Political Influence Challenges Fed's Autonomy Amid Bostic's Departure

- Fed President Raphael Bostic announced his retirement in 2025, leaving a key hawkish voice on inflation control in the FOMC. - His departure follows ethical scrutiny over 154 trades during blackout periods and Trump's push to reshape Fed leadership. - A Trump-aligned successor could shift monetary policy toward looser rates, impacting housing, tech, and import-dependent sectors. - Bostic's exit highlights political pressures on Fed independence as Trump campaigns to replace officials amid post-pandemic e

Federal Reserve President Raphael Bostic, known for his hawkish stance on the central bank’s policy committee, has announced he will retire on November 12, 2025, with his departure taking effect February 28, 2026. This announcement has sparked debate about the Fed’s policy outlook as political scrutiny intensifies, according to a

Bostic’s decision to step down follows years of scrutiny regarding his personal financial activities. In 2024, the Fed’s inspector general determined he breached internal guidelines by making 154 trades during blackout windows before policy meetings, raising concerns about potential use of privileged information, according to a

Throughout his time as Atlanta Fed president, Bostic was recognized for his firm approach to inflation. Addressing the Atlanta Economics Club, he stressed that inflation remains the “most pressing and evident threat,” outweighing unclear signals from the labor market, according to an

The process to name Bostic’s successor will be closely monitored, especially in light of Trump’s intentions to reshape the Fed’s Board of Governors and his role in the selection of regional bank leaders, as outlined in the

Fed Chair Jerome Powell commended Bostic’s work, describing his input as “a reliable perspective” that “deepened the FOMC’s insight into our evolving economy,” as referenced in the

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

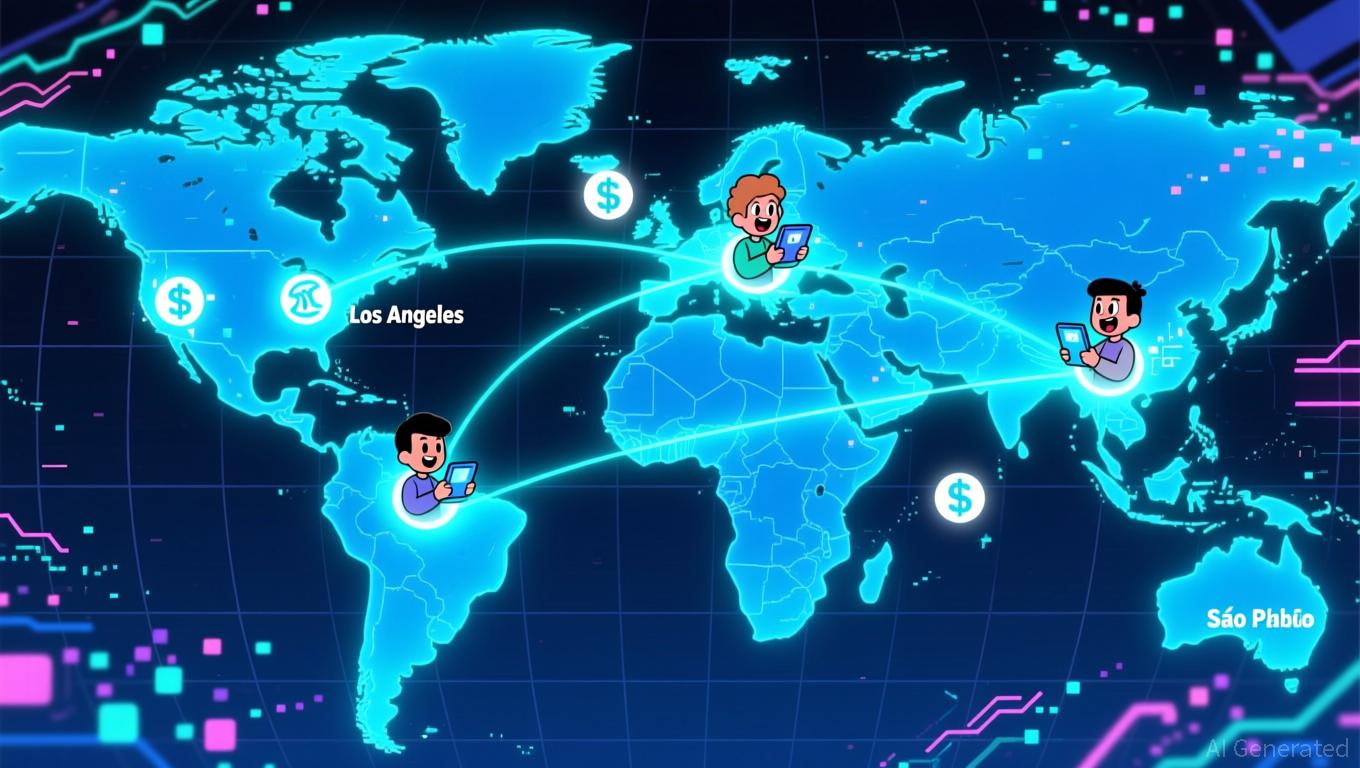

Visa Connects Conventional Finance and Blockchain with Real-Time Stablecoin Payments

- Visa launches stablecoin payout pilot, enabling instant cross-border transfers to crypto wallets via Visa Direct, targeting freelancers in emerging markets. - The program converts fiat to USD-backed stablecoins like USDC , addressing delays and volatility while leveraging blockchain for transparency and auditability. - Aligning with growing stablecoin adoption, Visa aims to bridge traditional finance and decentralized systems, competing with Mastercard's crypto initiatives and a $670B market potential. -

Regulatory ambiguities delay Ant Group’s $360 million acquisition in the fintech sector

- Ant Group delays $360M Bright Smart Securities acquisition deadline to 2025/11/25 due to regulatory uncertainties. - Hong Kong regulators approved the 50.1% stake deal, but mainland China's NDRC has not finalized its review. - Share prices fell 4% as Beijing's heightened fintech oversight echoes 2020 IPO collapse risks. - Acquisition aims to secure virtual asset trading license amid Asia's complex cross-border regulatory landscape. - Outcome could set precedent for fintech consolidation in Asia's blockch

Court finds OpenAI in breach of German copyright law and orders compensation