Ethereum Leads as Solana’s Developer Growth Challenges the Blockchain Hierarchy

A recent analysis of blockchain developer activity has revealed a strong influx of new talent across major ecosystems, with Ethereum maintaining its dominance. The report, based on data from Electric Capital, highlights shifting developer trends and growing debates over how blockchain contributions are tracked.

In brief

- Ethereum tops all blockchains with 31,869 active developers, maintaining dominance despite slower growth.

- Solana attracts over 17,000 developers, showing rapid expansion and challenging Ethereum’s long-held lead.

- Bitcoin ranks third with 11,036 developers, reflecting steady but slower ecosystem engagement.

- Debate rises over developer counts as experts question data accuracy and inclusion of automated projects.

Ethereum Retains Largest Developer Base, Followed by Solana and Bitcoin

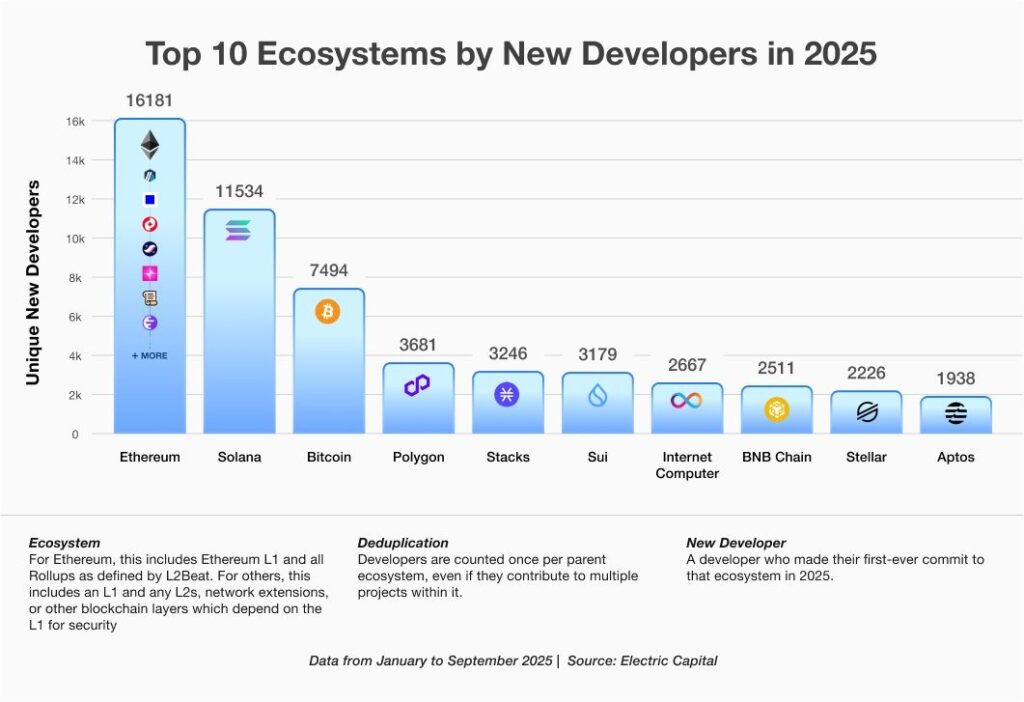

Between January and September, more than 16,000 new developers began contributing to the Ethereum ecosystem , according to data from the Ethereum Foundation. Solana followed with over 11,500 new developers, though a representative from the Solana Foundation suggested the data may be outdated. Bitcoin ranked third, attracting nearly 7,500 new developers in the same period.

A closer look at the data shows that:

- Ethereum leads with 31,869 active developers , making it the largest developer base across all blockchain ecosystems.

- Solana ranks second with 17,708 developers, showing continued strong developer interest.

- Bitcoin holds third place with 11,036 active developers contributing to its ecosystem.

- The Ethereum figure includes contributors to both layer-1 and layer-2 networks, such as Arbitrum, Optimism, and Unichain, without double-counting developers active across multiple projects.

It is worth noting that developers active across multiple Ethereum-based projects were not double-counted.

Ethereum Growth Slows as Solana Gains Momentum

Although Ethereum leads in total developer numbers, its growth has been modest—rising 5.8% over the past year and 6.3% over the past two years. By contrast, Solana has shown stronger momentum. Electric Capital’s tracker reports a 29.1% increase in full-time developers over the past year and a 61.7% rise over the past two years.

Despite these figures, Jacob Creech, Solana Foundation’s head of developer relations, claims that the data undercounts Solana developers by around 7,800. He urged developers to register their GitHub repositories to help improve Solana’s internal tracking.

Several community members have questioned how Electric Capital grouped developer data. Some chains operating on the Ethereum Virtual Machine (EVM) were merged, while others were excluded.

Tomasz K. Stańczak, founder of Nethermind, argued that EVM-based networks such as Polygon and BNB Chain should be considered together since they share compatible tooling and developer skill sets.

Skepticism Grows Over Reported Developer Numbers

Some industry observers remain skeptical of the reported developer numbers. Jarrod Watts, head of Australia for the layer-2 project Abstract, said the figures may be inflated by repositories generated by automated coding tools and temporary hackathon projects.

Watts suggested that short-term or low-quality code—such as hackathon projects and inactive repositories—may inflate the developer figures. He added that genuine new developer participation appears limited this year.

A social media user known as memevsculture noted a gap between the reported number of developers and the visible number of active decentralized applications , suggesting that developer counts may not fully reflect meaningful activity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana’s Latest Price Fluctuations and Institutional Involvement: Insights for Long-Term Investors

- Solana (SOL) faced 2025 price swings from $155 to $294, driven by macroeconomic pressures, on-chain weakness, and institutional adoption dynamics. - Institutional ETFs like Bitwise's BSOL attracted $2B AUM by mid-2025, with major holders staking SOL to deepen ecosystem integration despite short-term volatility. - Risks include network centralization, competition from Ethereum 2.0, and reliability concerns after the 2024 cluster outage amid Fed rate uncertainty. - Ecosystem resilience with 500+ dApps and

Timeless Strategies for Investing Amid Market Volatility

- In 2025, R.W. McNeel's 1927 value investing principles and Warren Buffett's strategies remain critical amid market volatility driven by tech disruption and geopolitical risks. - Both emphasize intrinsic value, emotional discipline, and long-term thinking to counter crypto and stock market swings fueled by speculation and social media hype. - Buffett's $340B cash reserves and focus on undervalued sectors like healthcare contrast with crypto's intangible promises, reinforcing tangible asset preferences. -

Saylor Strikes Again: Strategy Makes Its Biggest BTC Buy Since July

Bitcoin Experiences Sharp Decline: Underlying Reasons and Potential Impact for 2026

- Bitcoin fell 32% below $90,000 in 2025, raising bear market fears driven by Fed policy shifts, regulatory uncertainty, and institutional exits. - Fed's 0.25% rate cut and delayed inflation data created volatility, while the GENIUS Act's reserve rules may reduce Bitcoin's appeal unless rates drop further. - SEC's Project Crypto and Senate bills increased regulatory clarity risks, while $3.79B ETF outflows triggered self-reinforcing price declines. - 2026 outcomes depend on Fed clarity, regulatory resoluti