changes.

Notably, the days after the October 10 crash highlighted this difference. XRP posted three straight days of gains between Oct. 11 and 13, even though exchange flow data remained mixed.

Exchanges recorded $6 million in outflows on Oct. 11, $21.44 million in inflows on Oct. 12, and $47.05 million in outflows on Oct. 13. Those figures didn’t match XRP’s steady recovery, showing that exchange flows alone don’t explain price movements or capital shifts.

However, Rector’s suggestion that even small capital netflows could lead to a massive increase or decrease in XRP’s market cap was accurate. Nonetheless, what accurately measures these netflows is the CVD, not exchange netflows.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SOL Price Forecast: Solana Enters a New Phase with Network Enhancements and Market Fluctuations

- Solana's 2025 upgrades (Firedancer, Alpenglow) enable 1M TPS and 5,200x cheaper transactions, boosting institutional adoption. - TVL rebounded to $8.8B with 32.7% QoQ growth, supported by Bitwise ETF and 7% staking yields attracting institutional capital. - Fed's December 2025 rate cut and QT cessation create favorable macro conditions, historically correlating with crypto gains. - Technical indicators (RSI 42.5, bullish MACD) suggest strategic entry above 200-day EMA ahead of December FOMC meeting. - In

Solana's Abrupt Price Swings and Institutional Reactions: Analyzing Core and Market Factors Behind the Decline and Reviewing Long-Term Value

- Solana (SOL) plummeted 14% in late 2025 due to weak on-chain metrics, 7.5% inflation, and waning memecoin demand. - Institutional investors maintained 1% SOL treasury holdings and $101.7M ETF inflows despite macro risks and $19B crypto liquidations. - Alpenglow/Firedancer upgrades (1M+ TPS, 150ms finality) and 50-80% lower validator costs aim to strengthen Solana's infrastructure resilience. - Regulatory uncertainties (SEC ETF reviews, MiCA) and delayed $2.9B inflation reduction plan (2029) persist as sy

The Impact of Institutional Funding on Education and Workforce Training in Renewable Energy

- Institutional investors are boosting renewable energy education and workforce programs to drive long-term economic resilience and sustainability. - Global investments hit $386B in H1 2025, with education initiatives bridging skill gaps and enabling equitable clean energy transitions. - Case studies like Morocco’s 38% renewable electricity and Portugal’s green skills programs highlight education’s role in job creation and sector growth. - Education and green finance synergies in RCEP and U.S. $265B 2024 i

The Growing Influence of Artificial Intelligence on Universities and Preparing Tomorrow’s Workforce

- AI integration in higher education drives academic program expansion, with 2.5% undergraduate and 3% graduate enrollment growth in 2024. - Universities invest $33.9B in generative AI to modernize curricula and partner with industries , addressing 58% workforce readiness gaps. - AI-driven tools boost student retention (52% adoption) and project 1.5% U.S. GDP growth by 2035 through automation in key sectors. - Challenges persist: 71% academic integrity concerns and 52% training gaps highlight risks in AI a