Monad Faces Community Backlash After Unveiling Tokenomics

Layer 1 blockchain Monad has revealed plans for a public offering of its native token on Coinbase’s new token sale platform, with 7.5% of the total MON supply offered at a $2.5 billion valuation, implying a $187 million raise if fully subscribed.

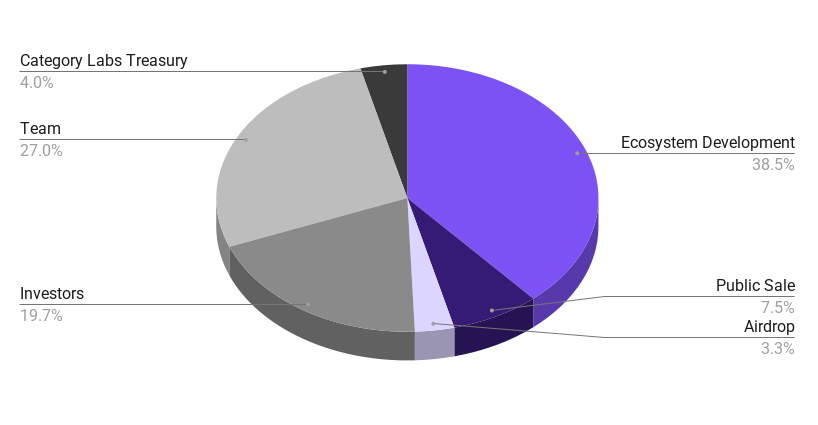

Alongside the announcement, Monad also unveiled its tokenomics, which have left users and community members fuming. Just 3.3% of the total MON supply will be airdropped, with another 7.5% distributed during the public offering, meaning only 10.8% of the total supply will be available to the average retail user.

Meanwhile, investor, team, and treasury allocations account for more than 50% of the total supply.

While the MON pre-market on Hyperliquid trades at a $6 billion valuation, community members are calling out Monad after the upcoming Layer 1 spent years preaching about how its community would be rewarded during the token generation event (TGE), only to disappoint.

Auri, a longstanding member of the Monad community with one of the exclusive “Mon” roles in the Discord, expressed frustration on X, saying, “I gotta say though this is not 'community first' tokenomics. For the first time with Monad, I feel the familiar sour taste of betrayal.”

Investors are voicing concerns as well. One user known as Monkey Rothschild, who invested on behalf of the Wassiverse NFT collection at a $600 million valuation, took to X to unleash a slew of tweets criticizing investors’ vesting compared to the public offering’s 100% unlocks, and the tiny airdrop allocation.

Rothschild said in one post, “3 years, 3%. Not sure how else to spin it, but that's just dirty work lmfao,” alluding to the fact that many users had been active in the Monad Discord for more than 3 years to receive only a 3.3% airdrop allocation.

It is also worth noting that the airdrop distribution is not exclusive to the Monad community but is shared with general EVM users, whether or not they have ever interacted with Monad.

Despite the broad pushback from community members and onlookers, some market participants welcomed today’s announcements.

“Coinbase offering + full tokenomics have made me more bullish monad tbh,” investor Cryptopathic posted today. He continued in the comments thread, insinuating that the MON token’s low circulating supply and its status as the first-ever Coinbase token offering bode well for its price action.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Blockchain Essentials for the Rave Ecosystem Enable Community Leadership and Charitable Initiatives

- RaveDAO launched Genesis Membership NFTs on Base and BNB Chain, offering four tiers with escalating event access and governance rights. - The $RAVE token economy allocates 30% to community incentives, 31% to ecosystem development, and includes deflationary buyback mechanisms. - Black-tier members ($499) gain backstage access and 7x reward multipliers, emphasizing token-driven tiered participation. - RaveDAO plans 50+ decentralized chapters by 2027 and channels event profits to philanthropy, distinguishin

Trust Wallet Token (TWT) Price Forecast: Could 2026 Mark a DeFi Surge?

- Trust Wallet Token (TWT) surged to $1.6 in 2025, driven by strategic partnerships and expanded utility via Trust Premium and FlexGas features. - Institutional adoption grew through RWA tokenization (e.g., U.S. Treasuries) and Binance CZ's endorsement, boosting TWT's transactional and governance roles. - Analysts project TWT could reach $3 by 2025 and $15 by 2030, but regulatory risks and DeFi competition pose challenges to its 1-billion-user vision. - With 17M active users and 35% wallet market share, TW

TWT's Updated Tokenomics Framework: Driving Sustainable Value and Expanding the DeFi Ecosystem

- Trust Wallet's 2025 TWT tokenomics shift prioritizes utility over governance, using Trust Premium's XP system to drive user engagement and retention. - Strategic integrations like FlexGas (transaction fee payments) and Ondo Finance's RWAs expand TWT's cross-chain utility, bridging DeFi and traditional finance. - TWT's loyalty-driven model reduces circulating supply through locking mechanisms, contrasting inflationary approaches while attracting institutional investors. - Binance's reduced collateral rati

Solana News Today: Solana Holds the Line at $150: Institutional Trust Remains as User Engagement Declines