Key Market Information Discrepancy on October 31st, a Must-See! | Alpha Morning Report

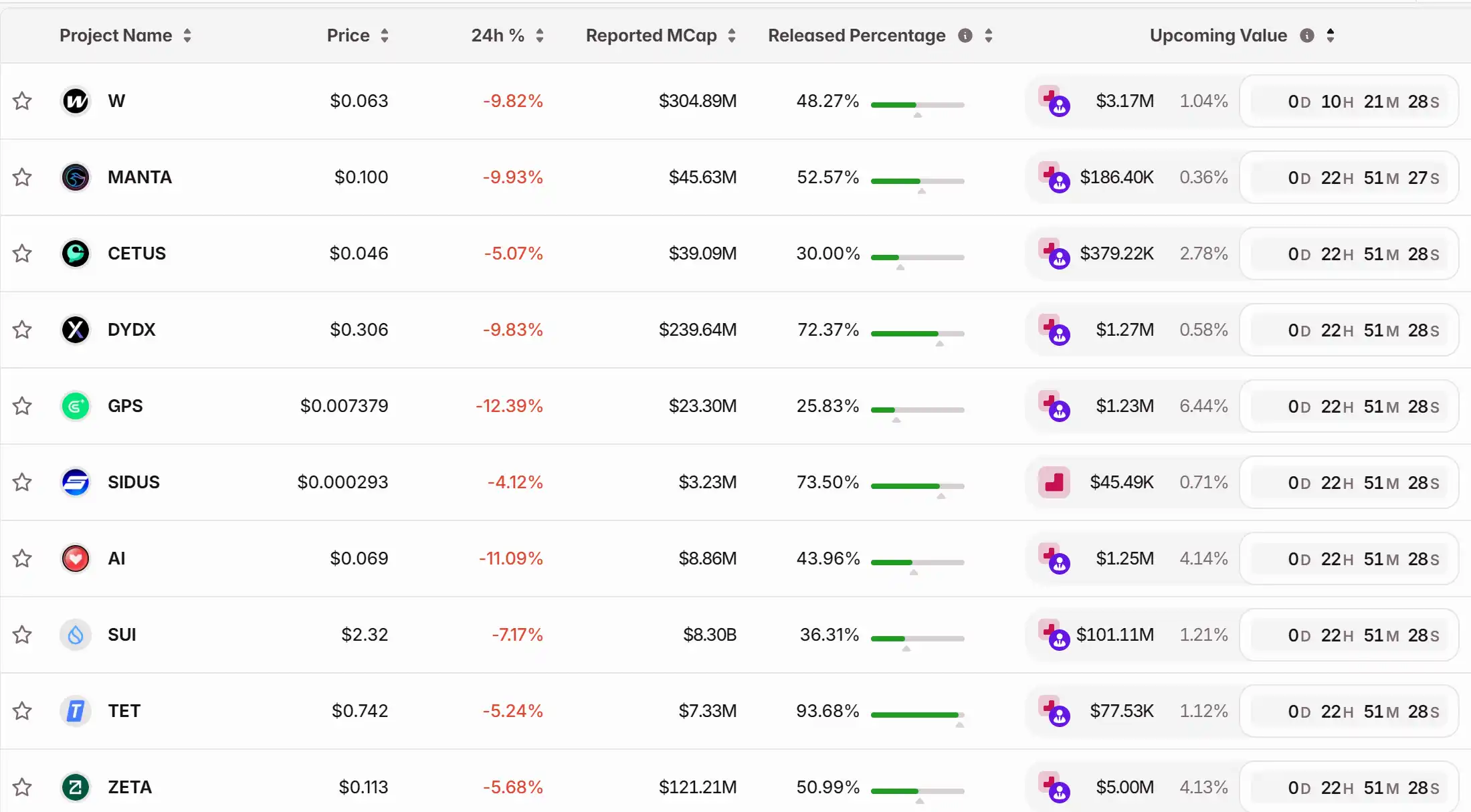

1. Top News: Ethereum's next major upgrade "Fusaka" is scheduled to go live on December 3rd 2. Token Unlock Schedule: $W, $MANTA, $CETUS, $DYDX, $GPS, $SIDUS, $AI, $SUI, $TET, $ZETA

Top News

1.Ethereum's Next Major Upgrade 'Fusaka' Scheduled to Go Live on December 3

2.Bitcoin Surges Past $110,000

5.$1.134 Billion Liquidated Across the Network in the Last 24 Hours, Mainly Long Positions

Articles & Threads

1. "Making Money While Giving Away Money: Recent Developments in Top Perp DEXs"

According to the latest on-chain data, the market landscape of decentralized perpetual contract exchanges (Perp DEXs) has become relatively clear. In terms of 24-hour trading volume, Aster leads with $121.2 billion, followed by Lighter at $86.16 billion in second place, Hyperliquid at $59.58 billion in third, with edgeX and ApeX Protocol ranking fourth and fifth with $50.6 billion and $21.22 billion, respectively. For investors and traders looking to delve deeper into the Perp DEX track, monitoring the developments of these top five platforms should provide a good sense of the overall direction of the industry.

2. "A Mysterious Team That Dominated Solana for Three Months Is Going to Launch a Coin on Jupiter?"

An anonymous team without a website or community that consumed nearly half of the transaction volume on Jupiter in 90 days. To better understand this mysterious project, we need to first delve into an on-chain transaction revolution quietly happening on Solana.

Market Data

Daily Marketwide Funding Rate (as reflected by funding rates) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TrustLinq Converts Cryptocurrency into Spendable Cash for Daily Life

- TrustLinq, a Swiss-regulated firm, launched a crypto-to-fiat platform enabling global payments in 70+ currencies without traditional banking infrastructure. - The platform addresses crypto adoption gaps by converting digital assets to fiat for rent, payroll, and international transfers, bypassing recipient crypto requirements. - Operating under Swiss AML regulations with non-custodial security, it targets individuals and businesses seeking crypto integration for practical financial operations. - Debit ca

Solana News Update: Pump.fun Transfers $436M—Strategic Treasury Move or Exit Strategy?

- Pump.fun denied allegations of cashing out $436.5M USDC , calling transfers routine treasury management amid a $19B crypto market crash. - Critics question timing as revenue dropped 53% to $27. 3M , with funds traced to June's institutional PUMP token sale at $0.004 each. - The team defended moves as reinvestment for ecosystem expansion, citing acquisitions and 12% PUMP buybacks since October. - Social media silence and a 72% PUMP price drop fueled exit speculation, despite $855M stablecoin liquidity rep

Ethereum Updates Today: BlackRock's Bold Move with Staked ETH ETF—Will It Influence Ethereum's Future?

- Ethereum faces bearish technical signals, with price below key averages and a rising wedge pattern suggesting further declines toward $2,050 if support breaks. - BlackRock's proposed staked ETH ETF aims to offer 3% annualized yields with low fees, potentially disrupting DATs by combining institutional custody and transparent staking structures. - Market dynamics show $1.9B in ETF outflows and whale activity shifting ETH to cold storage, while macro factors like sticky U.S. yields weigh on risk assets. -

China: Electricity Too Cheap Revives the Bitcoin Mining Industry