Dogecoin Price Looks Set For Another Leg — Up Isn’t The Likely Direction

Dogecoin’s trend still points down despite brief rebounds. Momentum shows a hidden bearish divergence, and long-term holders have increased their selling by nearly 280% in ten days. Unless DOGE reclaims $0.163, the downtrend stays active with risks toward $0.150 and lower. The chart remains bearish until buyers step back in convincingly.

Dogecoin (DOGE) is trading near $0.156, down almost 19% over the past month and 11% in the past week. While a few large-cap coins are trying to build early recovery signs, the Dogecoin price is doing the opposite. The trend still tilts lower, and the signals forming on the chart and on-chain point to weakness rather than relief.

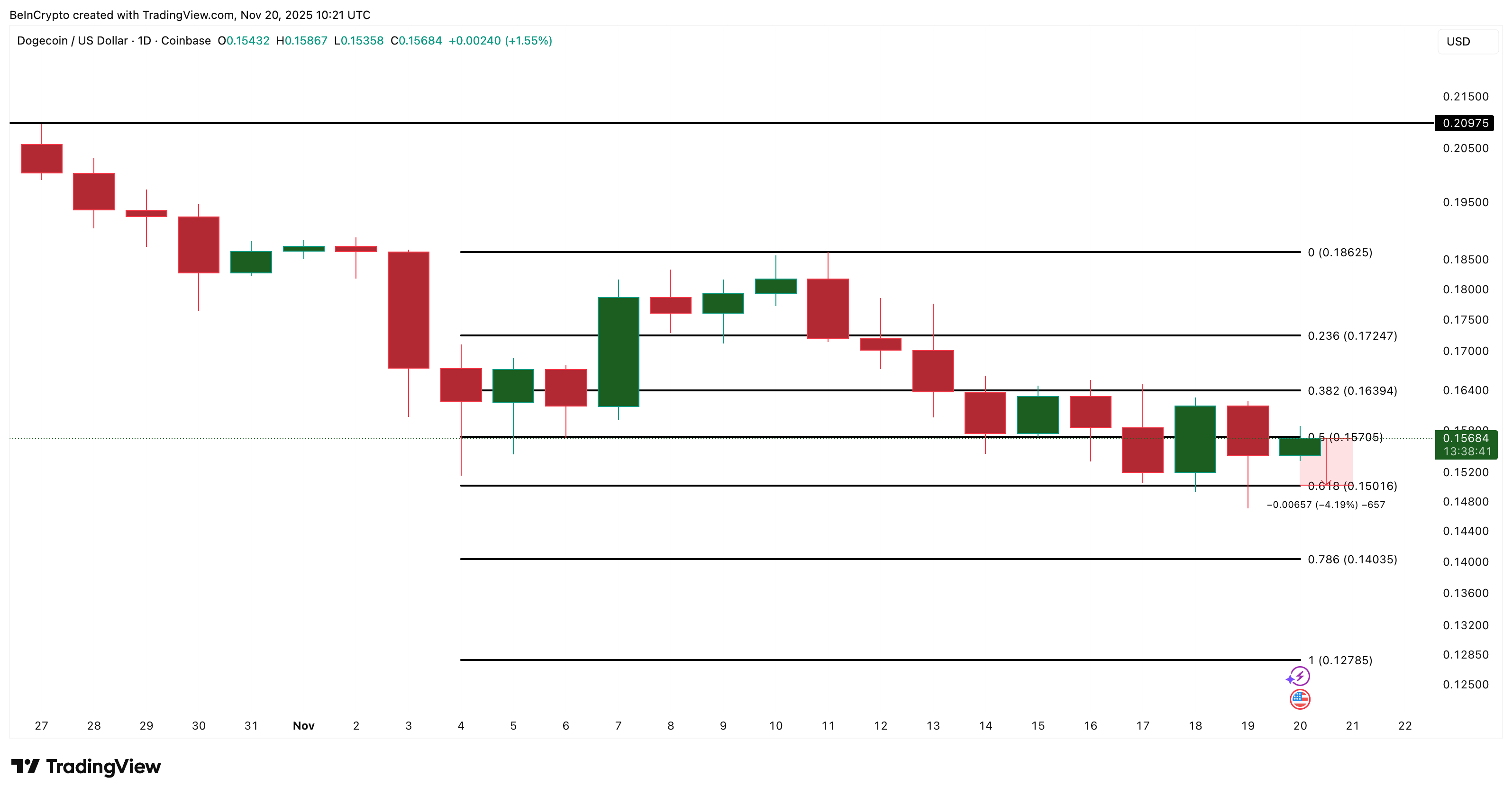

The short-term structure shows why the Dogecoin (DOGE) price weakness may continue before any meaningful upside can develop.

Momentum Weakens As Hidden Bearish Divergence Forms

The clearest problem sits in the momentum data. Between Nov. 15 and Nov. 18, the Dogecoin price made a lower high, but the RSI made a higher high. RSI, or Relative Strength Index, measures whether buying or selling pressure is strong. When RSI climbs while the price makes a lower high, it forms a hidden bearish divergence.

Traders treat this as a continuation warning, meaning the existing downtrend still has room.

DOGE Prints A Bearish Divergence:

TradingView

DOGE Prints A Bearish Divergence:

TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

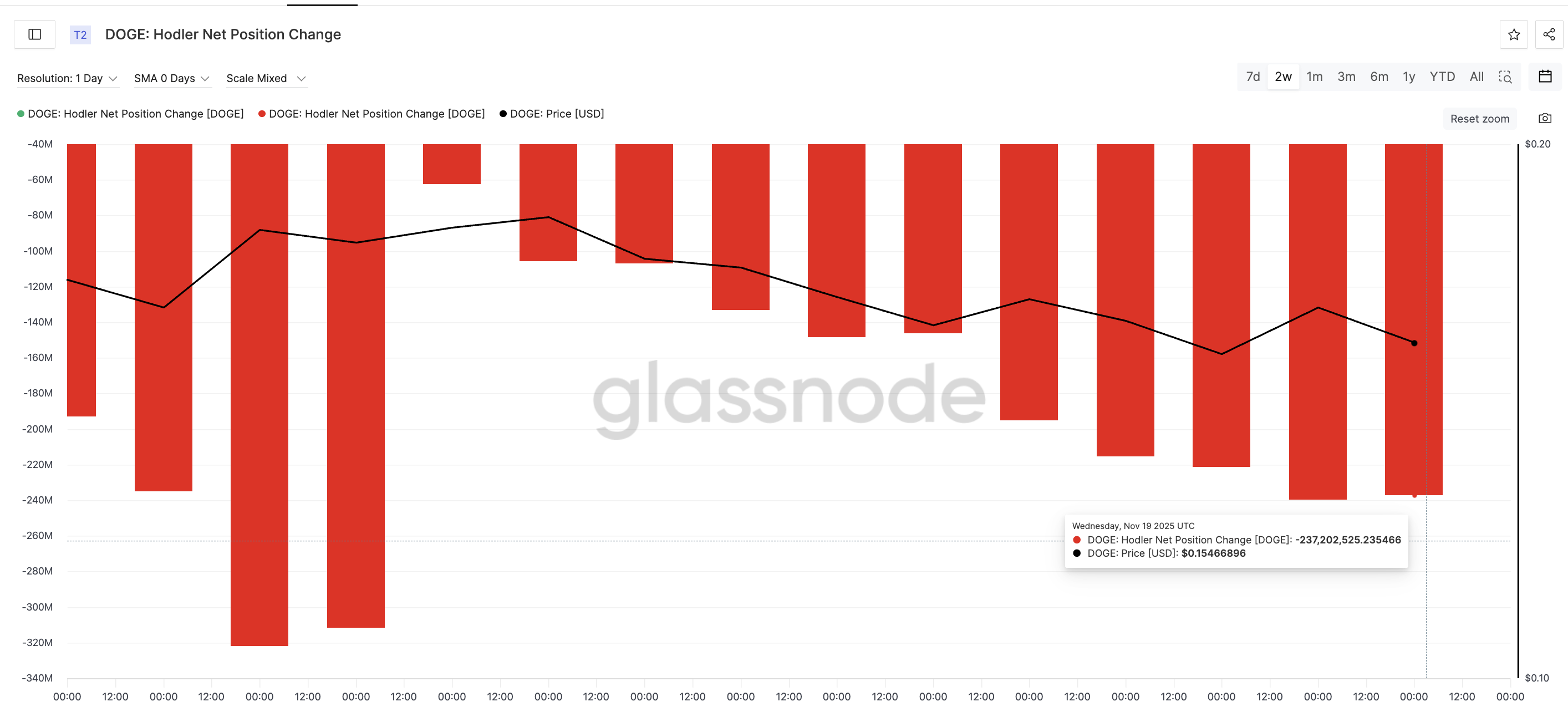

This weakness becomes more convincing when you look at long-term DOGE holders. Glassnode’s Hodler Net Position Change shows how many coins held for more than 155 days are moving. These wallets usually sell only when conviction collapses.

On Nov. 9, long-term holders were distributing about 62.35 million DOGE. By Nov. 19, that figure had grown to 237.20 million DOGE. That is a sharp increase of nearly 175 million DOGE in ten days, a 280% jump. This reflects a clear rise in long-term selling pressure.

HODLers Keep Dumping:

Glassnode

HODLers Keep Dumping:

Glassnode

Taken together, momentum is weakening, and holders with strong hands are stepping back. That combination makes short-term rebounds easy to fade. All while exposing downside risks.

Dogecoin Price Faces More Downside Unless Key Levels Break

The Dogecoin price continues to lean lower along its trend structure, so the next supports come from the trend-based projection levels. The first important level sits at $0.150, which has repeatedly acted as a short-term floor. Losing this support could push the price toward $0.140 and even $0.127 if broader market sentiment softens.

On the upside, the Dogecoin price needs to reclaim $0.163 to pause the bearish pattern. A clean move above $0.163 would shift momentum enough to target $0.186, the next major resistance on the chart. Until that happens, the downtrend remains intact, and every bounce carries the risk of fading.

Dogecoin Price Analysis:

TradingView

Dogecoin Price Analysis:

TradingView

For now, the overall picture stays simple. The trend is negative, the momentum favors sellers, and long-term holders are still distributing. Unless Dogecoin starts reclaiming key levels, the DOGE price trend is likely to continue — just not in the direction Long traders are hoping for.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: XRP ETF Launches Impressively Despite Price Drop Due to Large Holder Sell-Offs and Unstable Market Conditions

- Bitwise XRP ETF (XRP) debuted on NYSE with $22M trading volume, marking U.S. investors' first spot XRP exposure via a custodial trust. - XRP price fell 7% to $1.92 amid whale selling and broader crypto market volatility, despite the ETF's physical backing and fee waivers. - XRP's 13-year blockchain (4B+ transactions, 3-5s settlement) targets $250T cross-border payments market, but faces structural fragility with 58.5% supply in profit. - Regulatory clarity via the 2025 GENIUS Act enabled the ETF launch,

Tech's Next Horizon: Middle East Pioneers Blockchain and eVTOL Innovation

- Middle East emerges as tech hub with Abacus Group and Singapore Enterprise Centre expanding in Dubai, leveraging region's financial and regulatory advantages. - Blockchain reshapes industries: BAT's token distribution challenges ad models while Coinbase acquires Vector.fun to strengthen onchain market dominance. - TransFuture Aviation unveils Honghu eVTOL, promising 70% faster urban travel, aligning with Dubai's innovation-friendly regulations and global urban mobility trends. - AI and blockchain become

Bitcoin News Update: Rumble Introduces Wallet Feature, Giving Creators Full Control Over Their Crypto

- Rumble launches non-custodial wallet for Bitcoin , USDT, and tokenized gold tips during limited Android test. - Platform plans to expand crypto tipping to 51M users by December 2025, aligning with blockchain trends in social media monetization. - Non-custodial model emphasizes user fund control, addressing regulatory scrutiny while balancing stablecoin utility and crypto volatility. - Limited test prioritizes feedback refinement, aiming to attract crypto-focused creators and solidify Rumble's role in dec

Bitcoin News Update: "Does BlackRock's $642 Million Crypto Movement Indicate Lasting Bearish Sentiment or Just a Short-Term Dip?"

- BlackRock transferred $642M in BTC/ETH to Coinbase Prime, sparking fears of coordinated crypto sell-offs amid prolonged price declines. - Record $523M IBIT outflow and $903M Bitcoin ETF exodus signal institutional profit-taking, with risk-averse positioning accelerating market downturn. - On-chain data reveals BlackRock's Ethereum accumulation halt, contrasting prior aggressive buying, while retail investors offload 0.36% BTC/XRP holdings. - Analysts debate bear market vs. temporary correction, noting Bi