Japan’s Metaplanet to raise about $135m to buy Bitcoin

Tokyo-listed Metaplanet plans to issue Class B perpetual shares worth $135 million to expand its Bitcoin reserves.

- Metaplanet announced issuing about $135 million in shares to buy Bitcoin

- Class B shares will have no voting rights, but will have redemption at listing

- The firm currently owns 30,823 Bitcoin, worth about $2.69 billion

As corporate Bitcoin adoption strengthens worldwide, one Metaplanet is taking an increasingly aggressive approach. On Thursday, November 20, the Tokyo-listed Bitcoin treasury firm announced the issuance of 23.61 million Class B Preferred Shares, valued at about $135 million.

The firm will use the proceeds of these sales from these sales to expand its Bitcoin holdings. The firm will issue these shares at ¥900 per share, with an annualised 4.9% dividend rate. Holders will then be able to convert these shares into common shares, which hold voting rights.

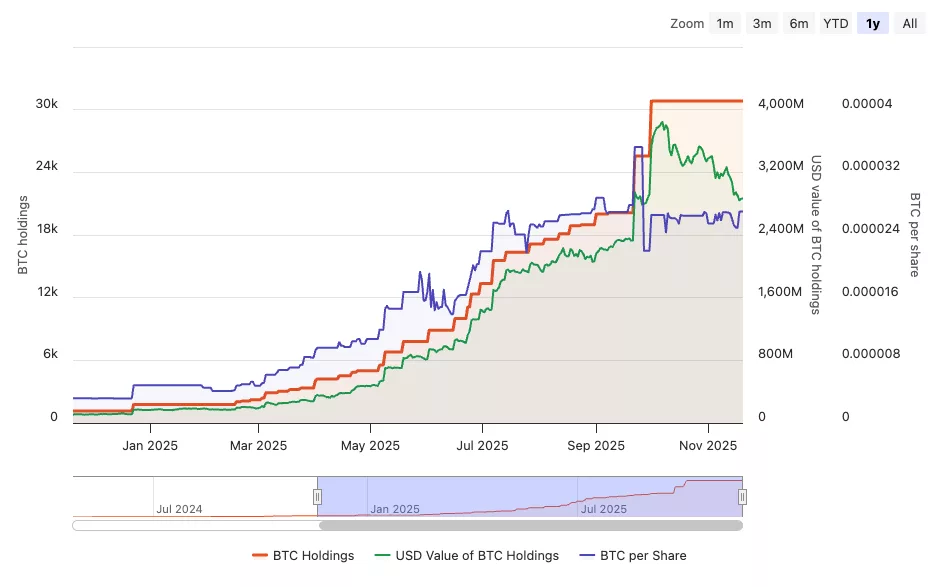

Metaplanet’s Bitcoin holdings over time, the USD value of its BTC, and its Bitcoin per share metric | Source: Bitcoin Treasuries

Metaplanet’s Bitcoin holdings over time, the USD value of its BTC, and its Bitcoin per share metric | Source: Bitcoin Treasuries

What is more, holders will be able to redeem their shares if they are not listed by 20 business days after Dec. 29, 2026.

Metaplanet mirrors Strategy in Bitcoin accumulation

The issuance of Class B Preferred Shares mirrors the model used by Michael Saylor’s Strategy. Notably, it enables the firm to raise more capital to pursue its aggressive accumulation. While the issuance initially dilutes shareholders, it does not immediately increase common stock. For that reason, its profitability hinges on Bitcoin’s near-term growth, which Metaplanet is betting on.

“The Company believes that Bitcoin will deliver long-term returns that exceed the preferred share dividend yield,” Metaplanet wrote in the filing.

Currently, Metaplanet holds 30,823 BTC , worth approximately $2.69 billion. The firm purchased its Bitcoin at an average price of $108,036, and is down 19.33% on its investment. Despite this, the firm has $3 billion in market cap, which is higher than its BTC holdings.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Exodus Purchases W3C to Connect Cryptocurrency Assets with Daily Expenditures

- Exodus Movement Inc. agreed to acquire W3C Corp for $175M to integrate card/payment processing into its crypto wallet platform, enabling stablecoin transactions via Visa , Mastercard , and Discover. - The deal aims to create an end-to-end on-chain payment ecosystem by reducing third-party reliance and generating recurring revenue from interchange fees, supported by Exodus's Bitcoin-backed financing. - Projected to close in 2026 after U.S./U.K./EU regulatory approvals, the acquisition follows Exodus's sta

Fed Split Over December Rate Reduction: Employment Concerns Versus Inflation Targets

- Fed President Mary Daly advocates for a December rate cut to preempt sudden U.S. labor market deterioration, prioritizing job market risks over inflation. - Officials like Susan Collins and Christopher Waller show divided stances, with some favoring rate cuts as insurance against weakness while others urge caution to avoid limiting future flexibility. - The debate reflects broader FOMC tensions between stabilizing employment and curbing inflation, amid softer tariff-driven costs and a fragile "low-hiring

Bitcoin News Update: Institutional Giant's 20x Short Position on BTC—$24 Million Profit Hinges on $101,000 Liquidation Point

- A Hyperliquid institutional whale opened a 20x leveraged $113M BTC short, generating $24M in unrealized profits with a $101,641 liquidation threshold. - Bitcoin ETF flows show divergence: $523M BlackRock outflow on Nov 18 contrasted with $238M net inflows on Nov 21 as institutional buyers accumulate amid retail exits. - High-leverage shorts ($105M and $87.58M) risk forced liquidations if BTC rebounds, amplifying volatility risks seen during 2020's margin calls. - Market dynamics highlight tension between

Solana’s Latest Price Plunge: Underlying Dangers in Fast-Paced Blockchain Platforms

- Solana's 2025 price crash exposed systemic risks in high-performance blockchain networks, driven by technical vulnerabilities and validator governance challenges. - Network congestion events, single-client architecture flaws, and validator centralization risks eroded user trust despite throughput improvements. - Scalability bottlenecks during peak activity and unresolved client-specific bugs fueled institutional skepticism amid declining DeFi TVL and stablecoin share. - A $352M Q3 net loss and regulatory