Standard Chartered Says Bitcoin Must Hold the Line for DeFi to Beat TradFi | US Crypto News

Standard Chartered’s Geoff Kendrick warned that Bitcoin’s stability now underpins the future of decentralized finance. Ahead of the Singapore FinTech Festival, he called BTC the “apex asset” of DeFi and outlined a three-step accumulation plan—arguing that sub-$100,000 levels could mark Bitcoin’s final major buying opportunity.

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee! Standard Chartered’s latest market note is not just about price targets. Geoff Kendrick, the bank’s Head of FX and Digital Assets Research, says Bitcoin now carries the weight of DeFi’s future. If it collapses, so could the dream of decentralized finance.

Crypto News of the Day: Standard Chartered Says Bitcoin Carries the Weight of DeFi’s Future

Standard Chartered’s Head of FX and Digital Assets Research, Geoff Kendrick, has warned that DeFi’s future hinges on one crucial condition: that Bitcoin remains structurally sound.

Speaking ahead of the Singapore FinTech Festival (SFF), Kendrick described Bitcoin as the “apex asset” underpinning DeFi’s growth. He also noted that any major collapse would undermine the broader digital finance movement.

“It is fair to say these days I spend most of my time talking about DeFi taking over TradFi…but for that to be possible, as the apex asset, Bitcoin needs to not collapse,” Kendrick wrote in an email.

His comments come as institutions, regulators, and innovators plan to converge in Singapore next week to discuss blockchain infrastructure and the future of open finance.

For Standard Chartered, one of the few major banks to actively publish digital asset research, Kendrick’s framing represents a shift from speculative to systemic thinking about Bitcoin’s role in the global economy.

While many analysts focus on price targets, Kendrick’s recent commentary emphasizes Bitcoin’s stability as a foundation for DeFi’s legitimacy.

“DeFi can’t replace traditional finance if its cornerstone asset is volatile or unreliable,” one market observer said in response to Kendrick’s remarks.

Against this backdrop, Kendrick laid out a structured three-step accumulation plan for Bitcoin investors, suggesting that the recent dip below $100,000 “may be the last one ever.” His proposed strategy includes:

- Buying 25% of a target allocation at current levels,

- Another 25% if Bitcoin closes above $103,000, and

- The remainder (50%) once the Bitcoin–gold ratio climbs above 30.

It aligns with remarks from a previous note to clients, where Kendrick stated that Bitcoin’s sub-$100,000 moves could be its last. As indicated in a US Crypto News publication, the bank’s executive noted that it would also mark the final entry point before a renewed bull phase.

Charts of the Day

50-week MA matters = Friday “close” of 103k above/below matters. Source: Kendrick

50-week MA matters = Friday “close” of 103k above/below matters. Source: Kendrick

Bitcoin-gold ratio matters = I would like it above 30. Source: Kendrick

Bitcoin-gold ratio matters = I would like it above 30. Source: Kendrick

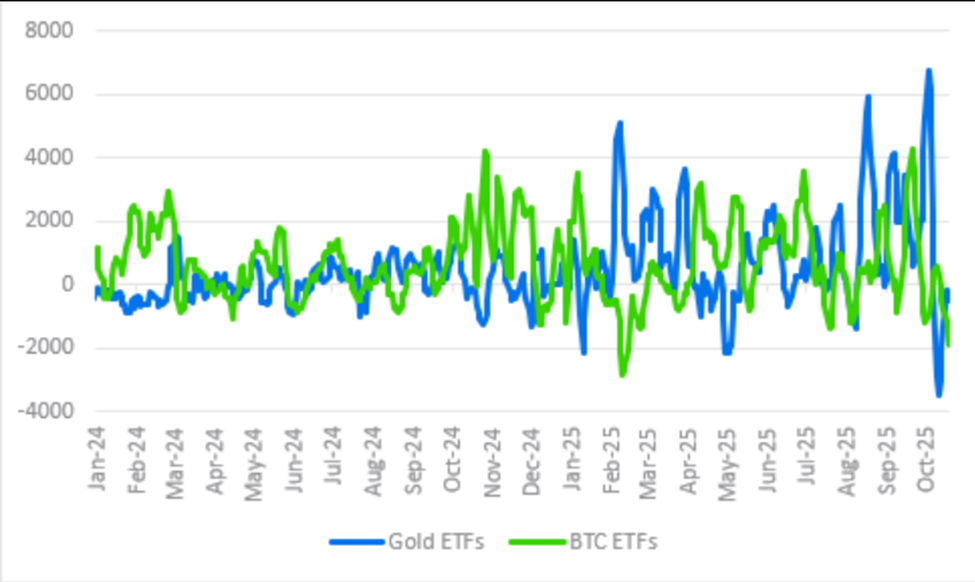

5-day MA of ETF inflows (USDmn) = outflows from both now. Source: Kendrick

5-day MA of ETF inflows (USDmn) = outflows from both now. Source: Kendrick

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Ethereum whales buy $1.37 billion in ETH amid 12% November price drop.

- Bitwise CIO Matt Hougan: “Good DATs do hard things — bad DATs Get Punished.”

- Circle bows to Second Amendment pressure in latest USDC policy update.

- Robinhood Q3 crypto revenue surges to $268 million. Will they launch a token?

- Metaplanet defies Bitcoin bear: Leveraging for long-term treasury.

- Chainlink secures major deal with SBI Digital Markets amid LINK supply drop.

- Zcash price breakout extends with volume support — No sign of exhaustion yet.

- Why Internet Computer’s (ICP) 100% rally might just be getting started.

Crypto Equities Pre-Market Overview

| Company | At the Close of November 5 | Pre-Market Overview |

| Strategy (MSTR) | $255.00 | $252.70 (-0.90%) |

| Coinbase (COIN) | $319.30 | $318.90 (-0.13%) |

| Galaxy Digital Holdings (GLXY) | $31.44 | $32.17 (+2.32%) |

| MARA Holdings (MARA) | $17.33 | $17.09 (-0.23%) |

| Riot Platforms (RIOT) | $18.97 | $19.03 (+0.32%) |

| Core Scientific (CORZ) | $21.80 | $21.96 (+0.73%) |

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Today: Ethereum’s Fusaka Update: Scaling Goals Face Challenges From Validator Compromises

- Ethereum's Fusaka upgrade (Dec 3, 2025) introduces PeerDAS to enhance scalability by verifying rollup data without full dataset downloads. - BPO forks enable incremental blob capacity increases (e.g., 14 blobs/block by Jan 7, 2026), avoiding disruptive hard forks while supporting 100k+ TPS via L2 solutions. - L2 data fees may drop 40%-60% with PeerDAS, but validators face trade-offs between reduced storage demands and increased upload requirements as blob capacity grows. - Market reactions remain mixed:

Bitcoin Updates: Challenges in Blockchain Infrastructure Drive Growth of Mixed Sustainability Approaches

- Blockchain networks show mixed fee revenue, with only 11 surpassing $100K weekly thresholds, highlighting structural inefficiencies and speculative challenges. - Lumint's hybrid staking model combines AI-driven tools with decentralized rewards to address PoW/PoS flaws, aiming for sustainability and reduced energy waste. - Bitcoin rebounded to $87,000 amid 2% market growth, but extreme fear persists (index at 20), with $380M in liquidations and mixed retail sentiment. - Hybrid solutions like Lumint priori

DASH drops 4.37% within 24 hours following Australian wage agreement

- DoorDash's stock fell 4.37% in 24 hours amid a 25% wage hike agreement for Australian delivery workers, including mandatory accident insurance. - The deal raises near-term cost concerns as operating margins stand at 5.5%, but reflects improved labor standards and regional commitment. - Institutional ownership rose to 90.64% with major investors increasing stakes, signaling long-term confidence despite recent volatility. - Analysts maintain a "Moderate Buy" rating ($275.62 target) as DoorDash shows strong

Ethereum Updates Today: Privacy First: Buterin Backs Messaging’s Fundamental Transformation

- Vitalik Buterin donates 128 ETH ($390K) to Session and SimpleX to advance metadata privacy and permissionless design. - Platforms use decentralized infrastructure and cryptographic IDs to protect communication metadata, resisting censorship and AI surveillance risks. - Donation counters regulatory threats like EU's Chat Control while promoting privacy-focused innovation in encrypted communication. - Experts emphasize permissionless account creation as critical for digital freedom, despite trade-offs like