New SEC Filing Shows Trump Media’s Total Bitcoin Holdings

TMTG's accumulation mirrors a broader surge in crypto assets across Trump-linked ventures, including multibillion-dollar positions held by World Liberty Financial and other affiliated projects.

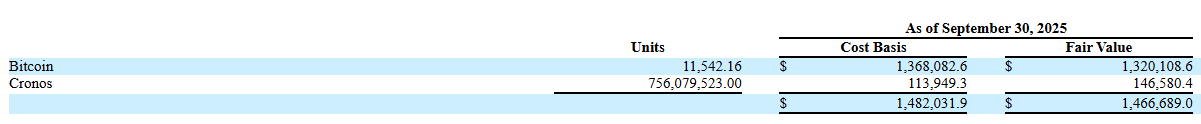

Trump Media and Technology Group (TMTG), the media company associated with US President Donald Trump, now holds more than 11,500 Bitcoin, valued at over $1.3 billion.

The disclosure marks the company’s largest confirmed allocation to date and places it among the biggest public-sector corporate holders of Bitcoin.

TMTG Bitcoin Holdings Fail to Yield Gains

TMTG accelerated its pivot earlier this year when it formally adopted Bitcoin as a core reserve asset.

At the time, TMTG said the company turned to BTC to protect itself from what he described as harassment and discriminatory treatment by financial institutions.

That argument tied Trump Media’s strategy to a wider corporate trend in which firms use Bitcoin to limit perceived dependence on banks that can freeze, slow, or scrutinize accounts.

Trump Media’s Bitcoin Holdings. Source:

SEC

Trump Media’s Bitcoin Holdings. Source:

SEC

Meanwhile, the company’s holdings extend beyond Bitcoin. TMTG reported owning roughly 756 million Cronos (CRO) tokens, worth approximately $110 million.

The position reflects the company’s growing alignment with Crypto.com, a relationship that has already produced several crypto-focused initiatives, including exchange-traded products and promotional tie-ins.

These initiatives helped position TMTG as a more active participant in the crypto economy, even though they have not reversed the firm’s financial challenges.

TMTG posted a $54.8 million net loss in the third quarter of 2025, extending its stretch of multi-million-dollar quarterly losses.

This suggests that the company’s crypto-heavy strategy has therefore served more as a political and operational statement than a source of near-term financial relief.

Trump’s Family Crypto Holdings Surge

As TMTG increased its exposure, other Trump-connected ventures expanded theirs as well, creating a broader cluster of politically adjacent crypto holdings.

Data from Arkham Intelligence indicates that several affiliated entities now hold substantial balances.

Other notable Trump Family entities:Donald Trump: holds $861K in cryptoWorld Liberty Fi: holds $5.76B in cryptoOfficial Trump Meme: holds $6.30B in cryptoOfficial Melania Meme: holds $19.65M in cryptoTrump Cards: holds $29.72K in crypto

— Arkham (@arkham) November 8, 2025

Trump personally holds about $861,000 worth of digital assets, while World Liberty Financial, one of the largest Trump-associated projects, controls more than $5.7 billion in crypto.

Additional holdings include $6.3 billion tied to Official Trump Meme, $19.65 million linked to Official Melania Meme, and nearly $30,000 associated with the Trump Cards collection.

These positions grew as the White House intensified its pro-crypto messaging, which shaped both the political environment and the commercial incentives for Trump-aligned ventures to deepen their involvement.

Taken together, the holdings show a coordinated embrace of digital assets across Trump-linked entities. They also reflect the administration’s broader effort to position crypto as both a strategic asset and a policy priority.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tom Lee says ISM strength could set the stage for a new Bitcoin and Ethereum supercycle

Vitalik Buterin's Latest ZK-Focused Statement and What It Means for Blockchain Infrastructure

- Vitalik Buterin advocates integrating ZK proofs with MPC, FHE, and TEE to enhance blockchain privacy and scalability. - GKR protocol reduces ZK verification costs 15-fold, enabling 43,000 TPS on platforms like ZKsync. - Ethereum's "Lean Ethereum" roadmap prioritizes ZK-EVMs and gas optimizations to compete with ZK-native layer 2s. - ZK ecosystem secures $28B TVL in 2025, with institutional adoption and $725M+ VC funding driving growth. - ZKP market projected to grow 22.1% CAGR to $7.59B by 2033, but face

Bitcoin ETFs See $224M Inflows, Led by BlackRock

U.S. spot Bitcoin ETFs gained $224M on Dec 10, with BlackRock's IBIT leading at $193M. Ethereum, Solana, and XRP ETFs also saw gains.Ethereum and Altcoin ETFs Also Gaining MomentumWhat This Means for Crypto Investors

State Street & Galaxy Launch Tokenized Liquidity Fund

State Street and Galaxy Digital unveil a tokenized private liquidity fund using PYUSD, launching on Solana in 2026.How SWEEP Works with PYUSDSolana Chosen as First Chain for Launch