LUNA Value Remains Steady as Wearable Health Integration Broadens

- LUNA maintains stable price at $0.0774 despite 81.5% annual decline, driven by health-tech partnerships rather than crypto market shifts. - Expanded integration with Clue enables LUNA wearables to sync sleep/temperature data with 100M+ users for menstrual cycle tracking insights. - Strategic partnerships with leading wearables (Fitbit, Huawei) and exclusive discounts aim to boost adoption of cycle-aware health tracking devices. - 60%+ user demand for health wearables highlights growing market opportunity

On November 18, 2025, LUNA’s price remained steady at $0.0774 over a 24-hour period. However, the token has seen a 5.77% decrease in the past week, a 17.88% drop over the last month, and a significant 81.5% fall over the previous year. These numbers highlight a persistent long-term downward

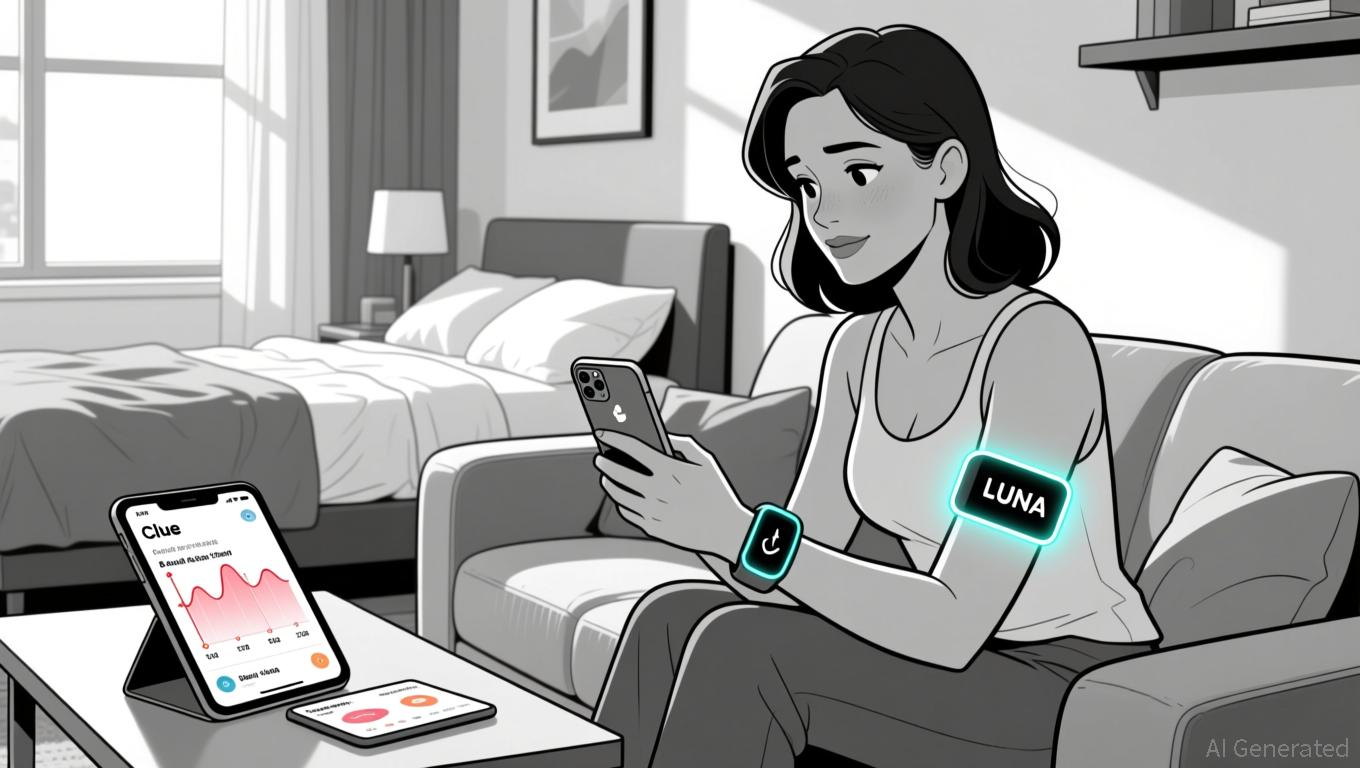

LUNA, known for its wearable health devices, has revealed new integrations with Clue, a top period and cycle tracking application used by more than 100 million people worldwide. This collaboration brings LUNA into a growing network of

This alliance is part of Clue’s larger initiative to broaden its ecosystem of wearable technology partners, which already features Withings, Ultrahuman, WHOOP, Huawei, Polar, Fitbit, and Noise. These partnerships enable ongoing passive collection of essential biometric information, followed by secure syncing and contextual analysis within Clue’s platform. Users are now able to track how their sleep, body temperature, and hormonal shifts interact, offering deeper insights into their overall health.

Clue Plus members benefit from exclusive perks through this integration, such as a 15% discount on all LUNA products and three complimentary months of Clue Plus for every LUNA user. These offers are designed to encourage the adoption of cycle-focused wearables, which are increasingly popular among those looking to gain deeper health insights.

This partnership marks a strategic effort by both Clue and LUNA to address the rising demand for wearable health tracking technology. According to a recent Clue survey of 1,382 participants, over 60% expressed interest in using wearables for health and fitness tracking, with nearly 40% specifically wanting to use them for monitoring menstrual cycles. These findings point to a significant market potential for companies like LUNA to integrate their health data with broader platforms such as Clue.

Rhiannon White, CEO of Clue, reiterated the company’s commitment to providing users with meaningful health insights, noting that expanding wearable partnerships is essential to this mission. By linking data from wearables with self-reported symptoms and cycle details, users gain a better understanding of their health in sync with their bodies’ natural patterns.

Although this announcement does not have an immediate impact on LUNA’s token price, it strengthens the company’s position in the wearable health tech industry. The integration with Clue also reflects a broader movement toward sharing health data across platforms, which could foster long-term user loyalty and engagement—factors that may influence investor confidence over time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

South Korea's Approach to Crypto Regulation Could Become a Model for Global Stability and Innovation

- South Korea's Digital Asset Basic Act (2025) establishes a unified regulatory framework for crypto assets, targeting stablecoins and cross-border transactions. - Stablecoin issuers face licensing, reserve requirements, and FSC oversight, while foreign VASPs must register and report transactions to combat forex crimes. - The reforms aim to balance innovation with financial stability, potentially attracting investment but increasing compliance costs for firms and scrutiny for investors. - As Asia's major c

Ethereum News Update: Ethereum Whale Makes $1.33B Leveraged Move—Sign of Confidence or Risky Overextension?

- Ethereum whale "66kETHBorrow" injected $1.33B into ETH via leveraged Aave borrowing, stabilizing prices near $3,500. - Whale's 385k ETH holdings and $270M Aave-funded purchases signal institutional confidence despite market volatility. - Analysts note leveraged accumulation often precedes recoveries, though risks include amplified losses if prices correct further. - Market remains divided as whale's strategy contrasts with $183M Ethereum ETF outflows and key support/resistance levels.

Algorand (ALGO) Falls 54.47% Over the Past Year as Company Developments and Market Challenges Persist

- Algorand (ALGO) fell 54.47% in one year due to macro pressures and lack of product milestones. - Biopharma firms Aligos and Allogene announced stock incentives/insider transactions unrelated to crypto. - Prolonged crypto bear market and weak adoption left ALGO vulnerable to sector-wide declines. - Investors await Algorand Foundation updates amid ongoing volatility and uncertain valuation metrics.

Lloyds Completes Curve Purchase Amid Shareholder Disputes Over Valuation

- Lloyds acquires Curve for £120M amid shareholder backlash over undervaluation and governance concerns. - IDC Ventures, Curve's largest investor, rejects the deal via legal action, disputing transparency and valuation. - Lloyds aims to integrate Curve's payment tech to compete with Apple/Google Pay amid EU regulatory shifts. - The acquisition reflects fintech consolidation as banks exploit lower valuations to fast-track digital infrastructure. - Legal challenges and governance disputes could delay the dea