Date: Wed, Nov 19, 2025 | 05:55 AM GMT

The broader crypto market is dealing with fresh downside volatility as Ethereum (ETH) slips back under $3,000 after touching a 24-hour high of $3,167. Even in this shaky environment, a few altcoins are standing out by maintaining strong upward momentum — and Starknet (STRK) is one of the brightest performers today.

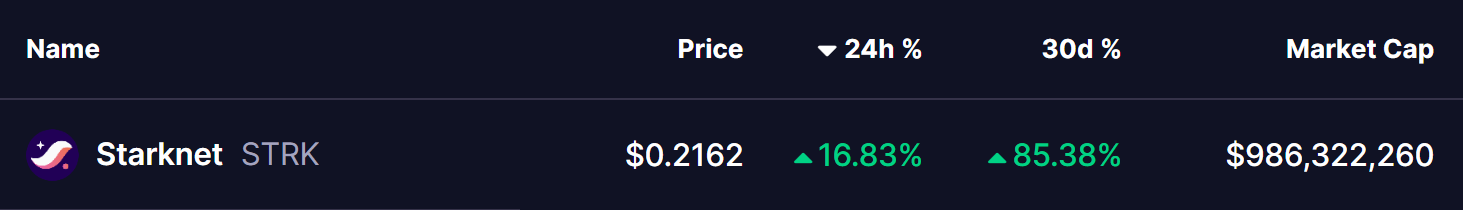

STRK has jumped an impressive 16% in the past 24 hours, extending its monthly rally to a massive 85%. This surge comes at a time when most of the market is pulling back, giving STRK extra attention from traders looking for strength during uncertainty. But despite the ongoing rally, the lower-timeframe chart is hinting at a pattern that could shape the token’s next major move.

Source: Coinmarketcap

Source: Coinmarketcap

Bearish Butterfly in Play?

On the 4H timeframe, STRK appears to be developing a potential bearish butterfly harmonic pattern.

This type of formation is known for pushing the price higher during the CD leg before reaching its completion zone, called the Potential Reversal Zone (PRZ). The early structure of this pattern began with Point X forming near $0.244976, followed by a sharp decline into Point A at $0.169772. After that drop, STRK bounced strongly to reach Point B at today’s high of $0.22.

Starknet (STRK) 4H Chart/Coinsprobe (Source: Tradingview)

Starknet (STRK) 4H Chart/Coinsprobe (Source: Tradingview)

The price has since slipped slightly below that level, currently hovering around $0.2164, which suggests that the BC leg may now be forming.

What’s Next for STRK?

If the bearish butterfly pattern continues to take shape, STRK could retest the 0.886 Fibonacci area, where a potential C point may form near $0.176800. This would represent a roughly 17% decline from current levels. While a drop may sound negative at first, this zone is where harmonic patterns often generate strong bullish reactions, setting the stage for a powerful CD-leg rally.

For now, the pattern is still in its early phase and cannot be confirmed until price action develops around the expected C-point area. Traders watching STRK should pay close attention to how the token behaves as it moves toward deeper support levels. If buyers step in aggressively at the projected zone, it could signal the beginning of the next strong upside wave.

Despite the unconfirmed structure, STRK’s overall trend remains strong. With its ongoing breakout momentum, a controlled pullback may actually strengthen the next leg of the rally — especially if the broader market stabilizes.